Persistent Systems Stock Target 2026: PSYS Growth Outlook in Indian IT

Investment Thesis & Summary

Investment Call: BUY

This company is growing revenue faster than most of its peers while maintaining strong margins - they’re capturing market share in high-value areas like AI engineering and platform modernization. The stock’s trading at a reasonable valuation given the 23% revenue growth, and they’re throwing off serious cash.

Youtube Link:

Business Model & Operations

Here’s how they make money: they help big companies modernize their tech infrastructure and build new digital products. Think of them as a specialized engineering firm that codes, not constructs. Their bread and butter comes from three main buckets - banking and finance clients (about 45% of revenue), healthcare companies, and software/tech firms.

What sets them apart is they don’t just write code for hire. They’ve built their own software frameworks and tools - platforms like SASVA and iAURA that speed up client projects. These aren’t one-off consulting gigs. They’re deep, multi-year relationships where they become an extension of the client’s engineering team.

They’ve been busy lately. In the last quarter, they landed deals with a semiconductor materials company to modernize their R&D platform, a fintech firm to rebuild their payroll systems, and an edtech leader to improve customer experience using AI. They’re also partnered with DigitalOcean to deliver AI infrastructure solutions. The company now has over 26,500 employees spread across 18 countries, up from 23,000 just two years ago. That headcount growth isn’t random - it tracks with their expanding client base.

Historical Financial Review

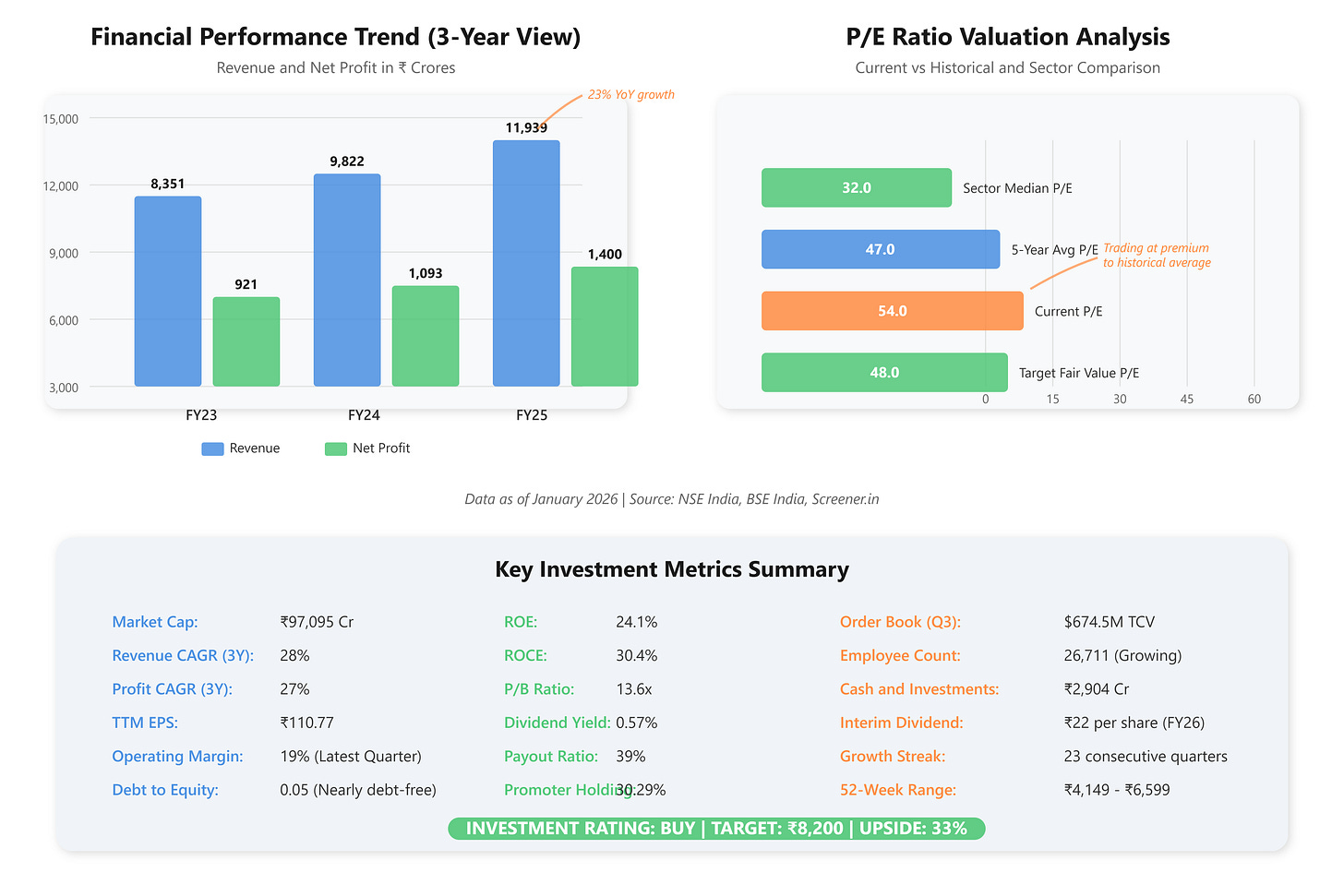

The numbers tell a solid growth story. Over the last three years, revenue grew at a 28% compounded annual rate. In FY25, they did ₹11,939 crores in sales, up from ₹9,822 crores the year before. That’s real momentum.

