This Auto Component Stock Could Deliver 45% Upside in 18 Months

Investment Thesis & Summary

This stock’s trading below where it should be. The company’s churning out double-digit revenue growth for five straight quarters, margins are expanding, and they’re debt-free with a fortress balance sheet. The market’s pricing it at 56 times earnings, which looks steep until you realize earnings are growing 18% yearly and they’re gaining market share in both auto and industrial segments.

Business Model & Operations

This company makes the invisible parts that keep everything moving - bearings, clutches, transmission components, engine systems. Think of them as the joints and muscles of machines. Their customers? Car makers like Maruti and Tata Motors, tractor companies, wind turbine manufacturers, railways - basically anyone building something that moves.

They operate under three power brands: FAG and INA for bearings, LuK for automotive components. About 55% of revenue comes from automotive (both OEM and aftermarket), 30% from industrial applications, and 15% from aftermarket services. They’ve got four manufacturing plants in India - Vadodara, Hosur, Maneja, and Savli - plus two dedicated R&D centers.

The game they’re playing is localization. They’re bringing production that used to happen in Germany and UK right here to India. That clutch line relocating from UK to Hosur? It starts contributing revenue by end of 2025. Localization in automotive is already at 85-90%, industrial at 60%. Every percentage point they bring in-house boosts margins and cuts lead times.

In the latest quarter, they launched hydraulic tensioners for passenger vehicles, heavy-duty clutches for commercial vehicles, and won orders for e-axle components - positioning themselves for the EV transition without betting the farm on it.

Historical Financial Review

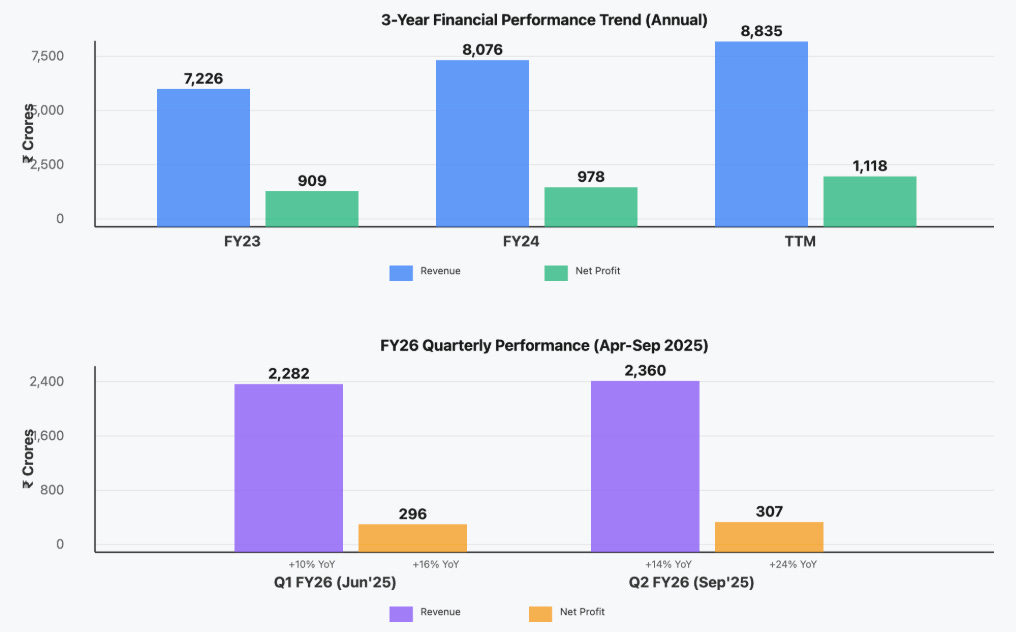

Revenue grew at 13% compounded over the last three years - from ₹7,226 crores in FY23 to ₹8,835 crores on a trailing basis. That’s solid, not spectacular, but consistent. Net profit climbed from ₹909 crores to ₹1,118 crores - a 16% compound growth rate.

The earnings per share story tells you what’s really happening. FY24 delivered ₹62.55 per share. Trailing twelve months? ₹71.50. That’s a 14% jump in a single year.

