Introduction

The 2008 market crash, also known as the Global Financial Crisis (GFC), was a pivotal event that reshaped global economies, centered in the United States, and triggered the Great Recession from late 2007 to mid-2009. This period, marked by the worst economic downturn since the 1929 Wall Street crash, offers valuable lessons for investors, especially during current market volatilities as of April 10, 2025. This note explores the crash’s details, identifies stocks that remained strong, highlights investors who profited, and constructs an emotional, motivating narrative to encourage investment in today’s downturns.

Background of the 2008 Market Crash

The crash originated from the collapse of the U.S. housing market, fueled by speculative behavior in real estate and the provision of cheap credit, particularly through subprime mortgages. These loans, offered to borrowers with poor credit, were bundled into mortgage-backed securities (MBS) that financial institutions heavily invested in. When housing prices fell, defaults surged, leading to significant losses for banks and triggering a liquidity crisis. Key events included:

Mid-2007: Collapse of Bear Stearns hedge funds and warnings from BNP Paribas about fund withdrawals.

September 15, 2008: Lehman Brothers declared bankruptcy, the largest in U.S. history, causing a global stock market crash (The 2008 Financial Crisis Explained).

The Dow Jones hit a pre-recession high of 14,164.53 on October 9, 2007, but by March 5, 2009, it had dropped to 6,594.44, a decline of over 50% (When and Why Did the Stock Market Crash in 2008?).

This rapid downturn, taking just 18 months compared to the Great Depression’s four years, led to bank failures, government interventions, and a global economic contraction, with effects felt worldwide, including ATM shortages in Britain and market halts in Indonesia (2008 Market Crash - The Global Financial Crisis).

Stocks That Performed Well During the Crash

While most stocks suffered, certain companies, particularly defensive stocks, remained strong due to their essential nature. The following table lists key performers, based on available data:

Surprising resilience, linked to high return on capital

These stocks, primarily in consumer staples, healthcare, and discount retail, were less affected because their products and services remained in demand during economic hardship. For instance, Walmart and McDonald’s saw increased patronage as consumers cut back on luxury spending, while Apple’s performance was notable given its growth stock status (Stocks That Went Up in 2008 | Plus ETFs, Bonds, Gold).

Investors Who Profited and Emerged as Wealth Creators

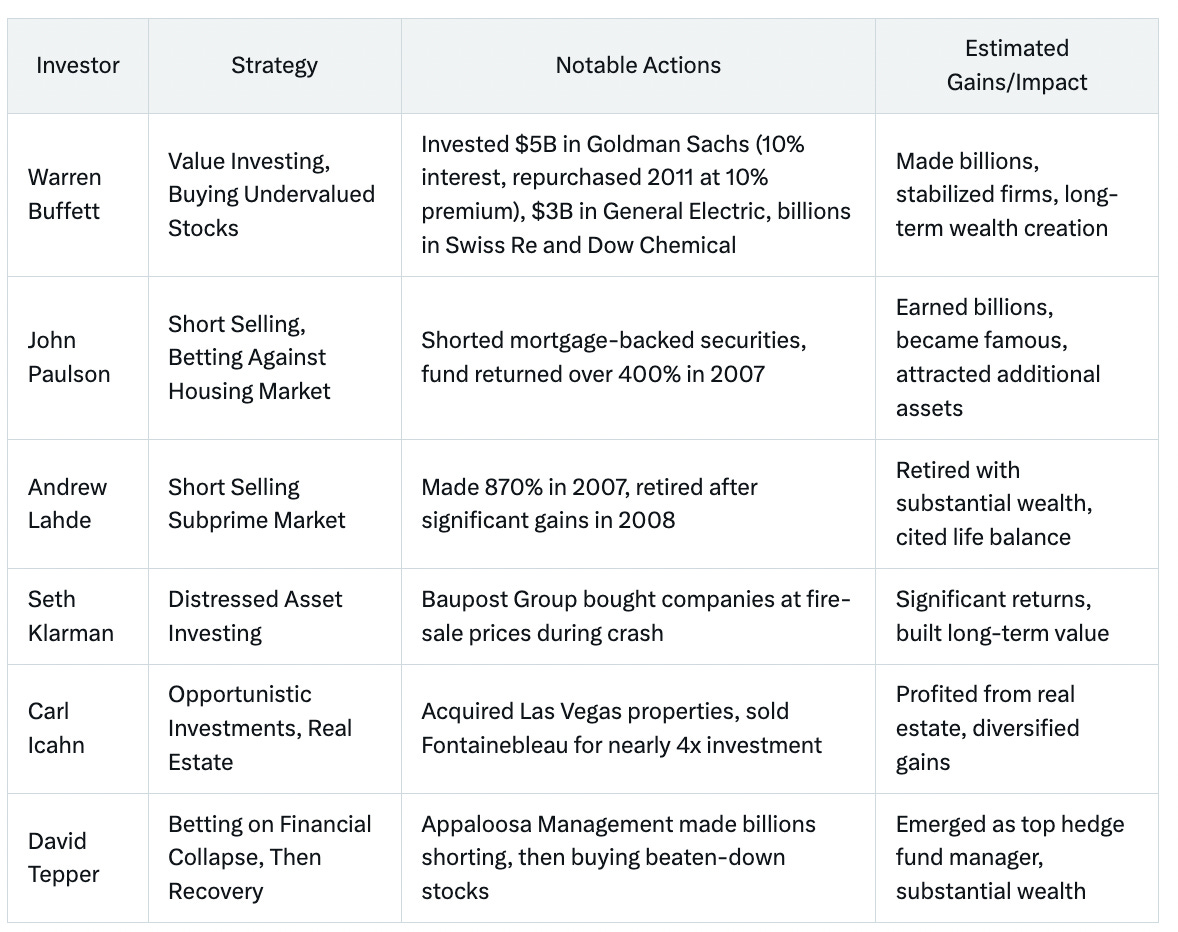

Several investors capitalized on the crash, using strategies like value investing, short selling, and distressed asset purchases. Below is a detailed table of key investors and their approaches:

