India's Largest Iron Ore Mining Giant: 30% ROCE, 4.3% Dividend Yield at 32% Discount - Deep Value Analysis

Disclaimer: This report is for educational purposes only under the Value Picks Studies framework. We are not SEBI Registered Investment Advisors. Please consult a professional before investing your hard-earned money.

Date of Analysis: December 21, 2025

Ticker: NSE/BSE (Name disclosed at end)

Sector: Metals & Mining - Iron Ore

1. THE SNAPSHOT

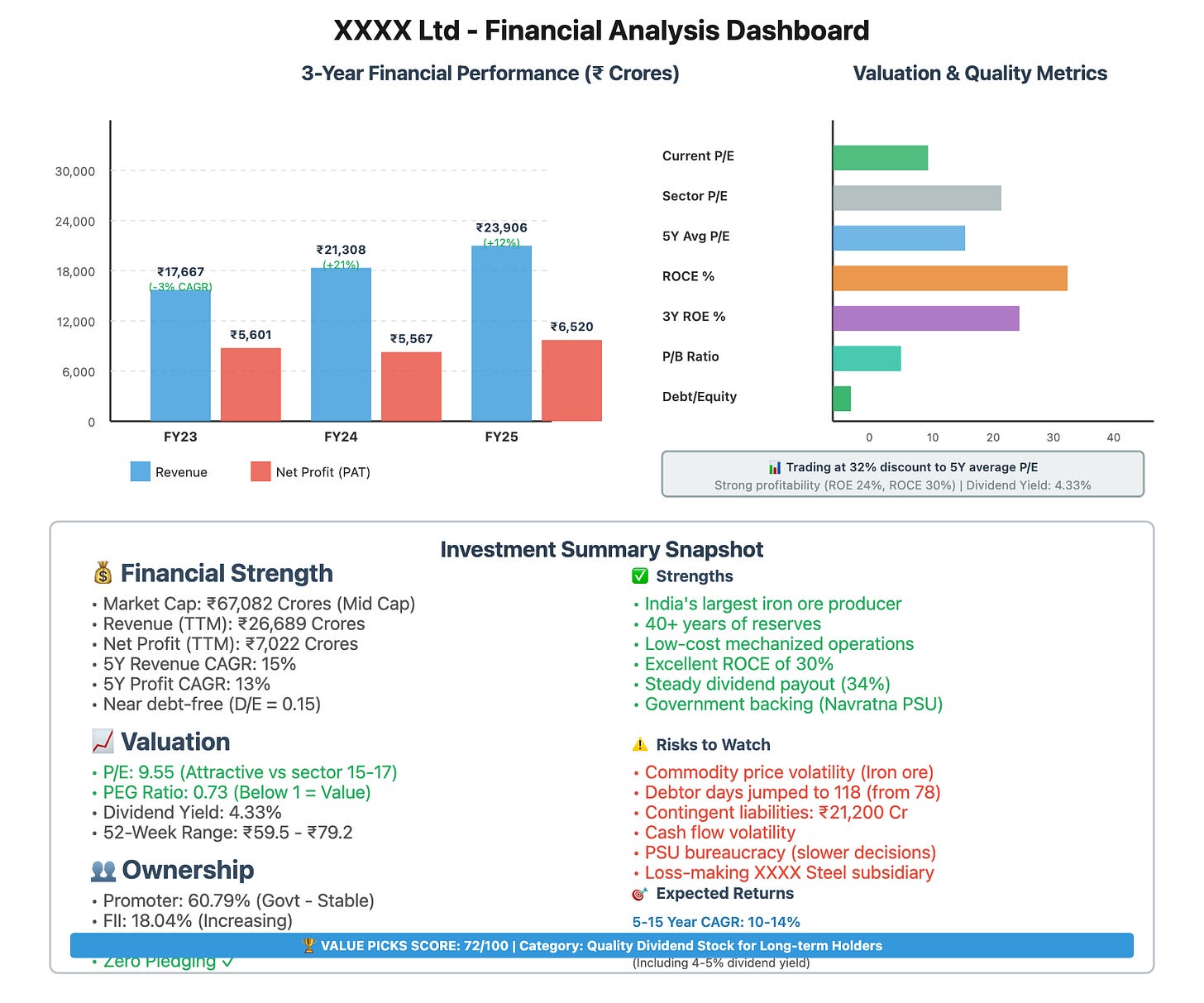

Current Market Price (CMP): ₹76.3

Intrinsic Value (DCF): ₹92-95

Market Cap Category: Mid Cap

Total Market Cap: ₹67,082 Crores

52-Week High/Low: ₹79.2 / ₹59.5

Dividend Yield: 4.33%

The “Elevator Pitch”:

