Divi's Laboratories Ltd - Investment Newsletter

I. Investment Thesis & Summary

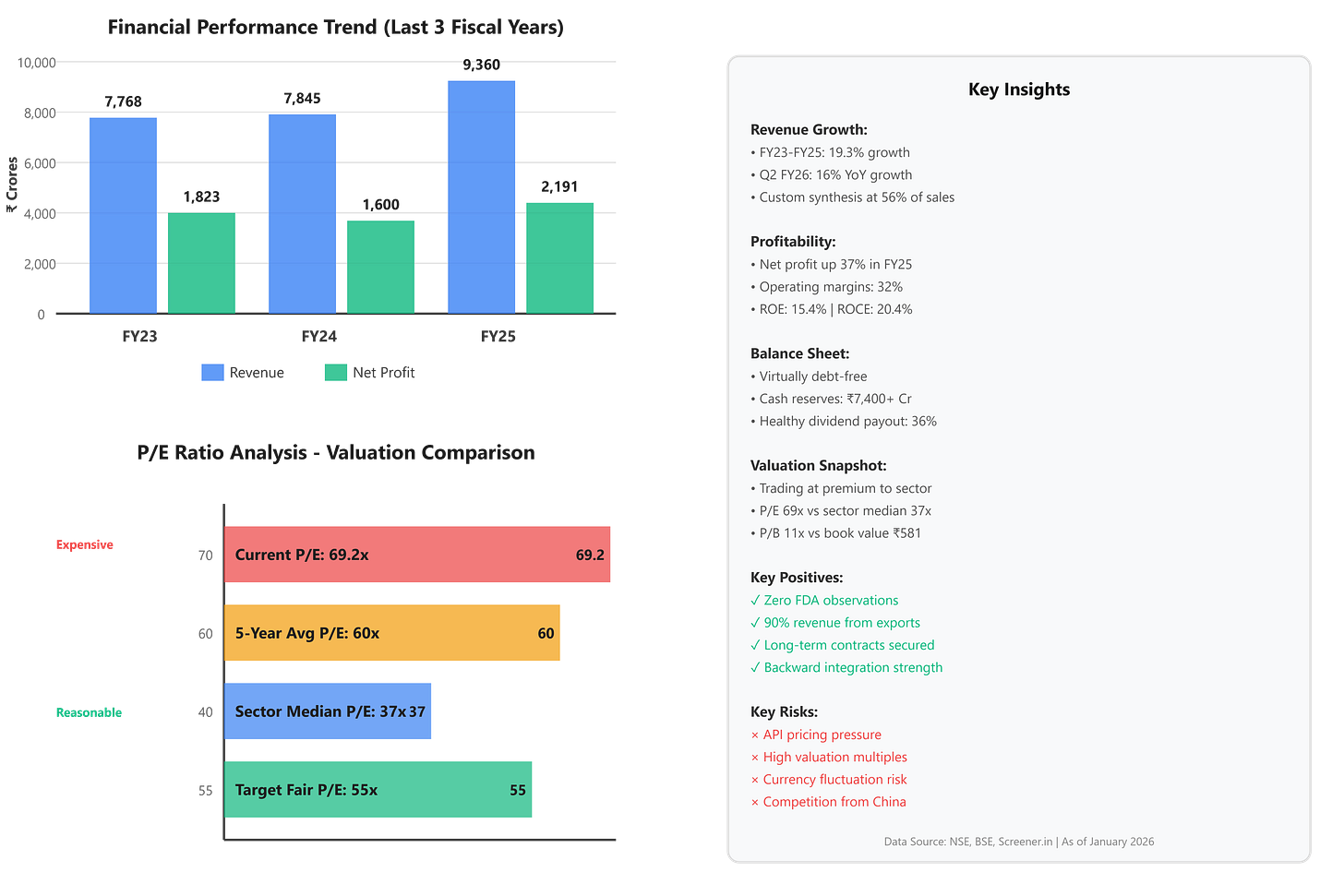

Divi’s Laboratories (NSE: DIVISLAB, BSE: 532488) is trading at ₹6,400, with a market cap of ₹1,71,850 Crores. The stock’s expensive at 69 times earnings, but here’s what makes it interesting - the company just came off a stellar year where profits jumped 37% while the stock price hasn’t caught up to that momentum yet.

Youtube Link:

II. Business Model & Operations

Divi’s is basically the behind-the-scenes powerhouse of the pharma world. They don’t make medicines you can buy at a pharmacy - instead, they manufacture the active ingredients that go into those pills. Think of them as the ingredient supplier to big pharma companies worldwide.

