Power Sector Investment Analysis: Unlocking Infrastructure Finance & Growth Opportunities

Power Sector Investment Analysis: Unlocking Infrastructure Finance & Growth Opportunities

Investment Thesis & Summary

Why this looks interesting - the stock’s trading at less than 6 times earnings while the company just posted record profits and is sitting on a massive ₹5.82 lakh crore loan book. The market’s punishing it for being a PSU, but the fundamentals are rock solid.

Business Model & Operations

This is India’s second-largest power sector lender, a Maharatna PSU under the Ministry of Power. Think of them as the bank for India’s electricity infrastructure. They lend money - lots of it - to state electricity boards, power generators, transmission companies, and distribution utilities. The money goes toward building power plants, transmission lines, substations, and the whole grid that keeps India’s lights on.

In the latest quarter, they’ve expanded beyond just power - now lending to metro rail, highways, ports, and logistics infrastructure. Smart move. The loan book grew to ₹5.82 lakh crores as of September 2025, up from ₹5.43 lakh crores in March. They’re financing about 25% of India’s total installed power capacity, which gives you an idea of their scale.

The business is straightforward - they borrow money at lower rates (think 7-8%) and lend it out at higher rates (9-10%). The spread is their profit. They recently set up two new subsidiaries to handle transmission projects under competitive bidding, which should open up more business opportunities.

Historical Financial Review

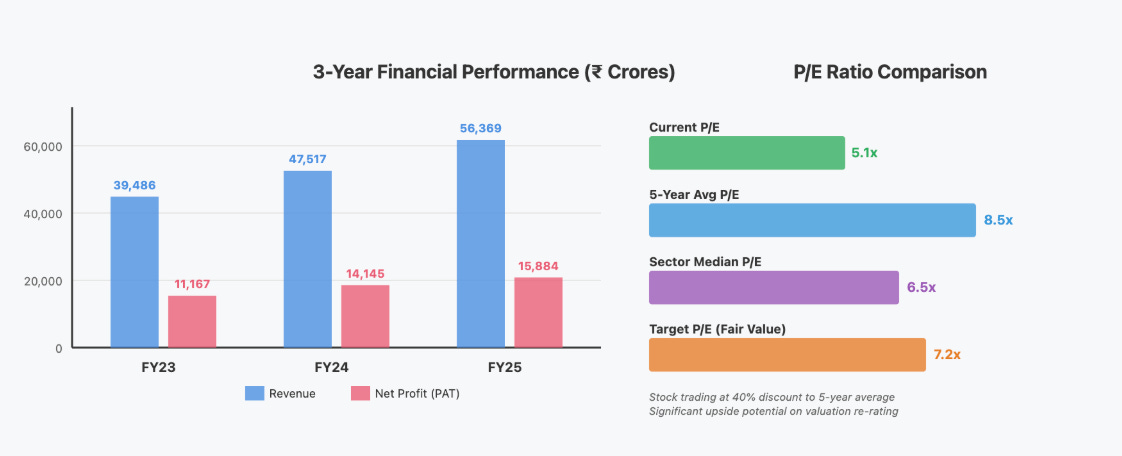

The numbers tell a good story. Over the last three years, revenue grew at 13% annually - from ₹39,486 crores in FY23 to ₹56,369 crores in FY25. That’s steady, predictable growth. Net profit jumped from ₹11,167 crores to ₹15,884 crores in the same period - a 17% annual growth rate.

Last year’s earnings per share hit ₹60.32, up from ₹42.41 three years ago. The company’s making more money and shareholders are getting a bigger piece. In the first half of this fiscal year (FY26), they posted ₹8,877 crores in profit - a 19% jump from last year.

The balance sheet’s clean. Gross NPAs dropped to 1.06%, which is excellent for an infrastructure lender. They’re managing credit quality well despite lending to sometimes troubled state utilities. Operating cash flow per share has been volatile - typical for a finance company that’s constantly growing its loan book. What matters more here is that interest income keeps climbing (₹14,590 crores in Q2 FY26) and profit margins stay healthy around 29%.