This is India’s largest iron ore producer - a government-owned mining giant that digs up 45 million tonnes of high-grade iron ore every year from massive mines in Chhattisgarh and Karnataka. Think of them as the fuel supplier to India’s steel industry. Right now, they’re trading cheap, paying fat dividends, and sitting on enough reserves to mine for the next 40 years.

2. BUSINESS GENETICS

Core Products: High-grade iron ore (65% Fe content) - both lumps and fines, diamond mining, iron ore pellets.

Revenue Mix: 99.9% Domestic (India) / 0.1% Exports. Iron ore accounts for 98.7% of revenue.

The Moat (Competitive Edge):

Here’s the thing - when you own the biggest iron ore reserves in India and the government backs you, competitors can’t just waltz in. These mines are mechanized to the teeth, running at some of the lowest costs globally. The license to operate massive mines isn’t something you get at the corner store. Plus, they’ve got captive customers - every steel plant in India needs what they’re selling.

Key Growth Driver:

Two things are going to push this higher. First, India’s infrastructure boom means more steel demand, which means more iron ore needed. Second, the government’s push for “Atmanirbhar Bharat” (self-reliant India) means they want local iron ore, not imports. The company produces about 45 million tonnes annually and sold about 44.5 million tonnes last year - they’re basically running at full capacity.

3. GOVERNANCE & PROMOTER CHECK

Promoter Holding: 60.79% (Rock solid - hasn’t moved an inch in years)

Promoter Pledging: 0% (Clean as a whistle)

Institutional Interest:

FIIs hold 13.04% (up from 11.72% in March 2025 - foreign money is slowly coming in)

DIIs hold 14.38% (steady)

LIC is the biggest non-government shareholder

Management Quality:

It’s a Navratna PSU, so the management changes with government appointments. Current CMD is Amitava Mukherjee. Being a government company, there’s bureaucracy, but they’ve consistently delivered on production targets. No major controversies. They’re transparent with quarterly production updates and investor calls. The downside of PSU management? Slower decision-making. The upside? No promoter shenanigans or fund diversion.

4. FINANCIAL VITAL SIGNS

Sales Growth (5-Year CAGR): 15% (Solid, considering they’re in a commodity business)

Profit Growth (5-Year CAGR): 13% (Good, but watch out - commodity prices swing this wildly)

ROCE (Return on Capital): 29.6% (Outstanding - they’re turning every rupee of capital into almost 30 paise of profit)

ROE (Return on Equity): 23.6% (3-year average - this is premium territory)

Debt-to-Equity Ratio: 0.15 (Basically debt-free. They have ₹4,276 Cr in borrowings against ₹28,817 Cr in reserves)

Cash Flow Check:

Here’s where it gets interesting. In FY25, operating cash flow was only ₹1,894 Cr while net profit was ₹6,520 Cr. That’s a yellow flag. Cash flow has been erratic - stellar in FY24 (₹7,394 Cr) but weak in FY25. Why? Working capital got eaten up. Their debtor days shot up from 78 to 118 days - customers are taking longer to pay.

5. THE VALUE PICKS “RED FLAG” CHECKLIST

✅ High Promoter Pledging: Clean. Zero pledging.

🚩 Related Party Transactions: Being a PSU, they have a subsidiary XXXX Steel that’s loss-making. That’s a drag. But no shady family deals here.

✅ Frequent Auditor Changes: Stable. Government auditors are consistent.

🚩 Rising Debtor Days: WARNING - This jumped from 78 days to 118 days. Steel companies are clearly taking their sweet time paying up. Not great.

🚩 High “Other Expenses”: Nothing alarming, but as a percentage of revenue, expenses did tick up in recent quarters.

