Dr. Reddy’s Laboratories Ltd Share Analysis: Stock Price, Growth Outlook & Investment Potential

Investment Thesis & Summary

Here’s the deal with Dr. Reddy’s - they’re quietly building a cash machine while the market’s too busy worrying about US generic pricing. The stock’s trading at 18 times earnings while they’re growing profits at over 20% per year. That gap doesn’t make sense, especially when you look at how they’re diversifying away from their risky US business into stable markets like India and Europe.

Business Model & Operations

Dr. Reddy’s makes money by selling medicines - both generic copies of expensive drugs and their own branded products. Think of them as three businesses rolled into one. Their biggest chunk, about 83% of revenue, comes from selling generic drugs worldwide. They make everything from diabetes pills to heart medicines to antibiotics, basically the everyday drugs people actually need.

The second part is making the raw ingredients that go into medicines - the active pharmaceutical ingredients or APIs. This is the chemical stuff that actually cures you, and they sell it to other pharma companies who turn it into finished pills.

The third piece is their India business where they sell branded generics. In India, doctors trust brand names even for generic drugs, so they’ve built a solid franchise with products like Omez and Nise.

Recently they made a smart move buying the Nicotinell nicotine gum and patch business in Europe. That’s a consumer health play that brings in steady cash without the pricing pressure they face in the US generics market. They’ve also been launching biosimilars - complicated biotech drugs that are way harder to copy than regular pills, which means better margins and less competition.

Youtube Link:

