Hindustan Unilever Ltd (HINDUNILVR): India's FMCG Titan Worth a Fresh Look

I. Investment Thesis & Summary

Here’s the thing about HUL - it’s India’s biggest consumer goods company, but the stock’s been going sideways for a while now. The company just demerged its ice cream business in early December 2025, which simplifies things and could boost margins by about 50 basis points. At a P/E of 51, this isn’t a cheap stock by any measure. But you’re paying for quality, brand power, and a business that touches every Indian household multiple times a day. The stock’s trading below its 52-week high of ₹2,660, and with volume growth slowly picking back up, there’s room for re-rating if they execute well.

Youtube Link:

II. Business Model & Operations

HUL makes money selling stuff everyone uses - soap, shampoo, detergent, toothpaste, tea, coffee, and packaged foods. They’ve got over 50 brands across 16 categories, with 19 brands doing more than ₹1,000 crores each in annual sales. Think Surf Excel, Dove, Lux, Lifebuoy, Rin, Wheel, Clinic Plus, Pepsodent, Brooke Bond, Lipton, Bru, Knorr, and Kissan - these names are everywhere in India.

The business runs in three main buckets: Home Care (detergents and cleaners), Beauty & Personal Care (soaps, shampoos, skin care), and Foods & Refreshment (tea, coffee, sauces, nutrition). They manufacture across India and sell through 2.3 million retail outlets. That distribution network is their moat - nobody else reaches as many corners of India.

What’s new?

They just spun off their ice cream business into a separate company called Kwality Wall’s India Limited. Every HUL shareholder got one share of the new company for every HUL share they owned. The ice cream business was growing but had lower margins than HUL’s core products, so separating it makes sense. It lets HUL focus on what it does best while giving the ice cream unit room to grow independently.

The latest quarter saw flat volume growth because of temporary GST changes that affected 40% of their products. Once the market adjusted to new prices in November, things started normalizing. Management’s betting on a better second half of FY26.

III. Historical Financial Review

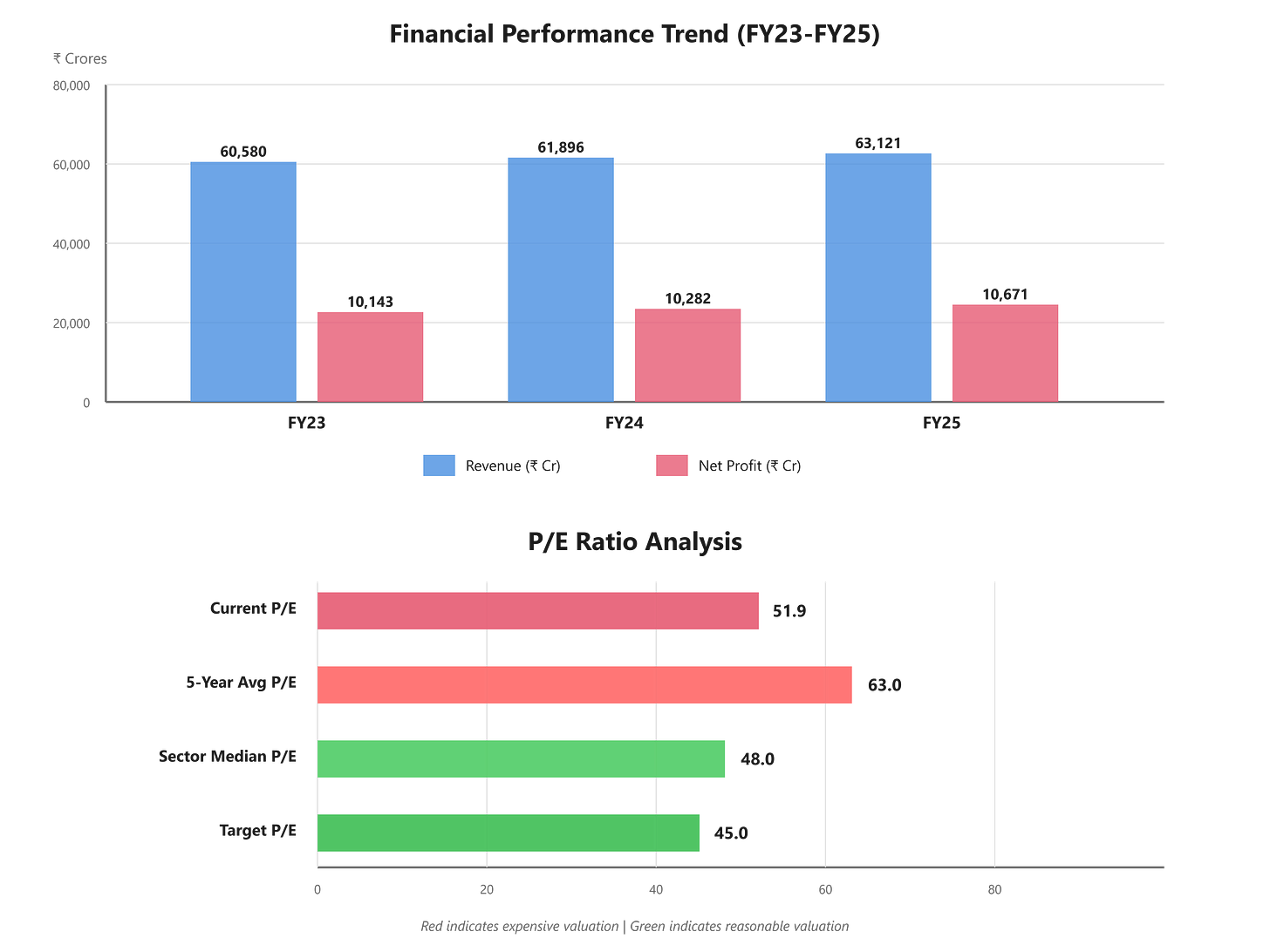

Let’s talk numbers. Over the past three years (FY23 to FY25), revenue grew from ₹60,580 crores to ₹63,121 crores - that’s about 6% compounded annually. Not spectacular, but steady. Net profit climbed from ₹10,143 crores to ₹10,671 crores over the same period, growing about 5% per year.

