Cipla Ltd – Investment Analysis

Business Model & Operations

Cipla makes and sells medicines. Simple as that. They’re the third-largest pharma company in India, selling everything from respiratory drugs to HIV medications, antibiotics, and heart pills. They’ve got a huge presence in generics – basically making cheaper versions of branded drugs once patents expire.

Here’s how they make money: 41% comes from India, 27% from North America, 16% from Africa, and the rest from Europe and other markets. They’re not dependent on just one geography, which is smart. In India, they’re number one in respiratory medicines – think asthma inhalers and breathing treatments. Over 85% of Indian doctors prescribe at least one Cipla product.

They just launched Afrezza, India’s first inhaled insulin for diabetics. They also started selling Pfizer’s brands in India through an exclusive five-year deal signed in December. In the US, they launched their first biosimilar, Filgrastim, opening up high-margin opportunities. The company’s pushing into specialty areas – biosimilars, consumer health products, and newer therapies. They’re not just making generic pills anymore.

Youtube Link:

Historical Financial Review

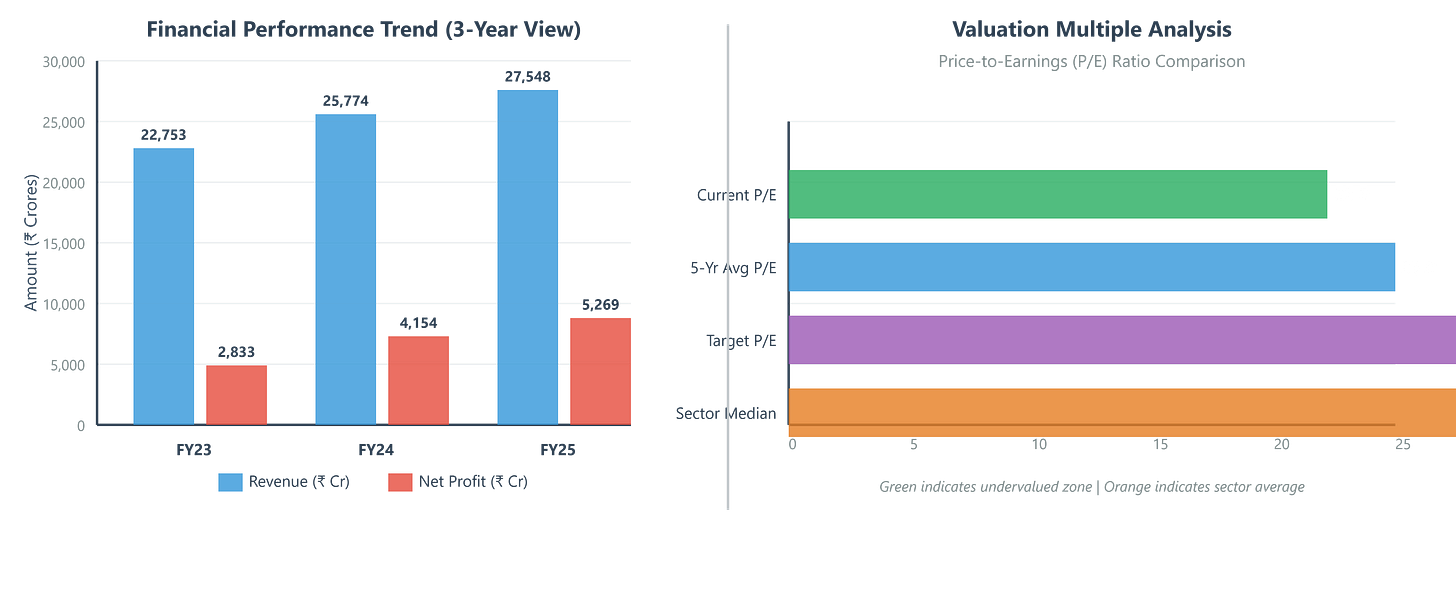

Revenue grew at 10% over the last five years – not spectacular, but steady. The last fiscal year, they did ₹27,548 crores in sales. The latest quarter hit ₹7,589 crores, a 7.6% jump year-over-year. That’s solid considering the US generic market’s been brutal with price erosion.

