PG Electroplast (PGEL) Stock Analysis & Investment Insights

NSE: PGEL, BSE: 533581

The Bottom Line: This stock’s expensive - trading at 62 times earnings while profits just collapsed 88% in the latest quarter. The promoters have been steadily selling, and the business is showing serious cracks.

How The Company Makes Money

PG Electroplast is in the electronic manufacturing services business - basically, they make stuff for other brands. Think room air conditioners, washing machines, air coolers, and LED TVs. They don’t sell under their own name. Instead, big consumer durable brands come to them and say “here’s our design, now manufacture it for us.” The company calls this ODM (original design manufacturing) and OEM (original equipment manufacturing).

The business has two main pieces. First, there’s the Products division - that’s where they make air conditioners and washing machines for brands. This is about 68% of their revenue. Second, there’s the Electronics division handling LED TVs and plastic injection molding components. They’ve also got a 50-50 joint venture called Goodworth Electronics that took over their TV business.

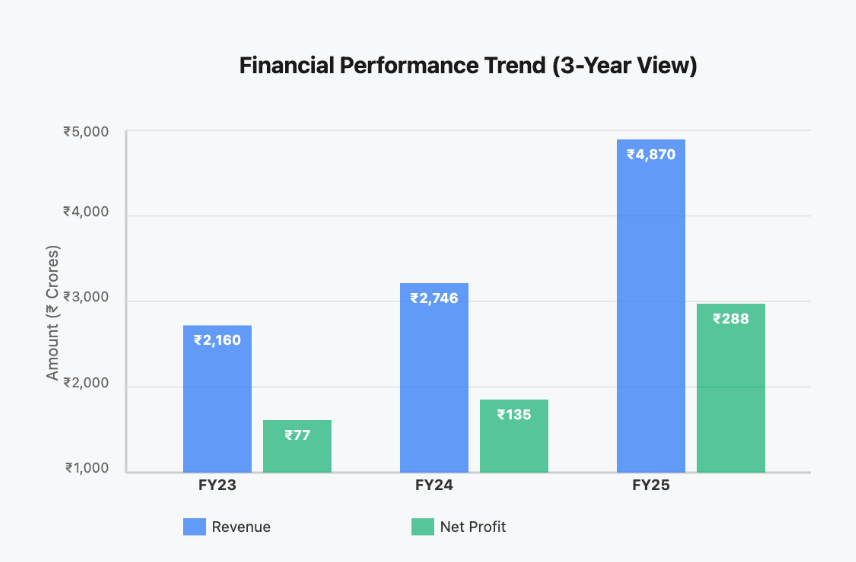

Over the past few years, they’ve been expanding aggressively. They opened a second air conditioner plant in Bhiwadi. They bought a new 10-acre plot in Ahmednagar. They acquired a company called Next Generation Manufacturers. The idea was to become India’s biggest player in room ACs and washing machines. And honestly, they did grow fast - revenues jumped from ₹2,160 crores in FY23 to ₹4,870 crores in FY25. That’s a 64% annual growth rate.

But here’s where things get messy. In the latest quarter ending September 2025, everything fell apart. Revenue dropped 66% from the previous quarter. Operating margins collapsed from 11% to under 5%. Net profit went from ₹67 crores to just ₹2.76 crores - down 88% from the same period last year. Management blamed it on early monsoons hurting air conditioner sales, but that’s a pretty weak excuse for such a massive drop.

The Numbers Don’t Look Good

Let’s talk about the growth story first. Over the past three years, revenue grew at 64% annually. Profit doubled every year. The EPS went from ₹3.41 in FY23 to ₹10.17 in FY25. Those are fantastic numbers on paper. The company became India’s largest ODM for room air conditioners.

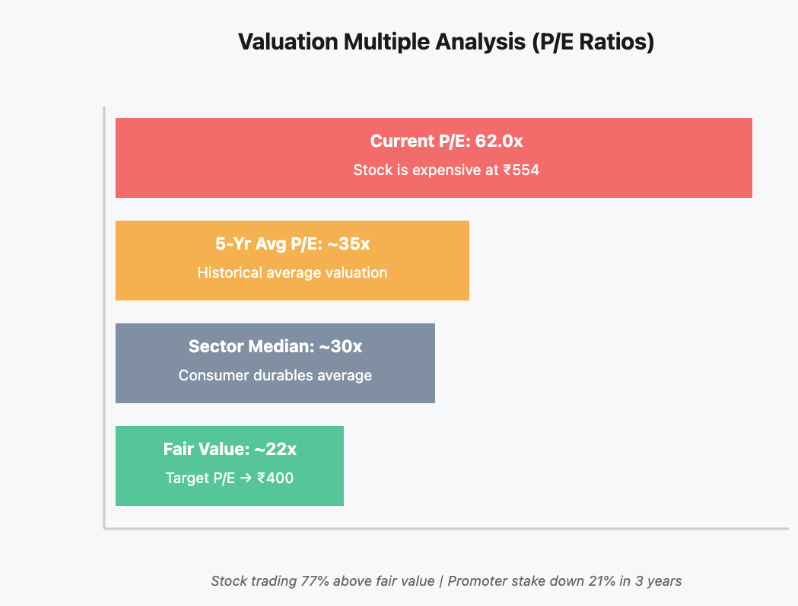

But here’s the problem - that growth is already baked into the stock price. The company is trading at a P/E ratio of 62. That means you’re paying ₹62 for every ₹1 of profit. For context, most manufacturing companies trade at 15-25 times earnings. Even fast-growing consumer durable companies rarely go above 40x.

