Bharat Forge Ltd 2026: Indian Stock Outlook, Business Strength & Future Growth Drivers

Investment Thesis & Summary

Here’s the thing - this stock is trading at a moment when everyone’s worried about export headwinds, but they’re missing the bigger picture. The company just built a ₹9,467 crore defense order book, and their domestic industrial business is firing on all cylinders. The market’s pricing in short-term pain while ignoring multi-year structural growth drivers.

Youtube Link:

Business Model & Operations

This company makes critical forged components - think crankshafts, connecting rods, and chassis parts that go into everything from trucks and passenger cars to defense equipment and aerospace systems. They’re the world’s second-largest forgings manufacturer, selling to names like Mercedes-Benz, BMW, Volvo, and Ford.

The money comes from three buckets. First, there’s the traditional automotive forgings business - both exports to North America and Europe, plus domestic sales. Second, they’ve got an industrial segment covering oil & gas, aerospace, construction equipment, and railways. Third - and this is where it gets interesting - defense and aerospace, which just crossed ₹1,700 crores in FY25 revenue.

Over the last year, they’ve been dealing with weak North American truck demand. Export revenues to the US dropped 63% year-over-year in Q2 FY26 because of inventory destocking and softer production volumes. But here’s what matters: they transferred all defense assets to a wholly-owned subsidiary called Kalyani Strategic Systems, won major orders including a ₹3,417 crore contract for artillery guns, and their aluminum castings business through JS Auto grew revenues 20% while doubling profits.

The company operates manufacturing facilities across India - Pune, Baramati, Chakan, Satara - plus plants in Germany, Sweden, Scotland, and the United States. They’ve completed their North American greenfield expansion, and a dedicated aerospace machining line is coming online in FY27.