But here’s where it gets interesting: profits grew at 29% annually over five years. Last year’s net profit was ₹5,269 crores, giving an EPS of ₹65.28. The trailing twelve months EPS is ₹67.37. That’s a 28% jump in earnings. They’re making way more money on the same amount of sales.

Operating margins expanded from 21% three years ago to 26% now. They’re getting more efficient – controlling costs, improving product mix, focusing on higher-margin therapies. The company’s sitting on ₹9,901 crores in net cash. Their total debt is just ₹438 crores, mostly lease obligations. They’ve been generating ₹5,000+ crores in operating cash flow annually.

Management’s been smart about capital allocation – paying dividends consistently while investing in R&D. They spent ₹539 crores on research last quarter alone, about 7% of sales. That’s building tomorrow’s pipeline.

Fundamental Valuation Metrics & Investment Call

The stock’s trading at a P/E of 22.2. That’s reasonable for a quality pharma company growing earnings at double digits. The sector median P/E is around 25-30, so Cipla’s actually cheaper than peers. The five-year average P/E for Cipla has been around 24-26, so we’re below historical levels.

Price-to-book is 3.6 times. You’re paying ₹3.60 for every rupee of book value. For a company generating 18% ROE, that’s fair. ROE of 17.8% is healthy – they’re making good returns on shareholder money. ROCE at 22.7% is even better – shows they’re using all capital efficiently, not just equity.

EPS has been growing steadily – from ₹51 in FY24 to ₹65 in FY25 to ₹67 now. That’s 18% annualized growth in recent quarters. Dividend yield is 0.87%, modest but the payout ratio’s only 25%, so plenty of room to increase it. They’re retaining most profits for growth, which makes sense.

The stock should be trading at ₹1,850 based on peer multiples and growth trajectory. That’s a 24% upside from here. At 22x earnings with 15-18% profit growth ahead, this is a quality business at a reasonable price.

Long-Term Outlook & Risk Assessment

Over the next 5-10 years, I’d estimate 14-17% annual returns. That comes from 12% earnings growth plus 2-3% dividend yield, maybe some multiple expansion if they execute well.

Why that range? The domestic business keeps growing as healthcare penetration increases in India. They’re gaining market share in chronic therapies – diabetes, heart disease, respiratory conditions. These are long-term treatments with sticky customers. The US business has new product launches lined up. They’ve filed for several complex generics that could bring in big revenue once approved. The Revlimid copycat drug is winding down, but the base business is growing nicely.

Africa and emerging markets are expanding 15% annually. These markets are undersupplied and Cipla’s built strong distribution over decades. Leadership transition looks smooth – Achin Gupta’s been with the company for years as COO. He knows the business inside out.

They’re investing heavily in biosimilars and specialty drugs. Higher barriers to entry mean better margins and less competition than plain vanilla generics.

Risks?

The promoter holding dropped from 34% to 29% over three years. They’ve been selling stake gradually. Not ideal, but institutional ownership increased, so smart money’s coming in. The US generic market keeps seeing price pressure. Every quarter, older products get cheaper. They need new launches to offset this erosion.

Regulatory risks are always there in pharma. One FDA warning letter can tank revenue from a facility. They’ve got multiple manufacturing sites, so risk is diversified but not eliminated. Competition’s intense. Sun Pharma, Dr. Reddy’s, Lupin – everyone’s fighting for the same pie. If Cipla slows down innovation, they’ll lose share.

Currency fluctuations hit international revenue. Dollar weakness means lower rupee revenues. India’s pharma sector is benefiting from China-plus-one strategy. Global buyers want alternatives to Chinese suppliers. Cipla’s well-positioned here. Government’s pushing “Make in India” for medical supplies. That tailwind should continue.

The company’s debt-free with strong cash generation. They’ve weathered every industry cycle for 90 years. That track record counts for something. If they keep executing – launching new products, maintaining margins, growing cash flow – this stock should compound nicely over the long run. It won’t double overnight, but it’s the kind of boring business that quietly makes you money over a decade.

Disclaimer

Disclaimer:

This content is for educational purposes only and is not investment or financial advice. Stock markets are subject to risks. Do your own research and consult a qualified advisor before investing. The author is not responsible for any financial losses. Mentions of stocks/companies are not buy or sell recommendations.