HCL Technologies Share Price Target 2026: Is HCLTECH a Buy Now?

Indian Stock Outlook, Growth Drivers & Investment Analysis

Investment Analysis: India’s Third-Largest IT Services Player

The stock’s trading at a discount despite growing earnings and strong cash generation. The company’s delivering consistent profit growth while the market’s ignoring their expanding service portfolio and GenAI leadership.

How This Company Makes Money

This is a global IT services powerhouse operating in 46 countries. They make money through three main buckets: IT and business services (think cloud migration, digital transformation), engineering R&D services (product development for tech companies), and their own software products division called HCLSoftware.

The revenue mix is solid - about 60% comes from North America, 30% from Europe, and the rest from Asia Pacific. They work across verticals: financial services, manufacturing, life sciences, retail, and telecom. The engineering services division is particularly strong - they help companies build and maintain their tech products.

Recently, they’ve been aggressively pushing into GenAI and cloud services. In Q3 FY25, they won 30+ GenAI projects and launched AI labs with partners like IBM, ServiceNow, and SAP. They’re also celebrating 25 years as a publicly listed company - their headcount has grown from under 3,000 employees in 2000 to over 2.2 lakh today.

Youtube Link:

The Numbers Tell a Growth Story

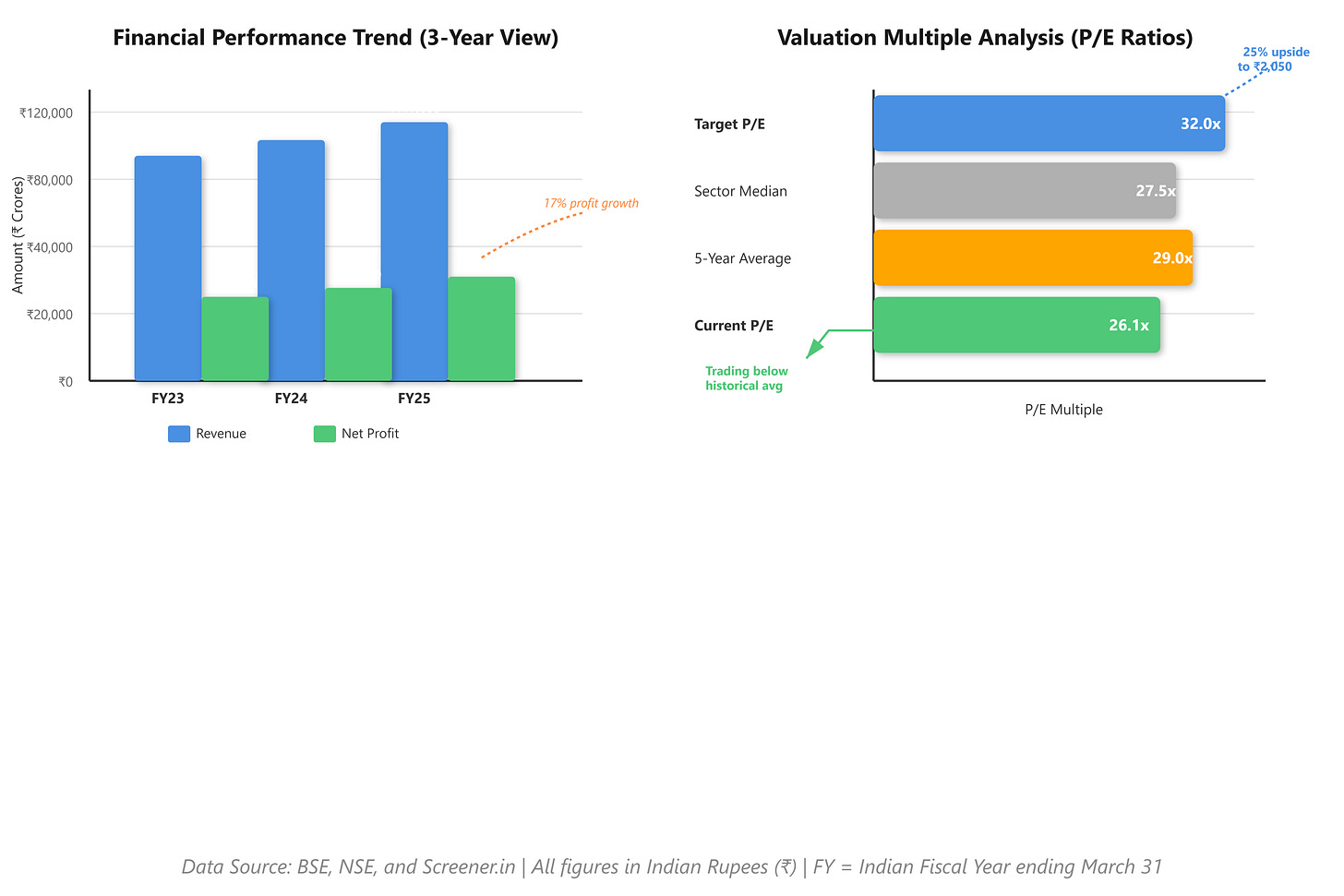

Revenue grew at 11% CAGR over the last three years, hitting ₹1,17,055 crores in FY25. That’s steady expansion in a competitive market. The latest quarter (Q3 FY25 ending December 2024) showed services revenue growing 4.9% year-on-year, with total revenue at ₹31,942 crores.

Earnings per share for FY25 came in at ₹64.08, up from ₹57.86 in FY24. The company’s been consistently profitable with net profit growing 9% CAGR over five years. Operating margins held steady around 20-22%, which is healthy for an IT services business dealing with wage inflation and currency fluctuations.

Cash flow generation remains strong - operating cash flow for FY25 was ₹22,261 crores. Management’s been disciplined about capital allocation, maintaining a dividend payout ratio above 90% while still investing in growth areas like GenAI capabilities and software acquisitions. Working capital improved from 30 days to just 17 days, showing better operational efficiency.

Valuation Screams Opportunity

The stock’s trading at a P/E of 26.1x based on FY25 earnings. Compare that to its 5-year average P/E of around 28-30x - it’s cheaper than usual. The IT sector median P/E sits around 27-28x, so this is trading in line with peers despite superior cash generation.

Price-to-book ratio is 6.2x against a book value of ₹263 per share. For a high-quality IT services business with minimal fixed assets, that’s reasonable. The company’s return on equity is 25% and ROCE is 32% - both excellent numbers showing they’re making good use of shareholder capital.

