Debt-Free Pharma Stock Trading at 22x PE: 61% Upside Potential in Emerging Markets

Investment Thesis & Summary

This company quietly prints cash in markets nobody else bothers with while trading at 22 times earnings. They’re making money in Africa and Latin America where big pharma won’t go, building a US business that’s just starting to hit its stride, and sitting on ₹1,334 crores in free cash with zero debt. The stock’s down 30% from its peak, which makes this a solid entry point for a business that’s been compounding profits at 20% a year.

Business Model & Operations

This Chennai-based pharmaceutical company makes and sells generic drugs to developing countries - think Africa, Latin America, and the Caribbean. They’ve got 4,000+ product registrations across 36 therapeutic areas, covering everything from basic tablets to complex injectables.

Here’s what makes them different: while most Indian pharma companies chase the US and Europe, these guys focused on emerging markets where competition is thin. They’ve built deep relationships in 23 countries, especially in Francophone Africa and Latin America. It’s not the sexiest market, but it’s profitable and growing.

The business has three main pieces. First, the emerging markets operation ships formulations to Africa and Latin America - that’s the bread and butter, generating steady cash. Second, their US subsidiary Xxxxxx Steriles makes injectable drugs for American hospitals - higher margins, more regulated, growing fast. Third, they’ve recently started moving into Chile and Mexico, opening up bigger Latin American markets.

Recent moves show they’re serious about expansion. In January 2026, they acquired 10 USFDA-approved injectables with a $473 million addressable market, including oncology products. Their Mexican subsidiary Triwin Pharma bought land for a manufacturing facility that’ll produce 50 million units per year starting FY2027. They also picked up stakes in Chilean pharma companies to crack that market.

The company runs lean. Manufacturing happens in India at their Puducherry facility for injectables and Chennai for other formulations. They’ve got warehouses close to customers - 52% of inventory sits in foreign warehouses, cutting delivery time. Transit time to Africa and Latin America is long, so they plan ahead. This model works because they’re not competing on marketing muscle - they compete on being there, being reliable, and being profitable

.