These investors saw the crash as a buying opportunity, with Buffett’s philosophy of being “greedy when others are fearful” epitomizing their approach. Paulson’s short selling, for instance, was based on anticipating the housing bubble burst, while Klarman and Tepper focused on distressed assets, buying low and selling high post-recovery (5 Top Investors Who Profited From the Global Financial Crisis).

Emotional, Motivating Story: From Crisis to Opportunity

Imagine it’s 2008, and the world is gripped by fear. Banks are failing, unemployment is soaring, and the stock market is in freefall. Headlines scream of economic doom, and every day brings new stories of lost jobs, foreclosed homes, and shattered dreams. It’s a time when even the most seasoned investors are panicking, selling off their holdings in a desperate attempt to preserve what little they have left. But amidst this chaos, a select few saw not despair, but opportunity—a chance to build wealth that would last a lifetime.

Take Warren Buffett, the legendary investor often called the "Oracle of Omaha." While others were fleeing the market in terror, Buffett was buying. He famously said, "Be fearful when others are greedy, and greedy when others are fearful." True to his word, he invested billions into companies like Bank of America and Goldman Sachs when their stocks were at historic lows. These weren’t just random bets; they were calculated moves on companies he believed were fundamentally strong but temporarily undervalued. His investments not only helped stabilize these institutions but also yielded substantial returns for him and his shareholders. By 2011, his stake in Goldman Sachs alone had been repurchased at a 10% premium, and his investments in other firms like General Electric and Swiss Re also paid off handsomely.

Then there’s John Paulson, a hedge fund manager who became a household name for his daring bet against the U.S. housing market. Paulson saw the subprime mortgage bubble for what it was—a ticking time bomb. He shorted mortgage-backed securities, betting that they would collapse when the housing market imploded. His fund, Paulson & Co., returned over 400% in 2007 alone, earning him billions and cementing his reputation as one of the savviest investors of his time. Paulson’s story is a testament to the power of contrarian thinking—seeing what others couldn’t or wouldn’t see.

But it wasn’t just billionaires who profited. Consider Sarah, a fictional but representative investor. In 2008, while her friends were pulling their money out of the stock market, Sarah decided to invest her savings into blue-chip companies that were temporarily undervalued. She bought shares of companies like Walmart and McDonald’s—businesses she knew would survive because people would still need their products, even in tough times. Walmart offered low prices on essentials, while McDonald’s provided affordable meals for families tightening their belts. Fast forward a few years, and Sarah’s investments had grown significantly, providing her with the financial security she sought. Her story shows that you don’t need to be a Wall Street titan to benefit from a market crash—just a willingness to look beyond the fear.

The key lesson here is that market crashes, while terrifying, present unique opportunities for those who can see beyond the immediate turmoil. Investing during such times requires courage, conviction, and a long-term perspective. It’s about recognizing that the market’s downturn is often temporary and that great companies can weather the storm. Of course, it’s not without risks. Thorough research, diversification, and perhaps consulting with financial advisors are crucial. But for those who can navigate these waters, the rewards can be life-changing.

Now, let’s talk about the stocks that thrived during the 2008 crash. While most companies saw their values plummet, a few stood strong—or even gained ground. Defensive stocks, which provide essential goods and services, were particularly resilient. Companies like Walmart and McDonald’s not only survived but thrived because their products were necessities. Similarly, Dollar Tree, a discount retailer, saw its stock rise as consumers sought affordable options. Even some growth stocks like Apple managed to deliver positive returns, proving that innovation can sometimes defy economic gravity.

But why does this matter today? Because history has a way of repeating itself. Market crashes are inevitable—they’re part of the cycle of capitalism. And while they bring pain and uncertainty, they also bring opportunity. The 2008 crash taught us that fear can be paralyzing, but it can also blind us to potential gains. Those who invested wisely during that time—whether it was Buffett buying financials or Sarah betting on consumer staples—emerged as wealth creators.

So, as we face market volatility today, remember this: after every crash comes a recovery. And those who invest wisely during the downturn often emerge as the biggest winners. It’s not about being reckless; it’s about being strategic. Look for companies with strong fundamentals, resilient business models, and a history of weathering storms. Take a deep breath, do your homework, and remember: sometimes, the best time to buy is when everyone else is selling.

Conclusion

The 2008 market crash, while devastating, highlighted the potential for significant gains during downturns. Stocks like Walmart, McDonald’s, and Apple showed resilience, while investors like Buffett and Paulson demonstrated the power of strategic investing. This narrative, rooted in historical data, encourages cautious optimism for current market conditions, urging investors to see beyond fear and seize opportunities for long-term wealth creation.