Luxury Hotel Stock Analysis: Indian Hospitality Growth Play with 82% Upside

This is a freshly listed hospitality platform that just spun out from its parent real estate company in November 2025. The stock’s trading at a premium because investors are betting on India’s luxury hotel boom and this company’s aggressive expansion plans. They’ve got two marquee hotels up and running right now, but the real story is the five massive projects in the pipeline that could quadruple their room count by FY27. The catch? They’re burning through capital, promoters have pledged a chunk of their shares, and the company’s barely profitable today. It’s a long-term growth play, not a value buy.

Business Model & Operations

This company makes money by owning and operating premium hotels under global luxury brands - think Grand Hyatt, Hilton, Marriott, St. Regis. They don’t franchise; they own the real estate and partner with big international hotel chains to run the operations. Right now, they’ve got two cash-generating properties: a 313-room Grand Hyatt in Goa and a 171-room Hilton near Mumbai airport. That’s 484 keys total.

The Goa property sits in Bambolim and pulls in solid occupancy from both leisure travelers and the wedding market. The Mumbai Hilton is strategically placed in Andheri East, close to the airport and corporate hubs - it’s all about business travelers and airline crews. These two hotels generated the bulk of their ₹367 crore revenue in FY25.

Here’s where it gets interesting. They’re developing five more hotels through a joint venture with Prestige Group - two at Delhi Aerocity (St. Regis and Marriott Marquis), plus three in Mumbai including a massive 1,175-room property at BKC. They’re also planning to expand the Goa Grand Hyatt by adding 113 more rooms. By the time all these projects come online around FY27, they’ll have 3,100 keys - that’s a sixfold jump from where they are today.

The business model is capital-intensive. Unlike asset-light hotel operators that just manage properties for fees, this company owns the land and buildings. That means huge upfront costs but higher margins once hotels mature. The trade-off is they need lots of debt and equity capital to fund construction.