Historical Financial Review

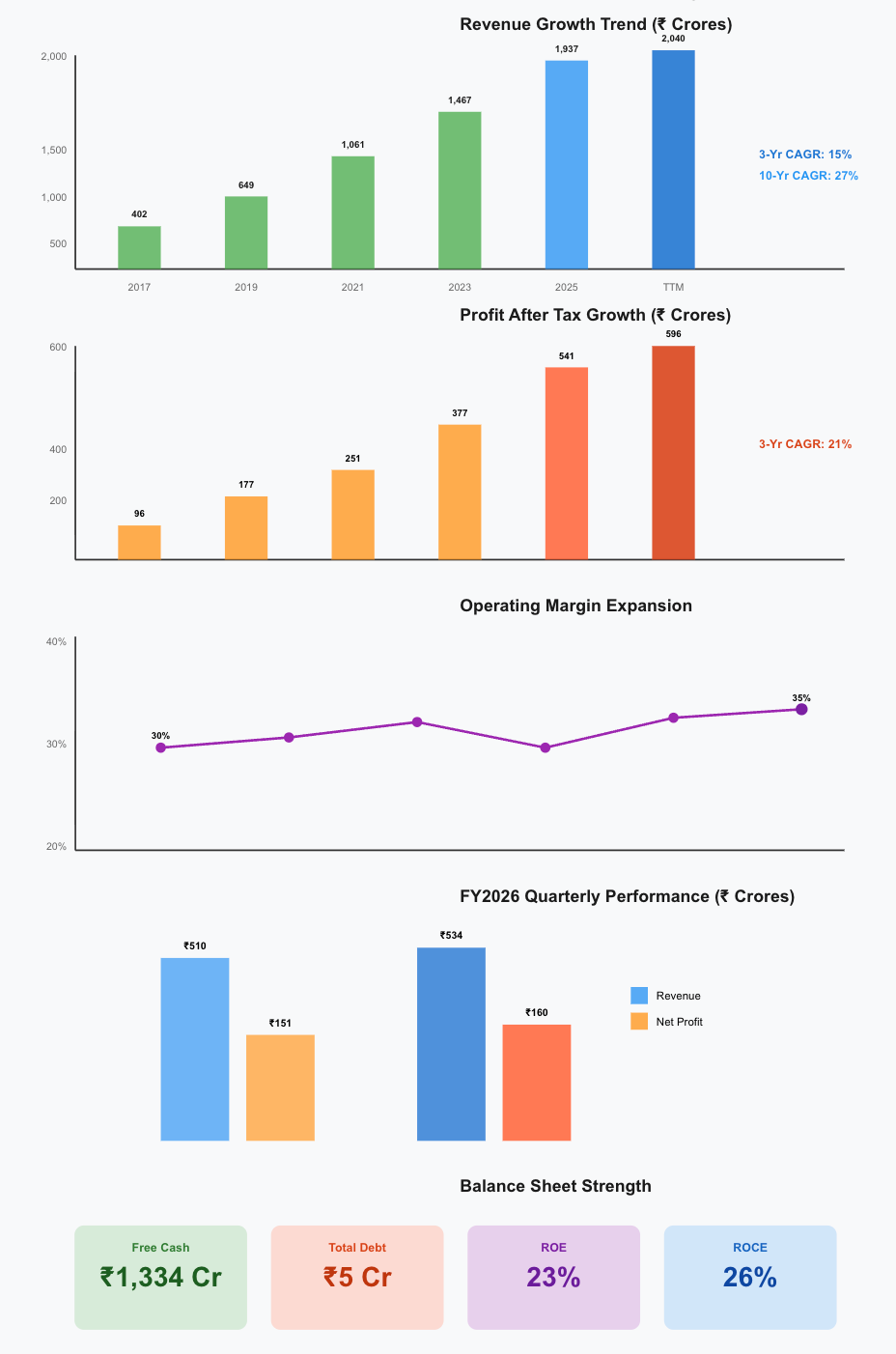

Revenue grew from ₹1,467 crores in March 2023 to ₹1,937 crores in March 2025 - that’s a 15% compound annual growth rate over three years. Not explosive, but rock-solid consistent. Profit after tax jumped from ₹377 crores to ₹541 crores in the same period, a 21% annual growth rate. They’re making more money on each rupee of sales.

Last twelve months diluted EPS came in at ₹77.46, up from ₹70.56 in FY2025. That’s a 10% jump.

The quarterly trends tell the story. Let’s walk through FY2026:

Q1 FY2026 (June 2025): Revenue hit ₹510 crores, up 11% from last year’s June quarter. Net profit was ₹151 crores, a 21% jump. Operating margin expanded to 35% from 34% in the prior year. They’re getting more efficient.

Q2 FY2026 (September 2025): Revenue reached ₹534 crores, up 11% year-over-year and 5% sequentially. Profit after tax was ₹160 crores, marking a 23% increase from last year’s September quarter. Operating profit margin stayed strong at 35%. EPS for the quarter was ₹20.32.

What jumps out is the margin expansion. Operating profit margin improved from 30% in March 2023 to 34% in March 2025, and they’re holding that in the current year. That’s real pricing power and operational efficiency.

Cash flow from operations was ₹432 crores in FY2025, up from ₹318 crores in FY2024. They converted 79% of operating profit into cash - that’s excellent. The company generated ₹56.50 in operating cash flow per share in FY2025.

The balance sheet is fortress-strong. They cut debt from ₹222 crores to ₹5 crores in six months (March 2025 to September 2025). Net debt is now negative - they have more cash than debt. Free cash reserves stood at ₹1,334 crores as of September 2025, with total liquid assets of ₹2,358 crores. That’s ₹175 per share in cash just sitting there.

Return on equity has been steady at 23% for the past year, down slightly from the 27% they clocked a decade ago as the base grew larger. Return on capital employed is 26%, which is exceptional for a manufacturing business. They’re reinvesting profits effectively.

Comparing to peers - Sun Pharma trades at 33x earnings, Dr. Reddy’s at similar multiples. This stock at 22x earnings is trading at a discount despite superior ROE and consistent growth.

Growth Drivers & Catalysts

The US injectable business is the big lever. Xxxxx Xxxxx has 42 ANDA approvals with 10 more under review. They just bought 10 more approved ANDAs in January 2026 addressing a $473 million market. Their US revenue is growing faster than the overall business, and they’re launching products under their own label “Xxxxx Services USA” instead of just being a contract manufacturer. That’s a margin upgrade.

Latin America expansion is accelerating. They’re entering Chile mid-2026 with 10 registered products, setting up operations in Mexico through Triwin Pharma with a facility coming online in FY2027, and eyeing Brazil and Colombia next. These are much larger markets than the countries they currently operate in. Chile alone is 19 million people versus the smaller African nations they’ve focused on.

Product complexity is increasing. They’re moving into drug-device combinations, oncology injectables, and ophthalmic products. These command higher margins and have less competition. The recent ANDA acquisition included oncology products, which is a strategic shift upward.