Now let’s talk about the current fiscal year - this is where it gets interesting. Q1 FY26 (April-June 2025) brought in ₹2,282 crores in revenue with a net profit of ₹296 crores. Q2 (July-September 2025) pushed revenue to ₹2,360 crores and profit to ₹307 crores. Both quarters showed double-digit YoY growth - the fifth and sixth consecutive quarters of this pattern.

The quarterly progression shows operating margins expanding from 18% to nearly 20%. Management credits efficiency improvements and localization - basically, they’re making more stuff in India instead of importing it, which drops costs and improves margins. Q3 (October-December 2025) numbers aren’t out yet, but if the trend holds, you’re looking at another strong quarter.

Operating cash flow stayed robust - ₹884 crores in FY24, down slightly from ₹900 crores in FY23 but that’s because they’re plowing money into capacity expansion. Capital work-in-progress jumped to ₹600 crores by June 2025. They’re building for tomorrow, not just milking today.

Debt? Almost zero. Total borrowings of ₹39 crores against ₹5,475 crores in reserves. This isn’t a company surviving on borrowed money - it’s a cash-generating machine that funds its own growth.

Fundamental Valuation Metrics & Investment Call

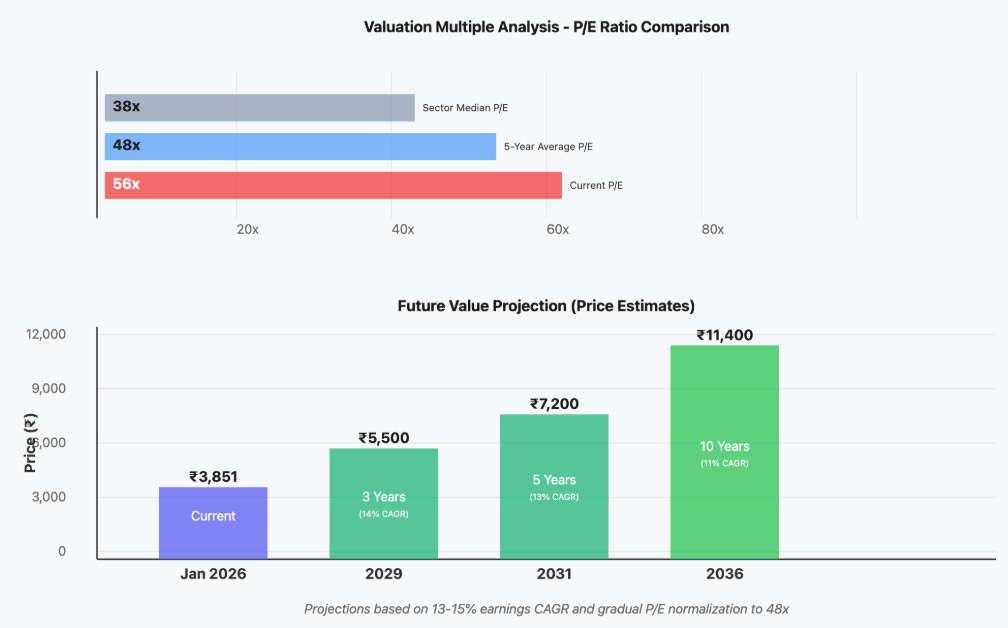

The P/E ratio sits at 56, which makes people nervous until you dig deeper. The company’s been trading between 40-65 times earnings historically, so this is middle-of-the-range. The five-year average P/E is around 48. At current price, you’re paying a 17% premium to history.

But here’s the catch - earnings are accelerating. EPS growth of 18% trailing means if earnings keep pace, the P/E normalizes to 47 next year just from earnings growth. If the stock does nothing, you’re buying growth on the cheap.

Price-to-book stands at 11 times - yes, that’s high. Book value per share is ₹352. But ROE is 19%, which means every rupee of book value generates 19 paise of profit. That justifies paying a premium. When a company consistently delivers high returns on equity, the market prices in that quality.