Historical Financial Review

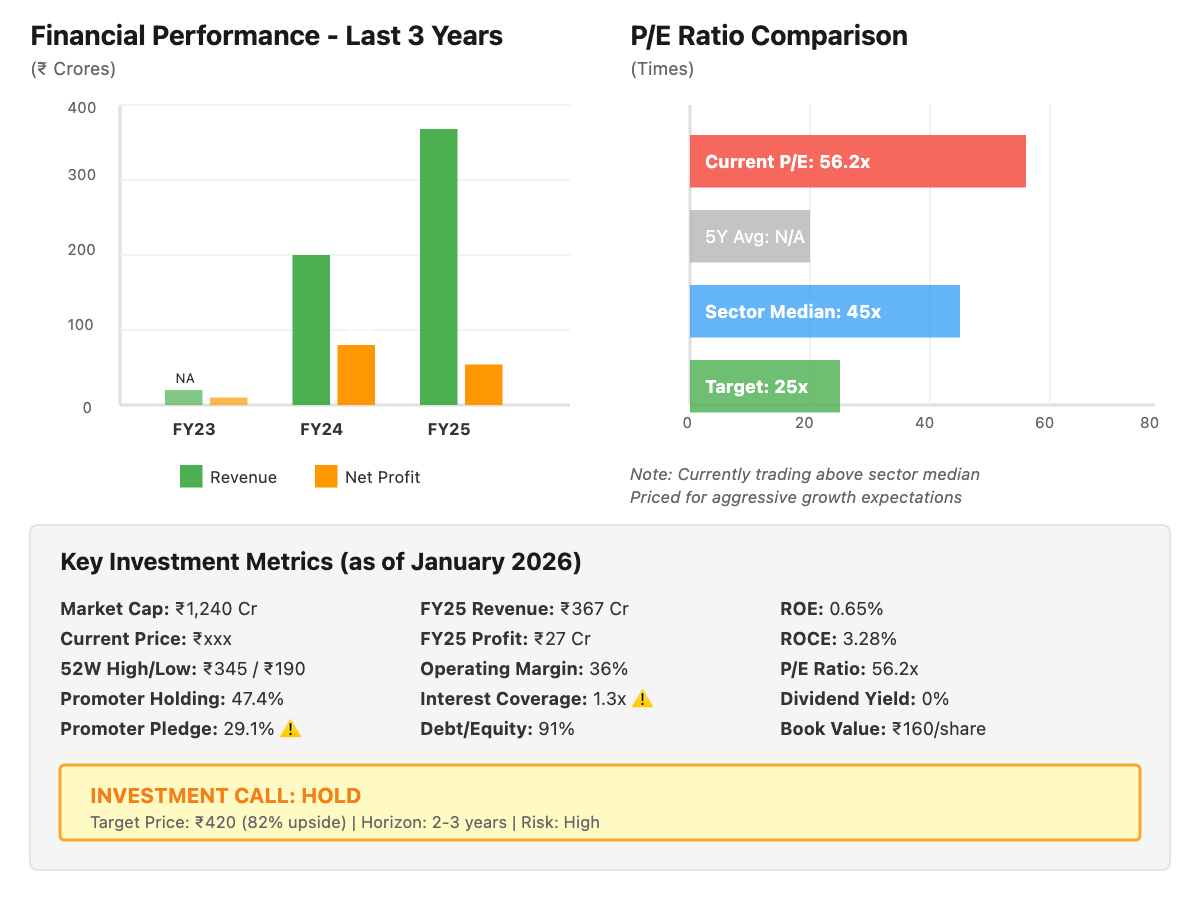

Let’s talk numbers. FY25 was essentially their first year as an independent entity post-demerger. Revenue came in at ₹367 crores, up 82% from the ₹201 crores they did in FY24. That massive jump reflects a full year of operations for both hotels after some COVID recovery. Net profit was ₹27 crores, which translates to about ₹50 per share based on their current share count of 5.4 crore shares post-listing.

But here’s the reality check - that 7% net margin is razor-thin for a luxury hotel operator. Operating profit margins are better at 36%, but they’re getting eaten up by interest costs of ₹61 crores annually. They’re servicing a debt pile of over ₹600 crores, and interest coverage sits at just 1.3x. That’s not comfortable.

Cash flow tells a more volatile story. In FY25, they generated ₹2,310 crores from operations, but that’s inflated by working capital adjustments related to the demerger. The core operating cash generation is closer to ₹130-140 crores annually. They spent ₹2,183 crores on investing activities - mostly pouring money into hotels under construction.

The latest quarterly numbers from September 2025 show some wobbles. Q2 FY26 revenue was ₹77 crores, flat quarter-on-quarter, and they posted a small loss of ₹1.2 crores. Q1 FY26 was better with ₹80.5 crores in sales and ₹32.5 crores profit, but that included ₹47 crores of exceptional income - likely related to demerger accounting. Strip that out, and the underlying business is barely breaking even right now.

The balance sheet is heavy. Total assets of ₹3,950 crores include ₹2,130 crores in fixed assets (hotels) and ₹1,209 crores in investments. They’re carrying ₹787 crores of debt plus another ₹2,294 crores in other liabilities. Shareholder equity is about ₹867 crores, giving them a debt-to-equity ratio of 91%. That’s manageable but leaves little room for error.

Fundamental Valuation Metrics & Investment Call

The stock’s trading at a P/E ratio of 56x based on FY25 earnings. For context, established hotel chains like Indian Hotels trade at 60-70x, while smaller peers are at 30-40x. So this company’s priced for growth - investors are paying up front for those five hotels that aren’t making money yet.

Price-to-book sits around 1.4x. That’s reasonable given the quality of their assets, but it’s not cheap. You’re paying ₹1.40 for every rupee of book value.

Return ratios are weak - ROE is 0.65% and ROCE is 3.28%. Translation: they’re earning barely anything on the capital they’ve deployed. That’s expected for a company in build mode, but it won’t justify the valuation unless those numbers improve dramatically as new hotels open.

Here’s the math on whether this is a buy at ₹230. The company’s guiding for EBITDA to grow from under ₹200 crores today to over ₹1,200 crores by FY32 as projects mature. If they hit that target and maintain a 30% EBITDA margin, you’re looking at ₹4,000 crores in revenue. After interest and taxes, net profit could reach ₹400-450 crores, or ₹75-85 per share. At a 25x multiple (more reasonable for a mature portfolio), the stock could trade at ₹1,875-2,125 by FY32.