🚩 Contingent Liabilities: Big one here - ₹21,200 Crores in contingent liabilities. That’s mostly legal cases and royalty disputes with state governments. If these crystallize, it’ll hurt.

6. VALUATION & PRICE LOGIC

Current P/E Ratio: 9.55

10-Year Median P/E: ~12-14

Sector P/E (Metals & Mining): ~15-20

Is it overvalued or undervalued?

It’s trading at a discount to its own history and way below the sector. At ₹76, with TTM EPS of ₹7.99, you’re paying less than 10 times earnings for a company with 30% ROCE and 24% ROE. That’s cheap. But here’s the catch - it’s cheap for a reason. Iron ore prices are cyclical, and when China sneezes, this stock catches a cold.

PEG Ratio: 0.73 (Below 1.2 is usually a bargain. This is screaming value if growth sustains)

7. LONG-TERM OUTLOOK & RISK ASSESSMENT

Expected 5-15 Year Returns: 10-14% CAGR

Let’s be real here. This isn’t going to be a rocket ship. Here’s my math: The stock could reasonably trade at 12-13x earnings in a normal year. With EPS growing at 10-12% (assuming iron ore prices stay stable and volumes inch up), you’re looking at doubling your money in 6-7 years. Add the 4-5% dividend yield, and you’re staring at 12-14% annual returns. Not spectacular, but solid.

What Could Go Right:

India’s infrastructure push is massive - roads, railways, metro projects, smart cities. All need steel. All steel needs iron ore. The government wants domestic sourcing. Plus, global iron ore supply could tighten if Australia faces regulatory issues or if Brazilian production stutters. If iron ore prices jump from current $100/tonne to $130-140, this stock could re-rate 30-40% overnight.

The company is also exploring lithium in Australia - if that pans out, it’s a bonus.

What Could Go Wrong:

Iron ore prices. That’s the single biggest risk. They’re cyclical. When China’s property sector tanks or steel production drops, iron ore crashes. This stock went from ₹250 to ₹100 in 2022 when prices fell. It can happen again.

Second risk - government interference. PSUs can be forced to sell at lower prices for “national interest.” They’ve done it before.

Third - the debtor days issue. If steel companies delay payments further or default, cash flows will suffer.

Fourth - those ₹21,200 Cr contingent liabilities. If even 20% crystallize, that’s a ₹4,000+ Cr hit.

Fifth - XXXX Steel (the subsidiary) is bleeding money. It’s a ₹11,755 Cr market cap company making losses. That’s a drag on the parent.

Capital Allocation:

They pay out about 34% of profits as dividends - that’s ₹1-1.5 per share annually. They’re spending on expanding capacity and modernizing mines. Not aggressive on buybacks. Promoter holding is stable at 60.79% - government isn’t selling, which is good for stability.

Industry Tailwinds for India:

Steel consumption in India is projected to grow 7-8% annually. We’re at 120-130 kg per capita steel consumption vs. China’s 600+ kg and the world average of 240 kg. As we urbanize, we’ll need more steel, which means more iron ore. That’s a 10-15 year structural story.

8. THE FINAL VERDICT

Value Picks Score: 72/100

Management (30 pts): 22/30 - It’s a PSU. Competent, transparent, but bureaucratic. No flexibility.

Financials (30 pts): 24/30 - Strong profitability and returns, but cash flow wobbles and rising debtors hurt.

Moat (20 pts): 16/20 - Strong competitive position, but commodity pricing kills pricing power.

Valuation (20 pts): 10/20 - Cheap on P/E, but there’s a reason. Cyclical risk.

Conclusion:

This is a “Buy and Hold for Dividends” stock, not a multibagger. If you’re okay with 12-14% annual returns over the next decade and can stomach 20-30% volatility when iron ore prices swing, this belongs in your portfolio. It’s boring, it’s a PSU, but it pays you to wait.

Avoid if you’re looking for quick doubles or if you can’t handle commodity cycles. It’s a value trap if iron ore prices tank below $80/tonne for a prolonged period.

Ideal for: Conservative investors wanting exposure to India’s infrastructure story with dividend income.