Olectra Greentech: Powering the EV Revolution | Q3 FY2025 Analysis

No 1 Electric Bus Manufacturer

📅 Edition: February 2025

🔎 Ticker: NSE: OLECTRA | BSE: 532439

📍 Sector: Electric Vehicles (EVs) & Composite Insulators

📌 Key Takeaways (At a Glance)

✅ Market Cap: ₹11,919 Cr

✅ Current Price: ₹1,452

✅ 52-Week High/Low: ₹2,222 / ₹1,240

✅ Stock P/E: 90.6 | Book Value: ₹120

✅ ROCE: 14.8% | ROE: 8.77%

✅ Sales Growth (YoY): 🚀 32.3%

✅ Profit Growth (YoY): 🚀 46.0%

✅ Sales (TTM): ₹1,642 Cr

✅ Promoter Holding: 50.0% (-1.60% in 3Y)

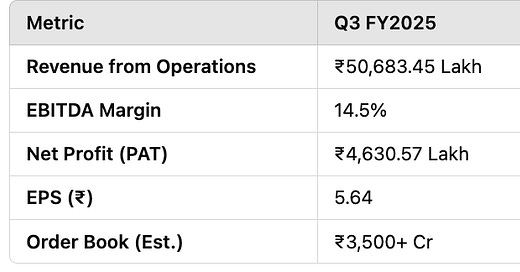

📈 Q3 FY2025 Financial Performance

Olectra Greentech Limited (OGL) has delivered an impressive Q3 FY2025, showcasing strong topline growth, margin expansion, and increased demand for its electric buses.

📌 Key Driver: Government tenders for electric buses & policy incentives under FAME-II.

🚀 Business Segments Performance

1️⃣ Electric Vehicles (EVs) - The Powerhouse

✅ Revenue Contribution: ₹45,977.93 Lakh (~90.7% of total revenue)

✅ YoY Growth: 55.4% 📈

✅ PBT (Before Tax & Interest): ₹5,926.52 Lakh

🔹 Major Growth Factors:

✔ Rising government tenders for electric buses under the FAME-II scheme

✔ Expansion into E-trucks & commercial EVs (New Segment)

✔ Strengthening partnerships with BYD & EVEY Trans

🎯 Future Outlook:

Capacity Expansion: New plant expected to double production capacity by FY2026

New Launches: Hydrogen-powered buses and high-end battery electric trucks

2️⃣ Composite Polymer Insulators - The Cash Flow Driver

✅ Revenue Contribution: ₹4,705.52 Lakh (~9.3% of total revenue)

✅ YoY Growth: 30.5%

✅ PBT (Before Tax & Interest): ₹1,224.35 Lakh

📌 Steady Revenue Stream: Demand is rising due to power grid expansion and transmission upgrades.

🎯 Future Outlook:

Export Expansion: Targeting new markets in the Middle East & Africa

New Product R&D: Advanced insulator technology under development

🌏 Future Growth Plans & Projections

⚡ Expanding Manufacturing & Capacity

📌 Planned Capex: ₹300-500 Cr investment

📌 New Factory: Increasing bus manufacturing capacity for upcoming government contracts

📌 Local Battery Production: Reducing import dependency to improve margins

🔹 EV Market Growth Projections (2025-2030)

India’s EV penetration to reach ~40% of buses by 2030

🔍 Competitive Landscape & Risks

Key Risks to Monitor

1️⃣ Government Policy Changes: Subsidy cuts (FAME-II) could impact future demand

2️⃣ Margin Pressure: Battery raw material price fluctuations (Lithium & Cobalt)

3️⃣ Execution Delays: New plant expansion timelines could impact deliveries

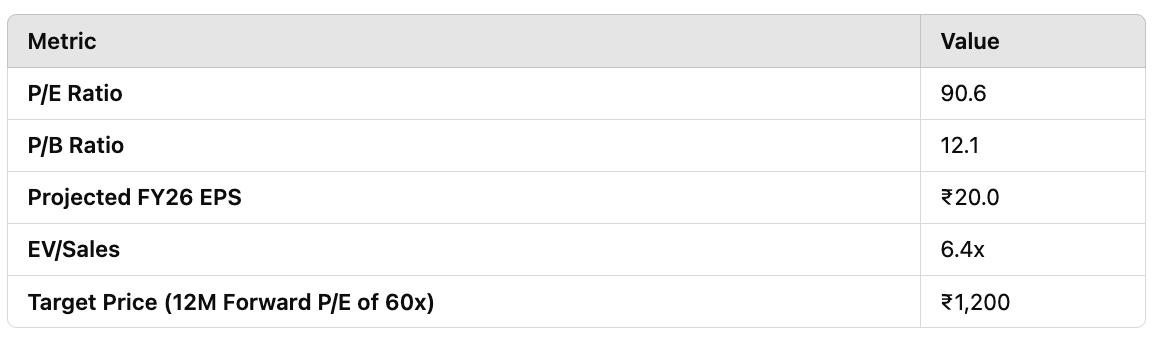

💰 Valuation & Investment Outlook

📊 Investment Thesis

✅ Long-Term Bull Case:

Government-backed growth: EV adoption increasing

First-mover advantage: Strong pipeline of bus orders

Manufacturing expansion: Higher capacity = Higher revenue

⚠ Short-Term Risks:

High valuation may lead to price correction

Competition from Tata, Ashok Leyland & global EV firms

📢 Final Thoughts

Olectra Greentech remains a high-growth, high-potential investment in India’s booming EV revolution. While near-term valuation concerns persist, the long-term upside is significant with increasing EV adoption, government contracts, and manufacturing expansion.

📜 Disclaimer

This report is for informational purposes only and does not constitute financial advice. Please conduct your own due diligence before making investment decisions.