Manufacturing capacity is expanding. The second injectable plant in Puducherry is ramping up with 2 vial lines, a lyophilizer line, and pre-filled syringe line. This isn’t speculative capacity - they’re filling it with approved products and firm orders.

Regulatory approvals keep coming. In the past year, they got USFDA approvals for Haloperidol Decanoate, Phytonadione Injectable, Brimonidine Tartrate eye drops, Milrinone Lactate infusion bags, and Nicardipine Hydrochloride injections. Each approval opens a piece of the US market. They completed inspections from INVIMA (Colombia), ANVISA (Brazil), and an unannounced FDA inspection - all successful.

The management just brought in the second generation. Ashok and Vivek Partheeban joined as Vice-Chairmen in November 2025. They’re young, they’ve been in the business, and the founder C.C. Paarthipan is setting up succession. This reduces key-person risk.

Risk Assessment

Market concentration risk: Heavy dependence on Africa and Latin America. Currency fluctuations in these regions can hurt. The Argentine peso devalued sharply in recent years. However, they operate in 23 countries which provides diversification, and they’re expanding into larger, more stable Latin American economies.

Regulatory risk: Pharmaceutical manufacturing is heavily regulated. An FDA warning letter or failed inspection could shut down their US operations. They’ve had clean inspections recently, but this risk never goes away in pharma.

Competition risk: Big Indian pharma companies could decide to enter their markets. When that happens, they’ll have trouble competing on marketing spend. Their moat is being there first and having established relationships, but that erodes over time.

Working capital: Their inventory days have increased from 159 days in March 2023 to 159 days in March 2025 (staying flat), and debtor days climbed from 98 to 119 days. They’re giving customers more time to pay, which ties up cash. If this trend continues, it’ll pressure cash flow.

Geopolitical risk: They operate in politically unstable regions. A coup, trade restrictions, or import bans could wipe out country-specific revenue overnight. They saw this with some African nations in the past.

Valuation risk: The stock has run up 148% over three years. At 22x earnings, there’s not much margin for error. If growth slows or margins compress, the multiple could contract quickly. The stock already corrected 30% from its peak.

Execution risk on expansion: They’re entering Mexico, Chile, adding capacity, acquiring ANDAs. If any of these initiatives stumble, growth will disappoint. Management has been conservative historically, but they’re accelerating which increases execution risk.

The company being nearly debt-free mitigates financial risk. They can handle a bad year without breaching covenants or facing liquidity issues.

Valuation & Price Target

Current P/E of 22.2 times seems reasonable for a company growing profits at 21% CAGR. Using a PEG ratio of 1.0, fair value would be 21x forward earnings. But this deserves a premium because:

Zero debt, huge cash balance provides optionality

ROE of 23% and ROCE of 26% are well above sector median

Consistent execution over a decade, not a flash in the pan

US business inflecting upward with own-label products

Assigning a 25x multiple to FY2027 estimated EPS of ₹110 gives a target price of ₹2,750. Adding ₹50 for the net cash per share gets us to ₹2,800.

From current price of ₹1,736, that’s 61% upside in 18-24 months. For a 5-year hold, assuming 18% annual profit growth (conservative vs their 21% historical), EPS could hit ₹175 by March 2030. At a mature 22x multiple, stock price would be ₹3,850 - a 122% return or 17% annualized.

For a 10-year view, maintaining 15% annual profit growth (assuming slower growth as they get larger), FY2035 EPS could be ₹380. At 20x (lower multiple for a larger, more mature company), price would be ₹7,600 - a 338% return or 14% annualized over the decade.

The downside case: if execution stumbles, growth slows to 10%, and the market re-rates them to 18x, stock could trade at ₹1,600 in a year - down 8%. Risk-reward is asymmetric to the upside.

At ₹1,736, you’re getting:

A debt-free pharma company with ₹175/share in cash

23% ROE business growing at 15%+ for the next 5 years

Expanding in underpenetrated markets with structural tailwinds

Trading below sector multiples despite superior metrics

That’s a buy.

Management Quality & Governance

Chairman C.C. Paarthipan founded the company in 1990 and has built it methodically over 35 years. The family holds 70.6% of shares, which is high but stable - they’ve barely sold any stock over the years. That aligns their interests with minority shareholders.

Management’s record on capital allocation is strong. They’ve avoided debt-fueled growth, preferring to build capacity from internal cash flow. When they did carry debt, they paid it down aggressively - from ₹222 crores to ₹5 crores in six months. They’ve made smart acquisitions: the recent ANDA purchase at what seems like a reasonable price given the addressable market, the Chilean entry through equity stakes rather than greenfield.

