Tata Motors Q3 FY25 – Strong Growth, Electrification & Market Leadership

Healthy correction after making high of ~1200.

📌 Executive Summary – Q3 FY25 Highlights

Tata Motors Group delivered a robust Q3 FY25 performance, with continued profitability, growth in key segments, and an aggressive push toward electrification.

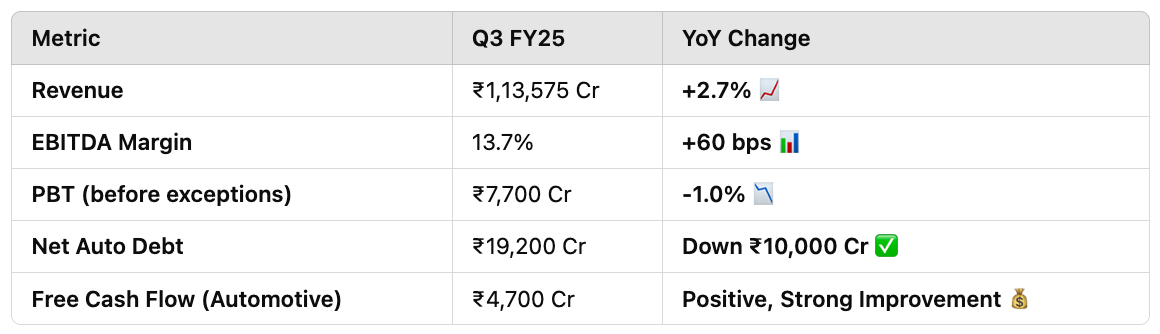

🔹 Revenue: ₹113,575 Cr (+2.7% YoY)

🔹 EBITDA Margin: 13.7% (+60 bps YoY)

🔹 PBT (before exceptional items): ₹7,700 Cr

🔹 Net Auto Debt: ₹19,200 Cr (down from ₹29,200 Cr YoY)

🔹 Free Cash Flow (Automotive): ₹4,700 Cr

🔹 Market Cap: ₹2,56,519 Cr

🔹 Stock P/E: 8.06 (Industry Avg ~15)

🔹 ROCE: 20.1% | ROE: 49.4%

🔹 EV Market Share: 35% (Highest-ever registrations in Q3)

🔹 Demerger Progress: Appointed Date – July 1, 2025

With a strong balance sheet, aggressive EV & hydrogen expansion, and a clear strategy for market leadership, Tata Motors remains one of the most promising plays in the Indian auto sector. 🚗💨

📊 Financial Performance Breakdown

🔹 Consolidated Financials

The revenue growth was driven by higher JLR sales, strong domestic PV demand, and sustained commercial vehicle performance.

🚗 Segment-Wise Performance

🏎️ Jaguar Land Rover (JLR) – Luxury & Electrification Lead

🔹 Revenue: £7.5B (+2% YoY)

🔹 EBIT Margin: 9.0% (Highest Q3 EBIT in a decade)

🔹 Net Debt: £1.1B (Improved by £0.5B YoY)

🔹 Electrification Push: 80% of JLR’s vehicles are now electrified

🚀 Key Developments:

✅ Jaguar Electric GT (First Model) to Launch in Late 2025

✅ JLR’s "House of Brands" Focus on Premium Luxury

✅ Freelander Brand Licensed to China JV – Local NEV Model in 2026

Bottom Line: Tata Motors is successfully transforming JLR into a premium luxury EV powerhouse.

🚛 Tata Commercial Vehicles (CV) – Resilience Amidst Challenges

🔹 Revenue: ₹18,431 Cr (-8.4% YoY)

🔹 EBITDA Margin: 12.4% (+130 bps YoY)

🔹 PBT (before exceptional items): ₹1,726 Cr

🔹 ROCE: 38.1% 💥

🌎 Market Dynamics:

✅ Passenger Carrier Demand Grew by 30% 📊

✅ Freight Rates Improved QoQ, Supporting Transporters 📈

✅ Digital Sales Channels Grew 1.2x YoY

🔋 Electric Mobility Push:

✅ 2,400+ E-buses deployed in Delhi, Bangalore, Jammu & Srinagar

✅ Ace EV (LCV) saw 26% YoY volume growth

✅ Corporate EV Fleet Adoption Accelerating (70 Clients Added)

💡 Key Takeaway: Tata CVs continue to drive innovation in EV & alternative fuels, staying ahead of industry trends.

🚙 Tata Passenger Vehicles (PV) & EVs – Market Leadership Continues

🔹 Revenue: ₹12,354 Cr (-4.3% YoY)

🔹 EBITDA Margin: 7.8% (+120 bps YoY)

🔹 PBT (before exceptional items): ₹292 Cr

🔹 EV EBITDA Margin: 10.0% (Highest to Date)

🔥 Market Positioning:

✅ #1 SUV Maker in India (Punch SUV - Bestselling Model)

✅ Highest-ever personal EV registrations in Q3

✅ CNG + EV Sales Penetration: 35%

🚀 New Models & Future Focus:

Avinya X & Sierra Concept Revealed

Tiago EV MY25 & Punch Flex Fuel Edition Incoming

Tata.ev Charging Network Expansion in Q4 FY25

🚀 Future Growth Plans & Expansions

🏭 Capital Expenditure & Strategic Rationale

💰 FY25 CAPEX Target: ₹32,000 Cr (~₹3.8B)

✅ JLR Investment: £3.8B for premium EV development

✅ Tata Motors India: ₹2.0K Cr in Q3 FY25 (Tech & Powertrain Upgrades)

✅ Focus Areas: Hydrogen ICE, Alternative Fuels, Digitalization

🔎 Key Risks & Challenges

⚠️ FX Volatility: Q3 saw a significant £146M hit due to currency movements

⚠️ China Demand Slowdown: 14% decline in the premium segment YoY

⚠️ EV Infrastructure Bottlenecks: More charging stations needed for mass adoption

⚠️ Competitive Pressure: Hyundai, Kia, and Tesla aggressively expanding in India

💡 Risk Mitigation: Tata Motors is aggressively expanding its charging infra, localizing EV production, and deleveraging to strengthen financial resilience.

📈 Valuation & Investment Outlook

🔍 Valuation Metrics

P/E Ratio: 8.06 (Industry Avg: ~15)

EV/EBITDA: ~6.5x (Undervalued vs Peers)

Implied Fair Value Range: ₹850 - ₹1,050

🔥 Investment Thesis – Why Tata Motors?

✅ Market Leader in India’s EV & SUV Segments

✅ JLR Turnaround & Luxury EV Expansion Underway

✅ Strong Cash Flow & Deleveraging Strategy

✅ Strategic Demerger Unlocking Value (Effective Oct-Dec 2025)

🎯 12-Month Target Price: ₹900+ (30% Upside from ₹697 Current Price)

📢 Investment Rating: BUY with a bullish long-term outlook.

📢 Final Thoughts & Closing Statement

Tata Motors remains a top Indian auto stock with a clear roadmap for electrification, premiumization, and digital transformation. The strong Q3 results reaffirm its leadership, and upcoming strategic moves—the JLR EV transition, CV hydrogen strategy, and the demerger—could significantly boost valuations. 🚀

📩 Share your thoughts in the comments – Where do you see Tata Motors in 2025?

more : Link

🚨 Disclaimer: This newsletter is for informational purposes only and does not constitute investment advice. Always conduct your own research before investing.