Sun Pharmaceutical Industries Ltd Share Price, Stock Analysis & Investment Overview (2025)

Investment Thesis & Summary

Here’s the deal with Sun Pharma – it’s India’s biggest pharma company, and they’re making more money every quarter while the stock price hasn’t kept up. The company’s throwing off solid cash, growing profits at a 24% clip over five years, and trading at a P/E of 37 when it historically traded higher. They just committed ₹3,000 crores to build a new plant, which tells you management thinks the good times will continue. The stock’s cheap relative to its growth potential.

Youtube Link:

Business Model & Operations

Sun Pharma makes money the old-fashioned way – selling pills, ointments, and injections. They’ve got two main engines: generic drugs that copy branded medicines once patents expire, and specialty drugs for tricky conditions like psoriasis and eye diseases. The US brings in about 30% of their revenue, India another 33%, and the rest comes from emerging markets across Asia, Africa, and Latin America.

What’s interesting is their specialty business – these are harder-to-make drugs that command better margins. Products like Ilumya for psoriasis and Cequa for dry eye disease are growing at 16% annually and now make up 20% of total sales. That’s where the real money is.

They’ve got 40+ manufacturing plants across the globe, making everything from basic tablets to complex injectables. In the last quarter, they launched 9 new products in India and got approval for 5 new generic drugs in the US. The board just approved spending ₹3,000 crores on a brand new factory in Madhya Pradesh, which won’t bear fruit for a few years but shows they’re betting big on future demand.

Historical Financial Review

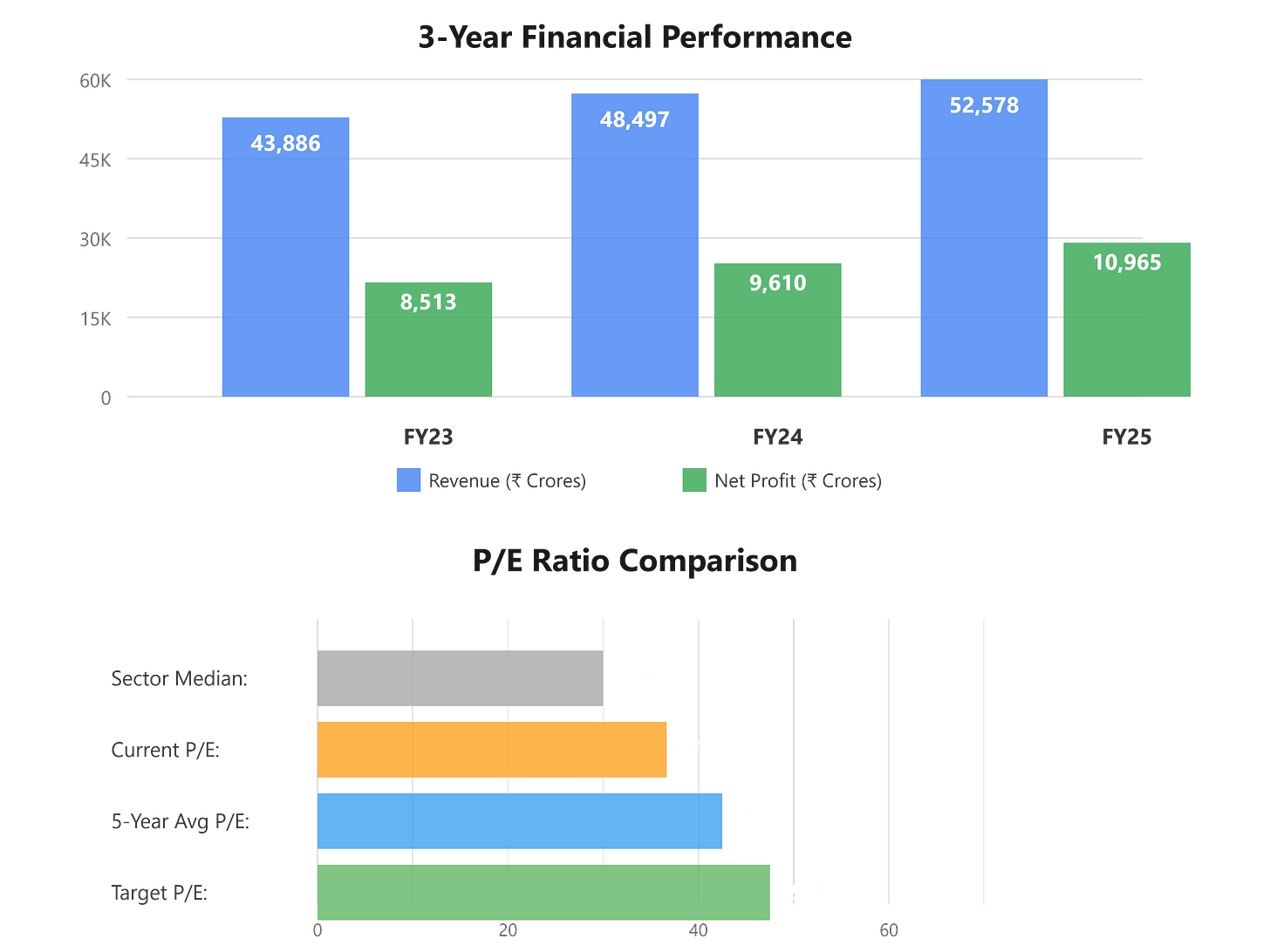

Let’s talk numbers. Over the last three years, revenue grew at 11% annually – not spectacular, but steady. What’s more impressive is the profit growth: 24% per year over five years. That’s the kind of compounding you want to see.

