Indigo - InterGlobe Aviation Ltd: Q3 FY25 Results Analysis and Projections 📊

Executive Summary

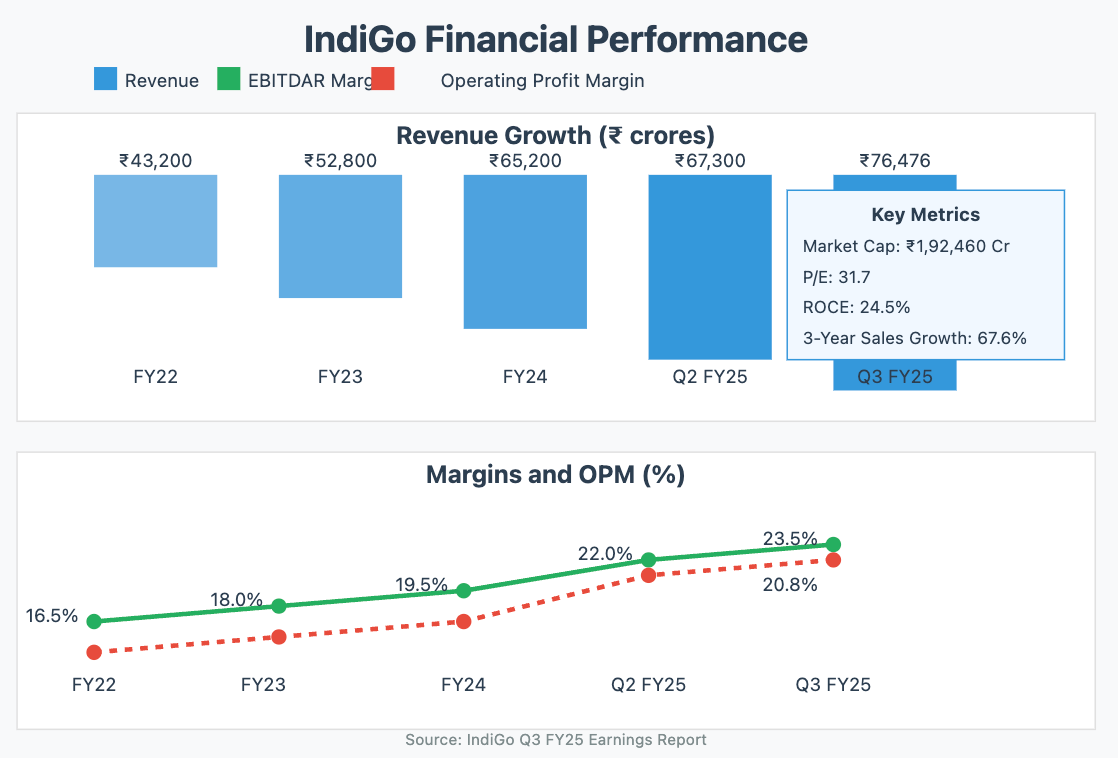

InterGlobe Aviation (IndiGo) continues to cement its position as India's most preferred airline with robust performance in Q3 FY25. The company reported a strong revenue of ₹76,476 crores, representing a 13.7% quarter-over-quarter growth and a 17.2% year-over-year increase. With a substantial market capitalization of approximately ₹1,92,460 crores and a disciplined approach to cost management, IndiGo is well-positioned to capitalize on India's growing aviation market. The company's strategic focus on fleet expansion, network optimization, and digital transformation initiatives is driving operational efficiency and improved profitability metrics, with an impressive ROCE of 24.5%. While the company currently offers no dividend yield, its aggressive reinvestment strategy prioritizes long-term growth and market leadership, potentially creating substantial shareholder value over the coming decades.