The money comes from three places. First, they make 30 different generic APIs - these are huge volume products they ship to 100+ countries, churning out anywhere from tens to thousands of tons each year. Second, they do custom synthesis work for the big boys - 12 of the top 20 global pharma giants have been working with them for over a decade. Third, they’ve got a nutraceuticals business making carotenoids and vitamins for food and supplement companies.

What’s been happening lately is pretty encouraging. In the latest quarter ending September 2025, they pulled in ₹2,715 Crores in revenue - that’s up 16% from last year. The custom synthesis business is doing particularly well, now making up 56% of sales versus 44% for generic APIs. They’ve also secured long-term supply agreements with global pharma companies and recently passed a US FDA inspection with zero observations, which is like getting a perfect score on a regulatory exam.

III. Historical Financial Review

Over the last three years, revenue has grown at 16% annually on a trailing basis - not spectacular, but steady. The real action is in profitability. Last year’s earnings per share came in at ₹82.53, and on a trailing basis we’re looking at ₹93.61. That’s solid growth.

Here’s what changed: in FY25, the company made ₹9,360 Crores in revenue, jumping 19% from the previous year. Net profit shot up 37% to ₹2,191 Crores. Operating margins improved from 28% to 32%, meaning they’re making more money on each sale. The cash flow story is healthy too - they generated ₹1,653 Crores from operations last year, up 31%.

The company’s sitting on a pile of cash with virtually zero debt. Their balance sheet shows negative net debt of ₹7,427 Crores - they have more cash than debt. They’ve been investing heavily in capacity expansion, spending around ₹2,000 Crores on capex this year, which should pay off down the line.

IV. Fundamental Valuation Metrics & Investment Call

Let’s talk numbers and whether this stock makes sense at current levels.

The P/E ratio is 69 times - that’s expensive by any measure. The five-year average sits around 60, so we’re trading above historical norms. The pharma sector median is closer to 37 times, meaning Divi’s trades at nearly double the sector average.

P/B ratio is 11 times, against a book value of ₹581 per share. You’re paying ₹11 for every rupee of assets on the books. That’s steep.

ROE at 15.4% and ROCE at 20.4% show the company is deploying capital reasonably well, though these numbers have been better in the past. The company’s track record shows they can generate 19% ROE on average over a decade.

EPS growth has been strong - up 37% last year and continuing to grow in double digits. The latest quarter showed 35% profit growth year-over-year.

Dividend yield is a measly 0.46% at ₹30 per share. They pay out about 36% of profits as dividends, which is reasonable but won’t excite income investors.

The stock is expensive on a historical basis and versus peers. But the business quality is high - clean balance sheet, growing profits, recurring revenue from long-term contracts, and regulatory compliance that’s rock solid. If you’re paying up, you’re betting on continued execution and margin expansion.

V. Long-Term Outlook & Risk Assessment

Looking 5-15 years out, a reasonable expectation is 12-18% annual returns if the company delivers on its plans. Here’s the math: if earnings grow 15% annually and the valuation de-rates slightly to a P/E of 50-55 times, you’d still make decent money.

Management is building new capacity across their manufacturing units. They’re investing ₹2,000+ Crores annually in capex, creating capacity for both generic APIs and custom synthesis projects. The custom synthesis pipeline is promising - they’re getting into peptide synthesis, which is a growing area as more peptide-based drugs come to market. Three new projects are in the works with capacity being built out.

Promoters hold 51.88% and that stake has been stable for years, which is reassuring. FIIs have been increasing their holdings, now at 19.4%, up from 18% last year. No red flags on the shareholding front.

The risks are real though. Pricing pressure on generic APIs is constant - commodity products get competed down over time. Regulatory risk is always there - one bad FDA inspection can hammer the stock. Competition from Chinese API makers, though China+ 1 sourcing trends are currently favoring Indian companies. Raw material costs can spike and hurt margins. Currency fluctuations matter since 90% of revenue is export-driven, though they had a ₹63 Crore forex gain last quarter.

The positive industry trends in India are working in their favor. The China+1 sourcing shift, BIOSECURE Act tailwinds from the US, growing global demand for APIs, and India’s positioning as a reliable pharma supplier all support the long-term thesis. The company’s backward integration - making their own raw materials - gives them better control over costs and quality than competitors.

Divi’s Laboratories - Financial Chart

VI. Disclaimer

Disclaimer:

This content is for educational purposes only and is not investment or financial advice. Stock markets are subject to risks. Do your own research and consult a qualified advisor before investing. The author is not responsible for any financial losses. Mentions of stocks/companies are not buy or sell recommendations.