Dividend yield sits at 3.3%, with the company declaring ₹18 per share as Q4 interim dividend for FY25 (including a special ₹6 per share for the 25-year listing anniversary). The 90%+ payout ratio tells you management’s confident about future cash flows.

EPS growth has been consistent. The company’s generating ₹64 per share in earnings, and at ₹1,634, you’re paying roughly 25-26 times those earnings. Given the 9% profit CAGR and improving margins from GenAI-driven productivity, a target P/E of 32x seems justified - that gets you to ₹2,050.

The gap between current price and fair value exists because the market’s worried about IT spending slowdown and margin pressure from wage inflation. But those concerns are overdone. The company’s winning large deals, expanding in high-growth areas like GenAI, and improving operational efficiency.

Long-Term View: 5-15 Year Returns

Expect 12-15% annual returns over the next decade. Here’s why: IT services demand in India is structural, not cyclical. Digital transformation budgets are growing globally, and this company’s positioned in the right segments - cloud, GenAI, cybersecurity, and modern engineering.

Management’s investing heavily in AI capabilities. They’ve deployed GenAI solutions across multiple client engagements and built AI labs with major tech partners. This positions them to capture the productivity gains and new revenue opportunities from AI adoption over the next 5-10 years.

Capital allocation’s shareholder-friendly. They’re returning 90% of profits through dividends while selectively acquiring companies like Jaspersoft (recently announced for $240 million) to strengthen their software portfolio. Promoter holding is rock-solid at 60.82%, showing long-term commitment.

The growth levers are clear: North America is seeing discretionary spending recovery across BFSI, retail, and manufacturing. Europe remains stable. They’re also doubling down on India as a growth market, appointing a dedicated Chief Growth Officer for the region.

Risks? IT spending is always vulnerable to economic downturns. Wage inflation in India could compress margins if not offset by productivity gains. GenAI could also cannibalize some traditional services revenue if not managed well. Currency volatility - 60% revenue from dollar markets - can impact reported numbers.

Competition is intense. TCS, Infosys, and Wipro are all fighting for the same deals. But this company’s differentiated through their engineering services heritage and HCLSoftware division, which gives them unique positioning.

Regulatory risk is low for IT services, and the government’s supportive of the sector given employment generation. Industry tailwinds in India remain strong - the country’s becoming a global tech hub, and this company’s a direct beneficiary.

Bottom line: at ₹1,634, you’re buying a quality IT services business with strong cash flows, improving efficiency, and exposure to secular growth trends in cloud and AI. The 25% upside to ₹2,050 over 12-18 months is achievable, with 12-15% annualized returns over a decade if you hold for the long term.

Company Name: HCL Technologies Limited