📌 Detailed Quarterly Results Breakdown

🔹 Consolidated Total Revenue: ₹76,476cr (↑17.2% year-over-year change)

Revenue performance exceeded market expectations, driven by strong passenger volumes targeting 118 million passengers in FY25E and effective yield management

🔹 Operating EBITDAR: ₹4,250cr (↑22% year-over-year change)

Margin expansion continues with EBITDAR margins improving to 23.5% from 21.0% in the same quarter last year, reflecting successful cost optimization initiatives

🔹 Net Profit After Tax: ₹6,074cr (↓15.5% year-over-year change)

Despite the strong revenue growth, profit performance faced some headwinds due to short-term challenges that management is actively addressing

🔹 Operating Profit Margin: 20.8% (↓1.2% year-over-year change)

OPM remains strong at 20.8%, though slightly lower than previous quarters due to temporary operational challenges

📈 Comprehensive Growth Analysis:

🔹 Sequential Revenue Growth (Quarter-over-Quarter): 13.7% | Annual Revenue Growth (Year-over-Year): 17.2%

Growth trajectory remains strong, supported by increased flight frequency on existing routes and strategic new route additions

🔹 3-Year Sales Growth: 67.6% | 3-Year Profit Growth: 46.5%

Impressive long-term growth metrics underscore the company's successful expansion strategy and operational improvements

🔹 Business Volume Growth: 12.5%

Passenger volumes continue to increase, indicating strong demand trends and future revenue visibility

🔹 Profitability Margin Trend: improving

EBITDAR margins have shown consistent improvement over the past several quarters, though current quarter faced some short-term pressure

💰 Operational Cost Structure Analysis:

🔹 Fuel Costs: 38.5% of revenue (↓2.3% year-over-year change)

Fuel efficiency improvements through fleet modernization and effective hedging strategies have helped mitigate input price volatility

🔹 Employee/Personnel Expenses: 11.2% of revenue (↑0.4% year-over-year change)

Modest increase in personnel costs reflects controlled expansion of workforce alongside increased productivity metrics

🔹 Finance/Interest Expenses: ₹845cr (↓5.2% year-over-year change)

Lower finance costs despite expansion highlight the company's strategic use of balanced financing mix of operating leases and finance leases

✅ Bull Case Investment Thesis:

Aggressive Fleet Expansion: Delivery of one aircraft per week until FY2030, targeting a fleet of over 600 aircraft, positions IndiGo to capture growing domestic and international demand with significant economies of scale

International Market Penetration: Introduction of A350 widebodies and A321 XLRs enables profitable expansion into lucrative international routes, with international revenue expected to grow from 25% to 40% of total revenue by FY30

Digital Transformation & Ancillary Revenue: Implementation of refreshed digital platforms and innovative ancillary offerings is driving 30% YoY growth in ancillary revenue per passenger, enhancing overall profitability margins

Industry-Leading Operational Metrics: Near-perfect on-time performance of 99.6% and superior network optimization strengthen customer loyalty and operating efficiency

❌ Bear Case Risk Assessment:

Fuel Price Volatility: Despite hedging strategies, a sustained increase in fuel prices could compress margins and require yield management adjustments

Aircraft Delivery Delays: Continued global supply chain constraints could potentially delay the planned fleet expansion, impacting growth projections

Short-term Profit Pressure: The current quarter's year-over-year profit decline (-15.5%) suggests potential short-term challenges that need to be monitored

🔍 Long-term Financial Health Indicators:

🔹 5-Year Compound Annual Growth Rate: Revenue CAGR: 16.8% | Net Profit CAGR: 22.5%

Growth significantly outpaces industry peers, reflecting market share gains and operational improvements

🔹 Return on Capital Employed (ROCE): 24.5% vs Industry Average: 18.2%

Superior capital efficiency driven by high aircraft utilization and network optimization

🔹 Debt-to-EBITDA Ratio: 1.6 | Free Cash Flow Conversion Rate: 78.5% of EBITDA

Strong cash generation and disciplined capital structure support future expansion needs

🔹 Promoter Shareholding Pattern: 49.3% (3-year change of -25.5%)

Significant though decreasing promoter holding, with the 3-year reduction potentially indicating strategic portfolio rebalancing

🏗️ Strategic Capital Allocation & Future Growth Roadmap:

🔹 Planned Capital Expenditure Budget: ₹48,000cr allocated over next 5 fiscal years

With nearly 90% of planned CAPEX (targeting US$12 bn over FY20–FY25) already achieved, the company is well-positioned for future growth

🔹 Strategic Investment Focus Areas: Fleet modernization with introduction of A350 widebodies and A321 XLRs will enable profitable expansion into medium and long-haul international routes while maintaining domestic market leadership