The last twelve months delivered earnings per share of ₹46.35. Compare that to ₹43.74 in FY24 - they’re making more money per share, just slowly. Operating margins have stayed remarkably stable around 23-24% for years. That’s what you want to see - consistent profitability even when raw material costs jump around.

Cash generation is strong. In FY25, they pulled in ₹11,886 crores from operations, though that was down from ₹15,469 crores in FY24 due to higher working capital needs. They’re essentially debt-free - total borrowings are just ₹1,648 crores against a ₹5.4 lakh crore market cap. That’s nothing.

Here’s what changed:

Sales growth slowed down to 3% in the trailing twelve months. The company faced headwinds from a long monsoon (which hurt ice cream sales), GST rate changes that temporarily disrupted the market, and cautious consumer spending in certain categories. Rural demand is recovering but urban growth remains subdued. Management highlighted that volume growth has been the engine - they’re not jacking up prices much because commodity costs are stable.

IV. Fundamental Valuation Metrics & Investment Case

Now for the reality check. At a P/E ratio of 51, HUL’s trading at the expensive end of its own history. The 5-year average P/E is somewhere around 60-65, so it’s actually below that - but both numbers are steep. You’re paying ₹51 for every rupee of earnings.

The Price-to-Book ratio sits at 11.3 times. Book value is ₹207 per share, meaning you’re paying about ₹2,300 for assets worth ₹207 on paper. That premium reflects intangible value - brands, distribution, customer loyalty. But it’s still a big multiple.

Return on Equity is 20.7% and Return on Capital Employed is 27.8%. These are solid numbers. They’re making good money on the capital they deploy. For context, anything above 15-18% ROE is considered strong, so HUL clears that bar comfortably.

EPS growth has been modest - around 5% annually over the past three years. Not bad, but not explosive either. Dividend yield is 1.84%. They paid out ₹19 per share as interim dividend in November 2025, and the total dividend payout ratio for FY25 was 117% - they paid out more than they earned because they had excess cash and wanted to reward shareholders.

Here’s how I see it:

The stock’s expensive, but not unreasonably so for a quality business with minimal debt, consistent margins, and dominant market positions. The ice cream demerger should add 50 basis points to margins. If they can get volume growth back to 4-5% consistently and maintain their pricing power, earnings could grow 8-10% annually. At current valuations, you’re banking on that growth materializing and multiples staying elevated. It’s not a screaming bargain, but it’s a bet on quality and execution.

V. Long-Term Outlook & Risk Assessment

Looking out 5-15 years, I’d estimate returns in the 8-12% annual range if things go reasonably well. That’s driven by earnings growth of 8-10% plus dividend yield of about 2%. You won’t get rich quickly, but you won’t lose sleep either.

What needs to go right?

HUL’s investing heavily in premiumization - moving consumers from mass-market products to higher-priced, higher-margin options. Their prestige beauty business and health & wellness categories are growing fast. If they execute on digital commerce and quick commerce partnerships, they can grab share from unorganized players. Rural consumption needs to keep recovering - that’s where volume growth will come from.

The promoter holding at 61.90% (held by Unilever) has been rock solid for years. No concern there. Management keeps talking about “future-fit portfolio” which means focusing on high-growth segments and exiting or demerging slower businesses. The ice cream split is part of that strategy.

Capital allocation looks balanced. They’re paying out most of their profits as dividends while still investing in brands, innovation, and digital capabilities. No reckless acquisitions or empire-building - just steady, boring execution.

Now for the risks - and there are real ones. First, volumes have been flattish. If Indian consumers don’t spend more on FMCG, growth will remain sluggish. Competition is fierce from both organized players (Nestle, ITC, Dabur, Marico, P&G) and unorganized local brands. HUL’s pricing power isn’t unlimited - raise prices too much and people trade down.

Second, input costs can spike. Palm oil, crude derivatives, tea, coffee - these commodities swing around, and while HUL manages them well, big moves can squeeze margins. Third, regulatory risk is always there. GST changes just disrupted their Q2. Any new regulations on advertising, labeling, or product composition can create headaches.

Fourth, the stock’s not cheap. If growth disappoints, the valuation could de-rate sharply. A P/E of 51 assumes things keep humming along. If earnings growth slows to 3-4%, the stock could easily drop 15-20% to reach a more reasonable 40-42 P/E.

On the positive side, India’s FMCG market is still underpenetrated. Per capita consumption of packaged goods is way below developed markets. As incomes rise, household penetration of HUL’s products will increase. The shift from unorganized to organized brands benefits HUL. Quick commerce is opening up new distribution channels in cities. And their brand portfolio is incredibly strong - these aren’t brands people switch away from easily.

Bottom line:

HUL’s a quality compounder, not a multibagger. If you can handle the rich valuation and are okay with single-digit to low double-digit returns, it’s a solid core holding. Just don’t expect fireworks.

VI. Disclaimer

Disclaimer: This content is for educational purposes only and is not investment or financial advice. Stock markets are subject to risks. Do your own research and consult a qualified advisor before investing. The author is not responsible for any financial losses. Mentions of stocks/companies are not buy or sell recommendations.