Historical Financial Review

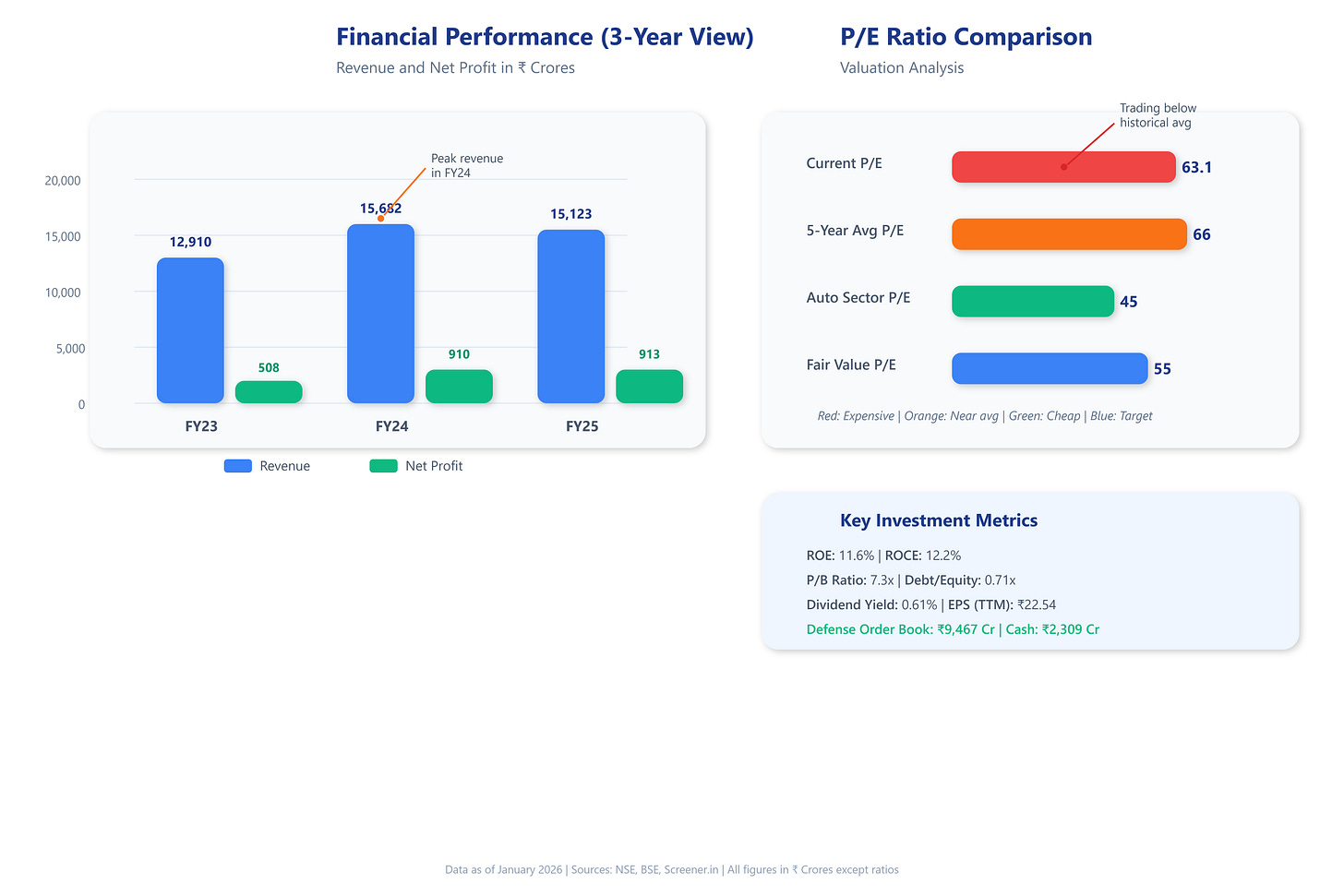

Revenue grew at 13% CAGR over the last three years, hitting ₹15,269 crores on a trailing twelve-month basis. But FY25 was essentially flat compared to FY24 - revenues dipped 3% to ₹15,123 crores as European commercial vehicle weakness and US export softness offset gains in defense and industrial segments.

Here’s where the story gets better. Despite flattish topline, operating profit margins held steady at 18% in FY25. The last twelve months delivered earnings per share of ₹22.54 - up from ₹19.69 in FY25. Net profit for the trailing year came in at ₹1,079 crores versus ₹913 crores in FY25, a solid 18% jump.

Cash generation remained strong. Operating cash flow for FY25 was ₹1,796 crores, and the company sits on ₹2,309 crores of cash with declining net debt - down from ₹4,086 crores in March 2024 to ₹3,669 crores in March 2025. They’re not burning cash on vanity projects; capex for FY26 is guided at a disciplined ₹500 crores, focused on aerospace capacity and productivity improvements.

The defense business exploded - revenues went from virtually nothing to ₹1,700 crores in FY25, with Kalyani Strategic Systems contributing ₹1,567 crores. Management guided 15-20% defense revenue growth for FY26. JS Auto, their castings joint venture, saw revenues jump 23% and EBITDA grow 35% with return ratios crossing 20%.

Debt-to-equity dropped to 0.71x, and the company returned cash to shareholders with a dividend payout ratio of 43%.

Fundamental Valuation Metrics & Investment Call

The stock trades at a P/E of 63.1 - that looks expensive on the surface, but let’s break it down. The three-year average P/E sits around 66, and the five-year average is similar. So it’s actually trading below its own historical average despite having a stronger business mix today than three years ago.

Price-to-book is 7.3x versus book value of ₹196 per share. This isn’t a capital-light business, so a premium to book makes sense given their market position and return profile. But the key metric is return on capital employed - ROCE stands at 12.2%, and ROE is 11.6%. These aren’t spectacular numbers, but they’re improving as defense scales and loss-making overseas operations turn profitable.

EPS growth over five years has been 21% CAGR, and over three years it’s essentially flat at 1% due to the cyclical downturn in automotive exports. But here’s the catch - the trailing twelve-month EPS of ₹22.54 shows growth is resuming. Dividend yield is modest at 0.61%, but they paid ₹8.50 per share as total dividend in FY25.

Operating cash flow per share works out to roughly ₹37-38 based on the ₹1,796 crore operating cash flow and 4,782 million shares outstanding. That puts the stock at about 37-38x operating cash flow - elevated, but justified if defense and aerospace deliver the projected growth.