But let’s be realistic. That’s a seven-year journey with massive execution risk. Projects could get delayed, costs could overrun, and India’s hotel cycle could soften. A more conservative target for the next 2-3 years is ₹420, assuming EPS grows to ₹15-20 as the first phase of new hotels opens and they maintain a 20-25x multiple. That’s 82% upside, but you’re taking on significant risk.

The zero dividend yield means you’re purely betting on capital appreciation. There’s no income while you wait.

Long-Term Outlook & Risk Assessment

Over 10-15 years, if everything goes right, you could see 12-15% compounded annual returns. That assumes they successfully complete all five development projects, achieve 70% average occupancy at ₹8,000-10,000 average room rates, maintain EBITDA margins of 50-55% at maturity, and don’t run into major funding issues.

India’s luxury hotel market is a structural growth story. Business travel is recovering post-COVID, MICE (meetings, incentives, conferences, exhibitions) demand is surging, and wealthy Indians are spending more on premium domestic travel. Supply of quality rooms in gateway cities remains tight. This company’s positioned in the right locations - Mumbai, Delhi, and Goa are the three strongest micro-markets in India.

Management’s strategy is clear: own trophy assets in the best locations, partner with the world’s best hotel brands for operations, and build a portfolio that can generate consistent cash flow once construction phases end. The promoters come from the DB Realty lineage, which has deep real estate expertise. The new CEO and management team are hospitality professionals.

But the risks are real. First, the debt load. They’re going to need another ₹2,000-2,500 crores to complete the pipeline. That means either more equity dilution (bad for per-share returns) or more debt (risky given their already-stretched balance sheet). The 29% promoter pledge is a red flag - it suggests they’re personally leveraged and might be forced sellers if the stock falls significantly.

Second, execution risk. Building hotels on time and on budget in India is tough. Regulatory approvals, construction delays, and cost inflation are constant challenges. If projects slip by even a year, your returns get pushed out and the whole investment case weakens.

Third, competition. Every major hotel chain is expanding in India. ITC, Indian Hotels (Taj), Lemon Tree, and numerous others are adding supply. If too many rooms hit the market at once, occupancies and rates could disappoint.

Fourth, capital allocation. Post-FY27, will management be disciplined about returns, or will they keep chasing growth? The real test is whether they can generate 15%+ ROE once assets are stabilized. If they instead plow all cash into more projects with mediocre returns, shareholders suffer.

Fifth, the parent company shadow. They demerged from Valor Estate, which has historically been a controversial real estate player. While the new entity has its own board and is institutionalizing governance, the promoter overlap and related party transactions bear watching.

On the positive side, India’s hotel sector is consolidating around winners with scale and brand partnerships. If this company executes well, they could become a pure-play luxury hotel platform that attracts institutional capital and trades at a premium. The Prestige partnership de-risks development since Prestige brings execution expertise and capital.

Another positive: they’re not paying dividends, which means all cash flow gets reinvested. For a company in growth mode, that’s the right call. Once the portfolio matures post-FY27, they could start returning cash to shareholders through dividends or buybacks.

The macro tailwinds for Indian luxury hospitality are strong. Domestic air traffic is growing 8-10% annually, international tourist arrivals are rebounding, and corporate spending on travel is back. India’s wedding market alone generates billions in luxury hotel revenue annually. The government’s infrastructure push (new airports, convention centers) should support demand in key markets.

Bottom line: this is a speculative growth play with 10+ year upside potential if you’re patient and willing to stomach volatility. For conservative investors, there are better places to park capital. For those who believe in India’s luxury consumption story and can handle 30-40% drawdowns along the way, this could be a multi-bagger - but buy on dips, not at these prices.

Disclaimer:

This report is for educational purposes only. We are not SEBI Registered Investment Advisors. only and is not investment or financial advice. Stock markets are subject to risks. Do your own research and consult a qualified advisor before investing. The author is not responsible for any financial losses. Mentions of stocks/companies are not buy or sell recommendations.

Subscribe for more details….