The dividend policy is conservative - 8% payout ratio in FY2025. They declared ₹6 per share in dividends during the year, yielding 0.35% at current price. They’re reinvesting most profits into growth, which makes sense given their high ROE.

Promoter holding increased marginally from 70.56% to 70.57% in the last quarter. FII holding has been climbing steadily from 2.36% in March 2023 to 6.51% in September 2025 - institutional investors are accumulating. DII holding is smaller at 2.10% but also increasing.

The appointment of Ashok and Vivek Partheeban as Vice-Chairmen signals succession planning. Both have been involved in operations, and the transition appears thoughtful rather than forced.

One concern: the company hasn’t been very communicative beyond required disclosures. Investor presentations are sparse on forward guidance. They prefer to let numbers speak, which is fine, but more transparency on strategy would help.

Related party transactions are minimal based on annual reports. No red flags on governance. They’ve been audited by reputable firms, financials reconcile across quarters.

Corporate governance score from external rating agencies is solid. No major lawsuits, no regulatory penalties in recent years. The board includes independent directors as of November 2025 with Dr. K C John’s appointment.

Overall, management gets a B+. They’re competent operators, conservative with capital, aligned with shareholders through high promoter holding. The minus comes from limited transparency and communication. But their execution track record speaks louder than investor presentations.

Competitive Positioning

The company occupies a niche: generic pharmaceuticals in emerging markets with a growing US injectable business. Let’s break down competitive advantages:

Geographic moat: They’re entrenched in countries where big pharma won’t go. It’s not profitable enough for Sun Pharma or Dr. Reddy’s to set up distribution in smaller African nations. The company has 35 years of relationships, regulatory approvals, and distribution infrastructure. A new entrant would need years to replicate this.

Regulatory approvals: Those 4,000+ product registrations took decades to accumulate. Each one requires clinical trials, documentation, waiting periods. It’s a barrier that compounds over time.

Low-cost manufacturing: Indian manufacturing costs with Chennai and Puducherry facilities give them cost advantage versus Western companies. They can price competitively in emerging markets and still make money.

US Steriles capability: Making sterile injectables is harder than tablets. It requires controlled environments, specialized equipment, and regulatory compliance. Their Puducherry facility has passed multiple FDA inspections. This creates a moat in the US market.

However, the moat isn’t unassailable. Competitive threats include:

Other Indian pharma companies: Cipla, Lupin, Alkem could decide emerging markets are attractive and use their larger scale to compete. If they did, they’d have marketing budgets that dwarf this company’s.

Chinese manufacturers: Chinese pharma is getting better at quality and has even lower costs. They’re starting to enter markets this company operates in.

Local manufacturers: Countries are building their own pharma capacity. Local manufacturers get preferential treatment from governments. We’ve seen this in several African nations.

US competition: In injectables, they’re competing against Fresenius Kabi, Pfizer’s hospital division, Hikma, and others. These are giants. The company’s edge is pricing and their ability to launch first-to-market generics quickly.

Comparing to peers:

Sun Pharma: 10x the revenue, operates globally, more diversified. But ROE is lower, growth is slower, and they trade at higher multiples.

Dr. Reddy’s: Similar revenue profile, stronger in US but weaker in emerging markets. Lower margins, higher debt.

Cipla: Bigger, more diversified geographically. Lower ROE, similar growth rates.

This company is smaller but more focused. They’re the pure play on emerging markets pharma. That focus is both strength and weakness - strength because they’re specialists, weakness because they lack diversification.

Product portfolio is broad but weighted toward basic formulations. They’re moving upmarket with ophthalmics and oncology, but most revenue still comes from routine drugs. That limits pricing power but ensures steady demand - people always need basic medicines.

Brand recognition is low among retail investors, high among emerging market distributors and hospitals. That’s fine for B2B business but limits their ability to command premium valuations from the stock market.

Technology and R&D spend is modest - 2-3% of revenue. They’re not inventing new molecules; they’re filing ANDAs and getting bioequivalence approvals. That’s appropriate for a generics business but means they won’t have blockbuster patents.

The competitive position is solid in their current markets, but they’ll need to keep moving into higher-margin, more complex products to sustain growth. The US injectable business and oncology push are the right strategic direction.

Disclaimer:

This content is for educational purposes only and is not investment or financial advice. Stock markets are subject to risks. Do your own research and consult a qualified advisor before investing. The author is not responsible for any financial losses. Mentions of stocks/companies are not buy or sell recommendations.

Subscribe to know more…