Hero MotoCorp Ltd 2026: Fundamentals, EV Strategy & Long-Term Investment Outlook

Investment Call: BUY

The stock’s trading at historically low valuations despite solid cash generation - the company’s sitting on mountains of cash with zero debt while growing at double digits.

How This Company Makes Money

This is India’s largest two-wheeler manufacturer. They sell motorcycles and scooters through 6,500+ dealers across the country. The money comes from three buckets - 88% from selling bikes, 8% from spare parts, and 4% from everything else like finance and accessories.

They’ve got the full range. Entry-level bikes like HF Deluxe for daily commuters. Mid-range bikes in the 125cc segment - Destini, Xoom. Premium models like the Karizma and the Harley-Davidson X440 they build under partnership. Plus their electric scooter brand VIDA that’s gaining traction. The premium segment now contributes about 25% of sales.

The latest quarter saw them push into international markets hard - Bangladesh and Colombia leading the charge. They’re also entering Europe - Germany, France, Spain, UK - in the coming months. Their electric vehicle division registered 10,701 units in December alone with an 11% market share.

Youtube Link:

The Numbers Tell the Story

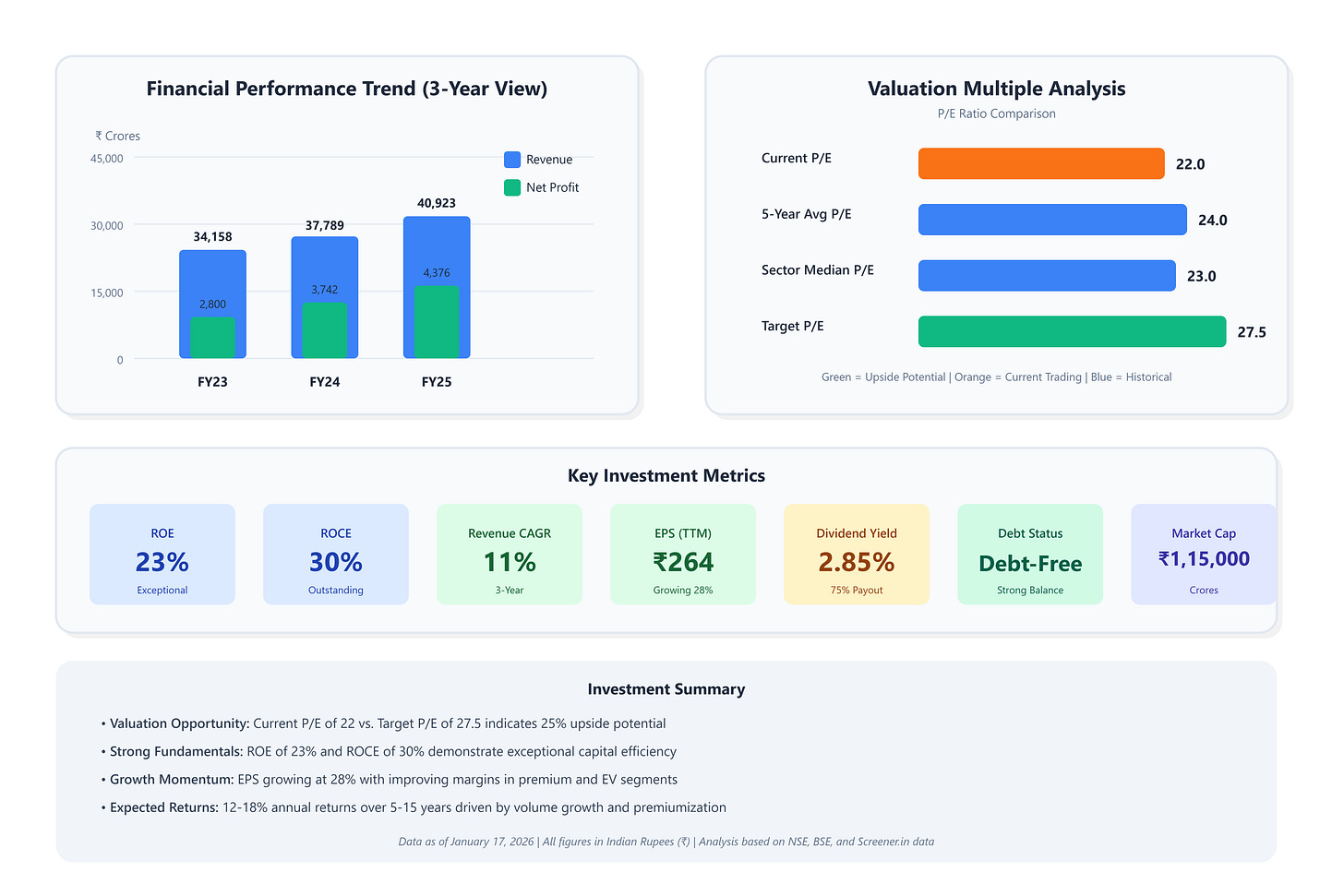

Revenue grew at 11% over three years - that’s solid given how the industry got hammered during COVID. Last twelve months, they made ₹264 in earnings per share. That’s up from ₹219 just a year ago. They’re not just selling more bikes - they’re making more money on each one.

The company generated ₹4,297 crores in operating cash flow last year. That’s real money hitting the bank account. They paid out 75% as dividends while keeping enough to invest in electric vehicles and new products. Debt is basically zero - ₹700 crores against ₹14,384 crores in liquid investments.

Latest quarter revenue hit ₹10,211 crores with net profit at ₹1,108 crores. The nine-month performance shows highest-ever revenue and profits. Management highlighted strong demand in entry motorcycles and 125cc scooters.

Valuation - Is This Thing Cheap or Expensive?

Current P/E is 22 times earnings. The five-year average is around 24. So you’re paying slightly less than usual. P/B ratio sits at 5.4 times book value - not screaming cheap but reasonable for a quality compounder.