Historical Financial Review

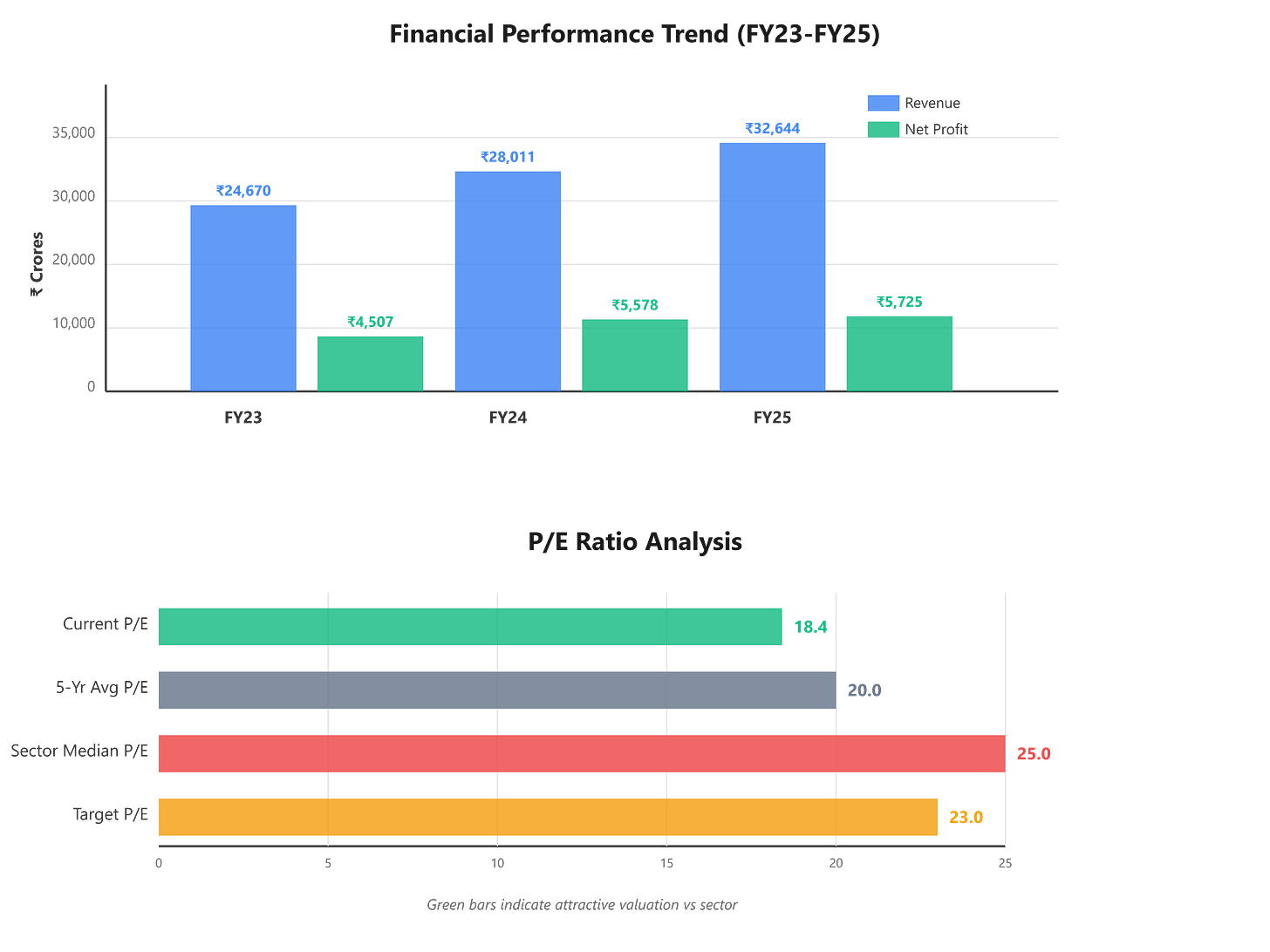

The numbers tell a good story. Over the last three years, their revenue has grown at 15% annually - not explosive, but solid and consistent. That’s real growth, not just accounting tricks. They’ve gone from ₹21,545 Crores in revenue back in FY22 to ₹32,644 Crores in FY25. That’s adding over ₹11,000 Crores of sales in three years.

The profit story is even better. Their earnings per share jumped from ₹26 in FY22 to ₹68 in FY25. That’s more than doubling your money in three years just from earnings growth. The 5-year profit growth rate sits at 22% - that’s the kind of compounding that builds real wealth.

In the latest quarter ending September 2025, they did ₹8,828 Crores in revenue with ₹1,337 Crores profit. The revenue was up 10% from last year, though margins took a small hit because one of their blockbuster US products, Lenalidomide, is facing more competition. But here’s what matters - they’re not sitting around crying about it. They launched 7 new products in the US that quarter and filed 5 more applications with regulators.

Their balance sheet is clean. They’ve got more cash than debt - actually ₹24.5 billion in net cash surplus as of March 2025. That’s money they can use to buy businesses, launch new products, or return to shareholders. They’re generating ₹4,600-4,900 Crores in operating cash flow annually, which means they’re actually collecting the money they report as profits.

Fundamental Valuation Metrics & Investment Call

Let’s talk about what you’re actually paying for here. At ₹1,270, the stock trades at 18.4 times trailing earnings. For a company growing profits at 20%+ per year, that’s pretty reasonable. Compare that to most Indian pharma companies trading at 25-40 times earnings, and you start to see the discount.

The price-to-book ratio is 3.1 - you’re paying ₹3.10 for every rupee of book value. That sounds high until you realize they’re generating an 18% return on equity. If a company makes 18% on its capital every year, paying 3 times book value isn’t crazy.

Here’s what really matters - return on capital employed is 22.7%. That means every ₹100 they invest in the business generates ₹22.70 in annual profit. That’s excellent, especially in a competitive industry like pharma. It tells you management knows how to allocate capital.

The dividend yield is small at 0.63%, but that’s fine. They’re growing fast enough that you’d rather have them reinvest the money than pay it out. Last year they paid ₹8 per share as dividend while earning ₹68 per share - that’s a conservative 12% payout ratio, leaving plenty for growth.

The stock’s currently trading about 10% below its 52-week high of ₹1,406 and well above its low of ₹1,020. That middle range is actually a good spot - not chasing peaks, not catching falling knives.

Looking at the 5-year average P/E, this stock has historically traded between 15-25 times earnings. Right now at 18.4, you’re getting it below the middle of that range. If earnings keep growing and the multiple just reverts to 22-23 times, you’re looking at a stock price around ₹1,550-1,650 even without any earnings growth. Add in the 15-20% annual earnings growth they’re delivering, and the math gets interesting fast.

