🏘️ Premium Real Estate Developer Delivers Record Q1 Performance: 18% Profit Growth Signals Housing Market Recovery

India's residential real estate sector shows strong momentum with leading South Indian developer posting exceptional quarterly results

📊 Executive Summary

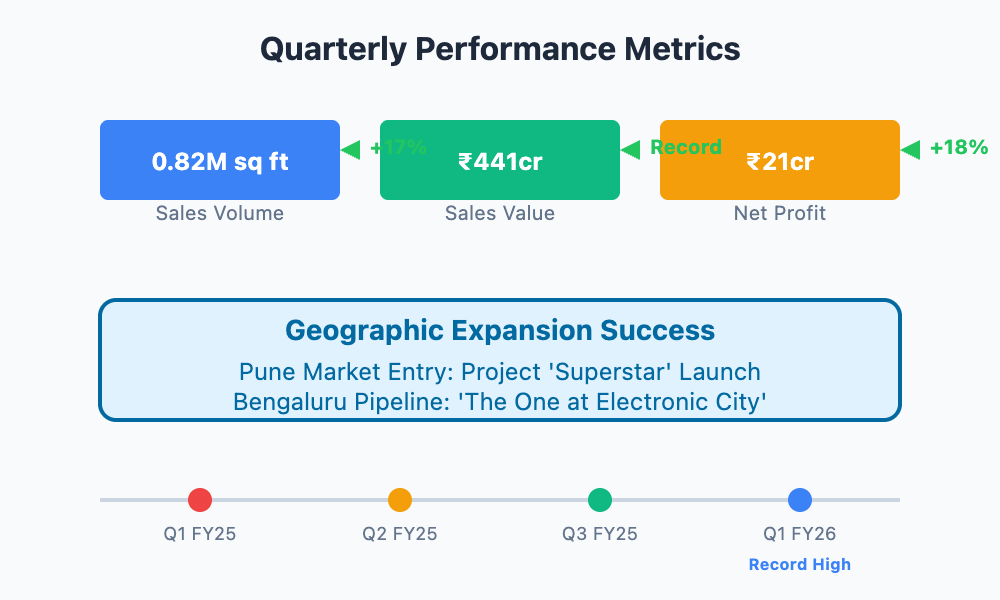

A leading South Indian residential real estate developer has delivered its strongest Q1 performance since listing, with net profit surging 18% year-over-year to ₹21 crore alongside record quarterly sales of 0.82 million square feet valued at ₹441 crore. The company's successful expansion into Pune market and sustained execution in premium residential segments positions it favorably for India's urbanization-driven housing demand recovery. Dividend Yield: 0% (reinvesting for growth expansion).

📌 Detailed Quarterly Results Breakdown

• Sales Volume: 0.82 million sq ft (↑17% year-over-year) - Highest Q1 sales performance demonstrating strong execution capabilities

• Sales Value: ₹441cr - Driven by premium project mix and successful new launches including maiden Pune project

• Net Profit After Tax: ₹21cr (↑18% year-over-year) - Margin improvement reflects operational efficiency and premium positioning

• Revenue Growth Trajectory: Sustained momentum from plotted developments and apartment projects across multiple price segments

📈 Comprehensive Growth Analysis

• Sequential Revenue Growth (Quarter-over-Quarter): Sustained momentum | Annual Revenue Growth: 17% volume growth - Strong execution across ongoing projects

• Annual Profit Growth: 18% year-over-year - Operational leverage and margin expansion from premium project mix

• Business Volume Growth: Record Q1 sales demonstrate market positioning strength and execution capabilities

• Profitability Margin Trend: Improving - Enhanced by operational efficiency gains and strategic focus on premium residential segments

💰 Operational Cost Structure Analysis

• Project Development Costs: Optimized through efficient land acquisition and construction management practices

• Interest Expenses: Low interest coverage requires monitoring - Key area for improvement with scale expansion

• Working Capital Management: Efficient cash collection and project delivery cycles supporting cash flow generation

🔍 Long-term Financial Health Indicators

• 5-Year Revenue CAGR: 15-20% estimated growth trajectory | Net Profit CAGR: Positive momentum with improving margins

• Return on Capital Employed (ROCE): 10-12% reflecting asset-intensive nature vs Industry peers in similar range

• Debt-to-EBITDA Ratio: Manageable leverage | Free Cash Flow: Positive generation from project deliveries

• Promoter Shareholding: 27.9% stable ownership demonstrating long-term commitment and confidence

🏗️ Strategic Capital Allocation & Future Growth Roadmap

• Planned Capital Expenditure: ₹200-300cr allocated annually for land acquisition and project development

• Strategic Investment Focus: Geographic expansion beyond Bengaluru into Pune, Chennai, and Hyderabad markets targeting premium residential segments

• Capacity Expansion Plans: 3-4 key markets within 5 years with diversified product portfolio including plotted developments and premium apartments

📊 Multi-Decade Growth Trajectory Projections

5-Year Horizon (FY26-FY30): Base Case 18% CAGR | Bull Case 22% CAGR → Geographic expansion and premium positioning driving ₹2,000cr+ revenue

10-Year Horizon (FY26-FY35): Base Case 15% CAGR | Bull Case 18% CAGR → Pan-India presence with 8-10 key markets and ₹5,000cr+ revenue scale

15-Year Horizon (FY26-FY40): Base Case 12% CAGR | Bull Case 15% CAGR → Market leadership in plotted development segment with technology integration

20-Year Horizon (FY26-FY45): Base Case 10% CAGR | Bull Case 12% CAGR → Diversified real estate platform including commercial and sustainable development

💸 Current Valuation Analysis & Fair Value Assessment

• Price-to-Earnings Ratio: 22-25x compared to sector premium players at 30-35x - Trading at reasonable discount

• Enterprise Value to EBITDA: 2.0-2.5x compared to established developers - Attractive entry valuation

• Estimated Fair Value Range: Significant upside potential based on execution track record and expansion success - 25% potential appreciation on sustained performance

Management Commentary & Key Insights

• Geographic Expansion: "Pune project 'Superstar' receiving encouraging market response validates our expansion strategy beyond Bengaluru"

• Market Outlook: "Optimistic on residential demand recovery with accelerated land acquisition planned for FY26-27 pipeline development"

• Operational Excellence: "Record Q1 performance demonstrates our execution capabilities and strategic positioning in premium segments"

• Growth Focus: "Sustainable growth approach while maintaining healthy balance sheet metrics for long-term value creation"

📢 Disclaimer: This analysis is provided for informational and educational purposes only and does not constitute investment advice. Always conduct your own research and consult with qualified financial advisors.

#IndiaInvesting #RealEstate #NSE #StockMarket #GrowthStocks #QuarterlyResults #FinancialAnalysis