Here’s where it gets interesting. ROE is 23% and ROCE is 30%. Those are exceptional returns. The company’s generating phenomenal returns on the money they’re deploying. EPS grew 28% over the last year. Dividend yield is sitting at 2.85%.

The math works like this - you’re buying a business that makes 23% returns on equity for 22 times earnings. That’s not expensive when you consider the quality and cash generation. Comparable companies in the auto sector trade at similar or higher multiples with lower returns.

The stock trades at ₹5,750 today. Fair value based on growth trajectory and return profile is around ₹7,200. That’s 25% upside just to reach fair value.

Where This Goes Over the Next Decade

Expect 12-18% annual returns over 5-15 years. That comes from three drivers - volume growth as rural India buys more two-wheelers, premiumization as consumers upgrade to 125cc+ bikes, and electric vehicle expansion.

Management’s investing heavily in R&D for EVs. VIDA’s scaling up fast with new models like the kids off-road bike at ₹69,990. The premium segment keeps expanding with Harley partnership bringing new models. International business is growing 40% plus in key markets.

Risks?

Raw material costs can spike. Electric vehicle competition is brutal - everyone from Ola to Ather is fighting for share. Regulatory changes around emissions and EV subsidies create uncertainty. The shift to electric could cannibalize their core ICE business faster than expected.

Promoters hold steady at 34.7% - they’ve barely sold any shares. FIIs hold 29%, DIIs at 26%. The company’s buying back shares and paying consistent dividends. Capital allocation is disciplined - they’re not throwing money at vanity projects.

Industry tailwinds are strong. Rising incomes in rural areas, better roads, credit availability through Hero FinCorp. The company’s positioned to capture both the mass market and the premium shift. Their dealer network is unmatched - six and a half thousand touchpoints across India.

The downside case?

If EVs disrupt faster than expected and Hero can’t transition quickly enough, growth stalls. But they’re hedging that with VIDA and partnerships. The base case looks solid for mid-teens growth.

The Company Revealed

Hero MotoCorp Ltd (NSE: HEROMOTOCO | BSE: 500182)