Earnings per share hit ₹90.54 in FY25, up from ₹70.98 the previous year. The trailing twelve months EPS is now ₹110.77 - they’re making more profit per share consistently. Net profit jumped from ₹1,093 crores in FY24 to ₹1,400 crores in FY25, a 28% increase.

Their cash generation is strong. Operating cash flow for FY25 was ₹1,157 crores. They maintain minimal debt - just ₹311 crores against ₹6,241 crores in reserves as of March 2025. The company’s free cash flow comfortably covers dividends and growth investments.

Management highlighted something important in their latest quarterly update: they hit 23 consecutive quarters of revenue growth. That’s almost six years of uninterrupted expansion. Operating margins stayed steady around 17-19% even as they scaled up. The latest quarter ended December 2025 saw revenue of ₹3,778 crores with a net profit of ₹439 crores, though profit took a one-time hit from new labor code implementation (about ₹89 crores impact).

They’re also returning cash to shareholders consistently. The board just declared an interim dividend of ₹22 per share for FY26, on top of the ₹35 they paid out in FY25 total dividends.

Fundamental Valuation Metrics & Investment Call

Let’s break down what you’re paying for:

P/E Ratio: Currently trading at 54x trailing earnings. That looks expensive at first glance, but here’s the context - their 5-year average P/E is around 45-50x, and the IT services sector median sits at roughly 30-35x. You’re paying a premium, no question. But for 23% revenue growth and 36% profit growth over the trailing twelve months? That premium starts making sense.

P/B Ratio: The stock trades at 13.6 times book value of ₹453. That’s high, but for a knowledge business with minimal fixed assets, book value matters less than earnings power and return on equity.

ROE and ROCE: Return on equity is 24.1% and return on capital employed is 30.4%. These are excellent numbers. They’re generating ₹24-30 of profit for every ₹100 of capital deployed. That’s the mark of a high-quality business with pricing power and efficient operations.

EPS Growth: Last twelve months EPS grew 36% year-over-year. The 3-year profit CAGR is 27%. They’re not just growing revenue, they’re converting it to bottom-line profit consistently.

Dividend Yield: At current prices, the yield is about 0.57%. Not great if you’re looking for income, but they’re maintaining a healthy 39% payout ratio while still investing heavily in growth.

Here’s my take on the call: BUY. The stock isn’t cheap on traditional metrics, but you’re getting quality - consistent growth, strong margins, minimal debt, and a management team that’s been executing well for six straight years. The 54x P/E is justified when you look at the 28% revenue CAGR and 33% profit CAGR over five years. If they can maintain even 18-20% growth (which their order book of $674 million TCV suggests they can), this valuation isn’t stretched. You’re paying for momentum and execution, both of which are on display.

Long-Term Outlook & Risk Assessment

Expected Returns: Over the next 5-10 years, I’m looking at potential returns in the 12-18% annual range. That assumes they can sustain 15-20% revenue growth and margins stay in the 16-18% range.

Why am I confident they can do this? Their order backlog tells the story. They booked $674.5 million in total contract value in Q3 FY26 alone, with $501.9 million in annual contract value. These aren’t small deals - they’re multi-year engagements in areas like AI, cloud migration, and digital transformation that aren’t slowing down.

Management’s putting money where the growth is. They’re investing in AI capabilities - they’ve been recognized as a Microsoft Frontier Firm and a Leader in ISG’s Generative AI Services. They opened an AI Garage in Pune designed specifically to accelerate AI-powered transformation projects. This isn’t marketing fluff - clients are paying for AI work.

On capital allocation, they’re balanced. Total dividends for FY25 were ₹35 per share (₹20 final + ₹15 interim), and they’ve already declared ₹22 for FY26. They’re not hoarding cash but they’re also not blowing it on bad acquisitions. The promoter holding has stayed steady around 30-31%, showing founder alignment without being locked in.

The Risks:

Global IT spending slowdowns hit them hard. Most of their revenue comes from the US market - if American companies cut tech budgets, this company feels it immediately.

Competition is brutal. They’re up against Infosys, Wipro, Tech Mahindra, and a dozen other capable firms, plus smaller startups bidding aggressively. Pricing pressure is real and constant.

Client concentration is a concern. Their top 5 clients grew 26% year-over-year, which is great, but also means they’re dependent on a handful of large relationships. Losing even one could hurt.

The rupee’s fluctuation matters. When the dollar weakens against the rupee, their export revenues take a hit. Recent quarters benefited from a weaker rupee - if that reverses, margins could compress.

Wage inflation in India is running hot. They need to keep hiring skilled engineers, and salaries for good tech talent keep climbing. They can’t pass all those costs to clients immediately.

What’s Working in Their Favor:

India’s position as a global tech services hub keeps strengthening. The government’s focus on digitization and technology infrastructure helps the broader ecosystem.

Enterprise spending on AI and cloud migration is accelerating globally, not slowing. Companies are moving away from legacy systems faster than they were three years ago.

The company’s niche in product engineering and platform modernization is less commoditized than basic IT services. They’re not competing on hourly rates for staff augmentation - they’re selling specialized capabilities.

Their partnerships with Microsoft, AWS, Google Cloud, and Salesforce give them access to enterprise clients already using those platforms. It’s a natural funnel for new business.