Last fiscal year (FY25 ending March 2025), they did ₹52,578 crores in revenue and ₹10,965 crores in profit. Earnings per share hit ₹45.55. Compare that to three years ago when EPS was ₹35.32 – that’s a 29% jump. The most recent quarter (Sep 2025) showed revenue up 9% to ₹14,478 crores with profit at ₹3,125 crores.

Operating margins have climbed from 27% to 31% over the past two years, meaning they’re squeezing more profit from every rupee of sales. That’s partly because their specialty drugs carry fatter margins than plain-vanilla generics.

The company’s sitting on ₹14,072 crores in operating cash flow for FY25, up from ₹4,959 crores two years ago. They’re printing money. Debt’s minimal at ₹2,362 crores against shareholder equity of ₹72,218 crores – basically debt-free. They paid out ₹16 per share in dividends last year, about 35% of earnings, which is reasonable.

Fundamental Valuation Metrics & Investment Call

The stock’s trading at 37 times trailing earnings. That sounds expensive until you dig deeper. Sun Pharma’s five-year average P/E is around 40-45, so it’s actually trading below its historical norm. The sector median P/E is about 33, so they’re commanding a premium – but that’s justified given they’re the market leader with better margins.

Price-to-book is 5.5 times. Book value sits at ₹324 per share, so you’re paying ₹1,786 for ₹324 of assets. That’s steep, but pharma companies trade on future earnings, not asset value. What matters more is return on equity of 17% and return on capital employed of 20% – both solid numbers showing they’re using shareholder money efficiently.

EPS grew from ₹35.32 in FY23 to ₹45.55 in FY25, that’s a 29% increase over two years or about 14% annually. If they can maintain even 12-13% EPS growth going forward, the current valuation looks reasonable.

Dividend yield is just 0.9%, which is low. But they’re reinvesting most of the cash into growth, which makes sense when you’ve got a 20% ROCE.

Here’s my math: If they grow earnings 12-13% per year and the P/E re-rates to 42-45 (their historical average), you’re looking at a target price around ₹2,250 over the next 18-24 months. That’s 26% upside plus dividends.

Long-Term Outlook & Risk Assessment

Over 5-10 years, I’d expect 13-15% annual returns. That gets you from ₹1,786 today to roughly ₹3,600-4,500 in a decade if everything goes right. Here’s why:

The Indian pharma market is growing 8-10% annually as healthcare access expands. Sun Pharma’s #1 in India with an 8.3% market share, up from 8% last year. That domestic business is rock-solid and growing.

Their US generics business is mature but stable. The real growth driver is specialty drugs, which are climbing 15-16% annually. They’ve got six new molecules in clinical trials that could hit the market over the next 3-5 years.

Management’s putting ₹3,000 crores into new capacity, which tells you they see demand coming. They’re also spending 7-8% of revenue on R&D, filing 4 new drug applications just last quarter.

Promoters hold 54.5% and haven’t sold a share in years. That’s a good sign – they’re in it for the long haul.

Now for the risks – and there are real ones. The FDA just slapped “Official Action Indicated” (OAI) status on two of their facilities in Baska and Halol after inspections in September. That’s not great. OAI means the FDA found serious violations. They can still sell from these plants for now, but if they don’t fix the issues, the FDA could ban exports to the US. That’s 30% of their revenue at risk.

Second risk: pricing pressure in the US. Generic drug prices keep falling as competition heats up. Their US generics business actually dropped 4% last quarter, though specialty drugs offset it.

Third risk: currency. A strong rupee hurts because 60% of revenue comes in dollars and other foreign currencies.

Fourth risk: patent litigation. They’re constantly fighting legal battles over generic drug approvals in the US. Sometimes they win, sometimes they lose.

The positives for the industry:

India’s positioning itself as the “pharmacy of the world.” The government’s pushing Production-Linked Incentive schemes to boost manufacturing. Global demand for affordable medicines is rising as populations age. That’s the tailwind.

Bottom line:

The business is solid, cash flows are strong, and the stock’s not crazy expensive if growth continues. But watch those FDA issues closely – if they escalate, all bets are off. The risk-reward at ₹1,786 tilts positive, but this isn’t a slam dunk.

Disclaimer

This content is for educational purposes only and is not investment or financial advice. Stock markets are subject to risks. Do your own research and consult a qualified advisor before investing. The author is not responsible for any financial losses. Mentions of stocks/companies are not buy or sell recommendations.