The operating cash flow story is even worse. In FY25, the company actually had negative operating cash flow of ₹77 crores. They generated ₹288 crores in profit but burned through cash in operations. That’s a red flag - it means the profit isn’t translating into actual cash. They’re tying up money in inventory and receivables faster than they’re collecting it.

The balance sheet has gotten stretched too. Borrowings went from ₹577 crores in FY23 to ₹590 crores recently, even after raising equity through QIPs. Working capital days jumped from 57 to 68 days. The inventory is sitting for 124 days versus 90 days two years ago. That’s not a sign of efficiency.

Return metrics tell a similar story. ROE is 15% and ROCE is 19%. Those aren’t terrible, but they’re not spectacular either for a company trading at such a premium valuation. Compare that to their peers who often deliver 20-25% returns with less debt.

Why This Stock Is Overvalued

Let’s be blunt - at ₹554, this stock is priced for perfection in a business that’s showing cracks.

The P/E ratio of 62 is crazy high. Even if we use the trailing twelve-month EPS of ₹8.99 instead of the FY25 number, you’re still paying nearly 62 times. The company guided for FY26 profit of ₹300-310 crores. That works out to about ₹10.60 EPS. At the current price, you’re paying 52 times next year’s estimated earnings. That’s expensive for a contract manufacturer in a cyclical industry.

The P/B ratio is 5.4. You’re paying ₹5.40 for every rupee of book value. For a capital-intensive manufacturing business, that’s steep. Most similar companies trade at 2-3 times book value.

Here’s what really bothers me - the promoters have been selling consistently. Their stake dropped from 65% in March 2022 to just 43.6% now. That’s a 21 percentage point drop in three and a half years. They sold during the bull run when the stock was above ₹1,000. If the promoters who built this business are cashing out, why should you be buying in?

The dividend yield is basically zero at 0.05%. They paid ₹0.25 per share for FY25. That’s nothing.

The recent quarterly performance is alarming. Q2 FY26 was a disaster - profits collapsed, margins evaporated, and revenue fell off a cliff. Sure, management says it’s seasonal because of early monsoons. But if your entire business can get wiped out by weather patterns, that’s a problem with the business model itself.

The Long Road Ahead

Looking ahead 5-15 years, I’m not excited. My expected return range is -5% to 5% annually. In other words, this stock could easily go nowhere or even lose money over the next decade.

Here’s why the outlook is dim. The consumer durables market in India is competitive and cyclical. Brands like Samsung, LG, Whirlpool, and Haier can easily shift manufacturing to other vendors if PG Electroplast’s prices aren’t competitive. There’s no moat here - no brand loyalty, no pricing power, nothing proprietary. It’s a commodity manufacturing business.

Management keeps talking about capacity expansion - new plants, new product lines, capex investments. But where’s the money coming from? They’re already burning cash in operations and taking on debt. More capacity in a cyclical downturn is a recipe for disaster. They’ll have expensive factories sitting idle when demand softens.

The promoter selling is a massive red flag. These guys know the business better than anyone. They’re selling at every opportunity - through block deals, QIP dilution, gradual stake reduction. That tells you everything about their confidence in the stock’s future.

The risks are piling up too. Raw material costs for plastics and electronics components can spike suddenly. The rupee-dollar exchange rate impacts their profitability since many components are imported. Competition from Chinese manufacturers remains intense. And if consumer demand for ACs and washing machines slows down - which happens in economic downturns - this company gets hit hard.

There’s also the capital allocation issue. Management’s track record shows they prefer empire-building over shareholder returns. They’ve spent aggressively on capacity, acquisitions, and JVs. But they’re paying almost no dividends and the cash isn’t flowing through to investors.

The electronics manufacturing sector in India is growing, that’s true. The PLI scheme supports domestic manufacturing. But PG Electroplast isn’t getting unique benefits here - every competitor has access to the same incentives. The real winners will be companies with better cost structures and stronger client relationships, not necessarily the ones with the most capacity.

The Reality Check

At the current price of ₹554, this stock offers poor value. Fair value is probably around ₹400 based on 40x the midpoint of FY26 guidance - and that’s being generous given the execution risks.

The business model is fine for a steady, low-multiple stock. But at 62x earnings with promoters selling, negative operating cash flow, and a recent earnings collapse, there’s no margin of safety here. This is the kind of stock that can drop 30-40% quickly when sentiment shifts.

If you own it, consider taking profits. If you’re thinking of buying, wait for a major correction. Don’t chase expensive growth stocks when the growth itself is questionable.

Current Price: ₹554

Target Price: ₹400

Market Cap: ₹15,784 Crores

Disclaimer: This content is for educational purposes only and is not investment or financial advice. Stock markets are subject to risks. Do your own research and consult a qualified advisor before investing. The author is not responsible for any financial losses. Mentions of stocks/companies are not buy or sell recommendations.

How would you value Dixon and Kaynes?