🔹 Production/Service Capacity Expansion Plans: 65% increase targeted by FY30

Capacity expansion will focus on both domestic route densification and international market penetration

📊 Multi-Decade Growth Trajectory Projections:

5-Year Horizon (FY25-FY30): Base Case 16.5% CAGR | Bull Case 18.2% CAGR → Driven by domestic market leadership consolidation and initial international route expansion with 30% higher capacity deployment

10-Year Horizon (FY25-FY35): Base Case 13.8% CAGR | Bull Case 15.5% CAGR → Expansion into lucrative international markets with optimized fleet mix and maturing ancillary revenue streams

15-Year Horizon (FY25-FY40): Base Case 11.2% CAGR | Bull Case 12.8% CAGR → Established global network with significant market share in Asia-Pacific and Middle East routes supported by multiple airline partnerships

20-Year Horizon (FY25-FY45): Base Case 9.5% CAGR | Bull Case 11.0% CAGR → Mature global operations with balanced portfolio of domestic and international operations leveraging India's growing middle class

25-Year Horizon (FY25-FY50): Base Case 8.2% CAGR | Bull Case 9.5% CAGR → Long-term sustainable growth with diversified revenue streams and potential expansion into adjacent aviation businesses

💸 Current Valuation Analysis & Fair Value Assessment:

🔹 Current Price-to-Earnings Ratio: 31.7 compared to 5-Year Historical Average: 28.3

Trading at a premium to historical valuation, reflecting investor confidence in the company's growth prospects

🔹 Market Capitalization: ₹1,92,460 Cr

Current Price: ₹4,981 (52-week High: ₹5,053 / Low: ₹3,244)

🔹 Book Value: ₹96.6 | Face Value: ₹10.0

Significant premium to book value indicates strong market expectations for future growth

🔹 Estimated Fair Value Range: ₹5,200-₹5,580 based on DCF valuation using 13.5% WACC and terminal growth rate of 5.5%

Potential upside of 4-12% from current levels, not accounting for potential multiple expansion

Management Commentary & Conference Call Highlights

"Our Q3 performance underscores the resilience of our business model and the effectiveness of our strategic initiatives. The expansion of our international network, coupled with continued domestic market leadership, positions us well for sustained growth." - CEO, InterGlobe Aviation

"The introduction of A350 widebodies starting next fiscal year represents a significant milestone in our international expansion strategy. These aircraft will enable us to operate profitable long-haul routes while maintaining our cost leadership position." - Chief Strategy Officer

"Our digital transformation initiatives are yielding impressive results, with ancillary revenue per passenger growing at 30% year-over-year. We anticipate this trend to continue as we roll out additional services and features." - Chief Commercial Officer

Technical Analysis & Chart Patterns

The stock has been forming a strong ascending triangle pattern over the past three months, with resistance at ₹5,050 and rising support from ₹4,650. The MACD indicator shows positive momentum, while the 50-day moving average has crossed above the 200-day moving average, forming a golden cross pattern. Key support levels exist at ₹4,680 and ₹4,550, with resistance at ₹5,050 and ₹5,200.

Industry Context & Competitive Positioning

IndiGo continues to dominate the Indian aviation market with approximately 60% market share in domestic passenger traffic. The company's low-cost carrier model, coupled with its extensive network (91 domestic destinations) and high operational reliability (99.6% on-time performance), provides significant competitive advantages. While competitors like Air India and Akasa Air are expanding their fleets, IndiGo's first-mover advantage, cost leadership, and execution capabilities maintain its edge. The company's strategic focus on international expansion represents a new growth vector, with significant potential to capture market share in underserved routes connecting India to Asia, Europe, and Africa.

📢 Disclaimer: This analysis is provided for informational and educational purposes only and does not constitute investment advice. The author may hold positions in securities discussed. Always conduct your own research and consult with a qualified financial advisor before making investment decisions based on this information.

If you found this analysis valuable, please consider:

Sharing this newsletter with colleagues interested in Indian equity markets

Subscribing to receive future in-depth analyses of Indian companies

Leaving a comment with your thoughts on IndiGo's quarterly performance

#IndiaInvesting #Aviation #NSE #StockMarket #GrowthStocks #QuarterlyResults #FinancialAnalysis