Long-Term Outlook & Risk Assessment

Over the next 5-15 years, I’d expect 12-18% annual returns from here. That comes from earnings growing 15-20% annually while the valuation multiple stays flat or expands slightly. Let me break down why.

First, their US business is maturing. They’ve got 76 products pending FDA approval, including 20 they filed first which could give them exclusive rights for 6 months when approved. Each approval is like a mini lottery ticket - some will be duds, but a few will be blockbusters worth hundreds of crores annually. The Semaglutide launch they’re working on for diabetes and weight loss could alone be worth ₹1,000+ Crores in peak sales.

Second, India’s a rocket ship. The domestic pharma market is growing 8-10% annually, and they’re taking market share with new brand launches. They added 16 new products in the first half of this fiscal year. In a country where healthcare spending per capita is still growing from a low base, that’s a 20-year runway.

Third, the Nicotinell acquisition in Europe gives them a consumer health platform that’s not subject to government price controls or generic competition. It’s recurring revenue from people trying to quit smoking - a market that’s not going anywhere.

Fourth, biosimilars are their ace card. These complex drugs are hard to make and even harder to get approved. They’ve got AVT03, their biosimilar to Prolia and Xgeva for bone health, just approved in Europe. That’s a multi-billion dollar market where they’ll compete with maybe 2-3 other biosimilars instead of 20 generic competitors.

Management’s spending ₹27 billion annually on capex, building new facilities and expanding capacity. Promoters hold steady at 26.6% - they’re not selling, which is always a good sign. DIIs have been steadily buying, going from 18% to 28% ownership in the last couple years.

Now the risks. First and biggest - US pricing pressure. About 40% of their revenue comes from North America, and generic drug prices there keep falling. Their Lenalidomide franchise, which used to be a cash cow, is already seeing this. If more of their big products face sudden competition, earnings could take a hit.

Second, FDA compliance. They got a Form 483 inspection observation at their Srikakulam plant in December 2025 with 5 issues noted. That’s not catastrophic - it’s classified as “Voluntary Action Indicated” not a warning letter. But any FDA problems can delay product launches or worst case, stop shipments. They need to stay clean.

Third, currency risk. They earn in dollars, euros, and rubles but report in rupees. A strong rupee eats into their reported earnings even when the underlying business is fine. Russia exposure is about 18% of revenue, and that market has geopolitical risk written all over it.

Fourth, R&D risk. They’re investing heavily in biosimilars and differentiated products. Some will work, some won’t. Each development program costs ₹50-150 Crores and takes years. If too many fail, that’s money down the drain.

What’s going right for Indian pharma overall?

The government’s pushing healthcare access, insurance coverage is expanding, people are aging and need more medicines. India’s becoming a major supplier to the world, not just a domestic market. Quality standards are rising which helps bigger players like Dr. Reddy’s who can afford the compliance costs.

If you’re buying this stock, you’re betting that management can navigate the US pricing pressure by diversifying revenue streams fast enough. You’re betting their biosimilars and complex generics deliver. You’re betting the India story stays strong. Those aren’t crazy bets, but they’re not guaranteed either.

The valuation cushion here isn’t huge - you’re paying fair price for a good company, not getting a screaming bargain. But sometimes fair price is good enough when the business quality is there. Over 10-15 years, if they compound earnings at 15% and the multiple stays flat, you double your money every 5 years. That’s the base case. The upside comes if biosimilars work, if they do smart M&A with that cash pile, if India accelerates.

Disclaimer

This content is for educational purposes only and is not investment or financial advice. Stock markets are subject to risks. Do your own research and consult a qualified advisor before investing. The author is not responsible for any financial losses. Mentions of stocks/companies are not buy or sell recommendations.

Dear Value Pick team Good morning 🙏 i would like to request you that, in value Pick series you always Share analysis of such Stocks Which always people know & they are Large Cap Stocks.Hence in value Pick series you bring Micro, Small and Mid cap Stocks. Thank you

Not exactly ground breaking.

Any portfolio worth the salt will have Dr Reddy in it.

Anyway thanks for the reaffirmation !