The valuation isn’t cheap, but it’s not absurd either. The market’s treating this like a cyclical auto components company when it’s actually transforming into a diversified industrial with defense providing multi-year visibility. At current price of ₹1,423, you’re paying for the peak of auto cycle earnings, but getting the defense growth story almost for free.

Fair value based on normalized 55x P/E on FY27 estimated EPS of ₹32-34 gives you a target of ₹1,850 - roughly 30% upside. The stock deserves to re-rate as defense contribution crosses 15-20% of revenues and margins expand with better product mix.

Long-Term Outlook & Risk Assessment

Expected 5-Year Return Range: 14-18% CAGR

The company’s playing a long game. Defense orders worth ₹9,467 crores provide three years of revenue visibility at current run rates. Aerospace exports have scaled 4x in five years and now account for 15% of industrial exports. New aerospace machining capacity coming online in FY27 will drive incremental growth. Management expects the aerospace business to show strong growth over the next 3-4 years.

Capex is strategic, not desperate. They’re spending ₹500 crores in FY26, focused on aerospace forging and machining lines plus aluminum plant capacity expansion in the US. The US operations just turned EBITDA positive for the first time - a huge milestone after years of losses. Europe’s steel business is under review for restructuring, which should reduce drag on consolidated margins.

The promoter holding stands rock-solid at 44.07%. No selling, no dilution concerns. Domestic institutional investors have been buying - DII ownership jumped from 28% to 32% over the last year while FII holding dipped from 16% to 13.6%. That’s actually a positive sign; sticky domestic money is replacing flighty foreign capital.

India’s push for defense indigenization plays directly into this company’s hands. They’re already supplying to the Indian Armed Forces and ISRO. The government’s “Make in India” focus in defense and aerospace creates a multi-decade opportunity. Separately, as global supply chains diversify away from China, their presence in multiple geographies positions them well to capture relocating business.

Risks to watch:

North American heavy-duty truck production could stay weak longer than expected. The company derives 30% of consolidated revenues from exports, mostly to developed markets. If the US enters recession or tariff uncertainties persist, export revenues will struggle.

Commercial vehicle cycle risk is real. The automotive industry runs in cycles, and we’re likely in the late stage of the current upcycle. Any sharp downturn in truck or passenger car production will hit volumes and margins.

Execution risk on defense contracts. Large defense orders are great, but delivering them on time and at targeted margins is different. Production ramp-up delays or cost overruns could disappoint.

Commodity price volatility affects raw material costs, particularly steel and aluminum. While they have some pass-through mechanisms, sharp moves can compress margins in the short term.

Foreign exchange movements matter given their global footprint and export exposure. A weaker rupee helps exports but increases debt servicing costs on foreign currency borrowings.

Restructuring risks in Europe - the steel business review could result in asset write-downs or restructuring charges that hit near-term profitability.

What’s going right for the industry:

India’s defense budget keeps growing, and offset requirements push foreign OEMs to source locally. This company’s already on approved vendor lists for multiple programs.

Aerospace is booming globally. Commercial aviation recovery post-pandemic plus defense aviation modernization drives multi-year demand for precision-forged components.

India’s industrial capex cycle is improving. Construction equipment, mining machinery, and power generation equipment - all use heavy forgings.

Quality matters more than ever in automotive safety. As emission norms tighten and electric vehicles scale up, precision-engineered components become even more critical. This company’s metallurgical expertise and testing capabilities create barriers to entry.

Marker: Company Name Disclosure

Company: Bharat Forge Ltd

Bharat Forge is not just an auto company anymore.

Today, it is becoming a defense and industrial business.

Exports are weak right now, and that is what the market is worried about.

But inside India, defense and industrial demand is growing strongly.

The company has a ₹9,467 crore defense order book, giving multi-year visibility.

Defense revenue has grown from almost zero to ₹1,700+ crore.

Even with flat sales, profits and cash flows are improving.

Debt is coming down and capex is controlled, not aggressive.

Valuation looks high, but the business mix is much stronger than before.

If defense and aerospace scale well, long-term growth can continue.