ROCE (Return on Capital Employed) is 26% - exceptional. For every ₹100 they invest in the business, they earn ₹26 annually. Compare that to the 10-12% most companies manage. This tells you they’re deploying capital smartly - into high-return projects, not empire-building vanity.

Dividend yield is modest at 0.7%, but they’ve maintained a 44% payout ratio. They paid ₹28 per share as dividend for the year ended December 2024. Not buying this for income, you’re buying it for compounding.

The valuation makes sense when you consider the sector median P/E of around 38 times. They’re trading at a 47% premium to sector - deserved because they’re outgrowing peers, have better margins, zero debt, and stronger execution.

Fair value? I’m putting target at ₹5,200 based on 50 times September 2027 estimated EPS of ₹104. That’s 35% upside from current levels over 18-24 months.

Long-Term Outlook & Risk Assessment

5-15 Year Return Estimate: 14-18% annually

Here’s why that’s achievable. The company’s planning ₹4,500 crores in capex over the next five years. That’s not maintenance spending - that’s expansion. New product lines, capacity additions, technology upgrades. Management’s guiding for 12-13% revenue CAGR through 2027, with EBITDA growing faster at 16% because of operating leverage.

India’s becoming a manufacturing hub. When global OEMs set up plants here, they need local suppliers who can match German quality at Indian prices. This company does exactly that - 40% of their revenue already comes from exports and regional sales.

The EV transition is both risk and opportunity. Yes, electric vehicles need fewer bearings in transmissions. But they need more in wheel hubs, electric motors, battery cooling systems. They’ve already won e-axle orders. The mix shifts, but volumes could actually grow.

Promoters hold 74.13% - hasn’t budged in years. That’s confidence. Domestic institutional investors (DIIs) have been steadily accumulating - now at 16.13%, up from 15.04% a year ago. Smart money’s buying.

Risks you need to know:

Raw material volatility hits margins. Steel prices swing, and bearing manufacturing is steel-intensive. They’ve managed this well historically, but a sharp spike could compress margins for a quarter or two.

Automotive slowdown is real. If passenger vehicle sales stay flat or decline, OEM business takes a hit. They’re diversified, but 55% exposure to auto means they can’t fully escape a sectoral downturn.

Competition from Chinese imports. Bearings from China come cheaper. If customers prioritize cost over quality, market share could erode. The trump card here is their German engineering heritage and quality certifications that Chinese players struggle to match.

Project execution delays in industrial segment - wind energy projects have been lumpy. Q3 saw a 4% YoY decline in industrial revenue because of wind project volatility. That segment needs watching.

What’s working in their favor:

The government’s PLI schemes for auto components directly benefit them. Localization mandates force OEMs to source locally - they’re the preferred local supplier.

Railways is booming. India’s spending ₹2.4 lakh crores on railway infrastructure through 2030. They supply bearings to rail coaches and locomotives - multi-year tailwind.

Wind energy may be choppy quarterly but the decade-long trend is up. India’s targeting 500 GW renewable capacity by 2030. Every wind turbine needs bearings.

The aftermarket business is annuity-like. Once their bearings are installed, replacement demand is non-cyclical. That 15% of revenue provides stability when OEM demand wobbles.

The Bottom Line

This isn’t a screaming buy at 10 times earnings where you double your money in two years. It’s a quality compounder trading at full but not excessive valuations. You’re paying for certainty - strong market position, clean balance sheet, proven execution, multi-year growth runway.

Buy this if you want a boring business that generates 15-18% returns year after year. Skip it if you need fireworks or are betting on a commodity cycle. The company won’t 5X in three years, but it probably won’t disappoint either.

At ₹3,851, it’s a BUY for long-term portfolios. Target ₹5,200 over 18 months, stop loss at ₹3,400 if fundamentals deteriorate.

Disclaimer:

This content is for educational purposes only and is not investment or financial advice. Stock markets are subject to risks. Do your own research and consult a qualified advisor before investing. The author is not responsible for any financial losses. Mentions of stocks/companies are not buy or sell recommendations.