Management’s been prudent about capital. They maintain 30% dividend payout, paid out ₹18.40 per share last year through interim dividends. The company recently announced a ₹1.70 lakh crore borrowing program for FY26 to fund loan growth - that’s how confident they are about finding good lending opportunities.

Fundamental Valuation Metrics & Investment Call

Let’s talk numbers. The stock trades at a P/E ratio of 5.1. That’s dirt cheap. The 5-year average P/E was around 8-9, and peers like Power Finance Corporation trade at similar levels. The whole sector’s undervalued, but this one’s particularly beaten down.

Price-to-book is 1.1 - you’re paying just ₹1.10 for every rupee of book value. For a company generating 21.5% ROE, that’s a steal. Most quality financials trade at 1.5-2x book.

ROE of 21.5% is fantastic. They’re turning shareholder equity into profit efficiently. ROCE is lower at 9.96% because they use a lot of leverage (it’s a finance company), but that’s normal for the industry.

EPS grew from ₹42.41 in FY23 to ₹60.32 in FY25, then ₹65.58 on a trailing basis. That’s 25% CAGR over three years. Earnings growth is accelerating, not slowing.

Dividend yield sits around 5.5% at current prices. You’re getting paid to wait while the business grows.

The valuation screams “buy” if you believe in two things: India needs massive power infrastructure investment (it does), and this company will keep its credit quality strong (track record says yes). At 5x earnings with 20%+ ROE and 5.5% yield, you’re getting a quality asset at PSU discount prices.

Long-Term Outlook & Risk Assessment

I’m expecting 15-20% annual returns over the next 10-15 years. Here’s the math: the government plans ₹46 lakh crore in power sector investments over the next decade. This company will finance a big chunk of that. Loan book should grow 12-15% annually based on management guidance. With stable margins, that translates to similar profit growth. Add the 5.5% dividend yield, and you’re looking at solid mid-to-high teens returns.

The company’s pivoting toward renewable energy - targeting 25% of their loan book in renewables, up from 12% currently. That’s where the growth is. They’re also expanding into roads, metros, and logistics, diversifying away from pure power lending.

Management’s deploying capital smartly. They’re paying consistent dividends, growing the loan book, and maintaining capital adequacy ratios well above regulatory requirements. Promoter holding (the government) is steady at 52.63% - they’re not selling. FIIs have been trimming positions (down to 18%), but that’s more about PSU sentiment than company fundamentals.

Now for the risks - and they’re real. State electricity boards are chronically cash-strapped. If power utilities default en masse, this company’s in trouble. The 1.06% gross NPA number looks great today, but it can spike quickly if the power sector hits a rough patch. Watch the asset quality metrics quarterly.

Interest rate risk is another concern. They borrow short and lend long. If borrowing costs shoot up faster than they can reprice loans, margins compress. So far they’ve managed this well, but it’s something to monitor.

There’s regulatory risk too. The government could change priority sector lending norms or capital requirements. As a PSU, they’re vulnerable to policy whiplash.

On the positive side, India’s adding 50 GW of renewable capacity annually. The grid needs massive upgrades. Electric vehicle charging infrastructure, battery storage, smart grids - all need financing. This company’s sitting at the epicenter of India’s energy transition. The sector tailwinds are strong for the next decade plus.

One more thing - the stock’s been hammered, down 41% from its 52-week high of ₹566. That’s created an opportunity. Market’s worried about slower power sector growth and rising bond yields. Both concerns are overdone. At ₹335, you’re getting a quality business at a discount. If the P/E just normalizes to 7 (still cheap), you’re looking at ₹459 per share. Get it to 8x (fair value), and it’s ₹524. That’s 40-55% upside before factoring in any earnings growth.

Disclaimer

This content is for educational purposes only and is not investment or financial advice. Stock markets are subject to risks. Do your own research and consult a qualified advisor before investing. The author is not responsible for any financial losses. Mentions of stocks/companies are not buy or sell recommendations.