Ashok Leyland Ltd 2026: Commercial Vehicle Cycle, Fundamentals & Long-Term Investment Outlook

How This Company Actually Makes Money

This is India’s second-largest commercial vehicle maker - they build trucks and buses that keep the country’s economy moving. Think medium and heavy trucks hauling goods across highways, buses ferrying millions, and light commercial vehicles making last-mile deliveries. The company commands a 31% market share in medium and heavy commercial vehicles and 20% in light commercial vehicles.

Here’s where the cash comes from: About 60% flows from medium and heavy commercial vehicle sales - those big trucks you see on highways. Another 25-30% comes from light commercial vehicles. The remaining chunk is defense vehicles for the Indian Army, power solutions like diesel generators and marine engines, plus a growing aftermarket business selling spare parts and services.

They’re not sitting still either. The latest quarter showed they sold 49,100 vehicles, up 8% from last year. Exports jumped 45% - they’re getting serious traction in the Middle East, Africa, and neighboring countries. The electric vehicle division is expanding too, with their Circuit electric bus gaining ground. They just announced plans for a ₹5,000-10,000 crore battery manufacturing facility.

The business is spread across eight manufacturing plants in India, with production capacity around 120,000 units annually. They’re running at about 70% capacity right now, which means they can grow without massive new investments. The Hinduja Group backing gives them financial muscle and global connections.

Youtube Link:

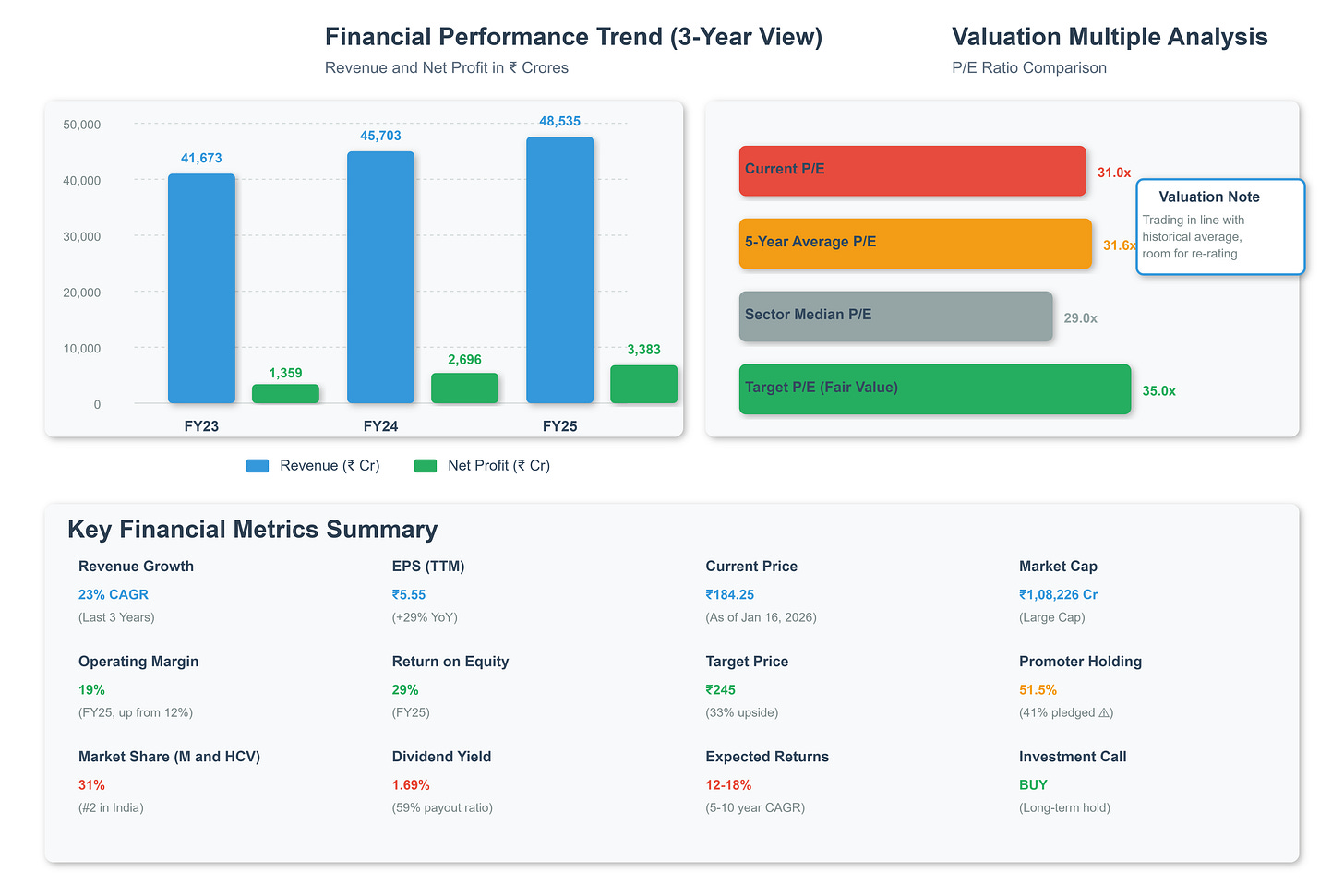

The Numbers Tell a Story of Turnaround

Revenue grew 23% annually over the past three years - that’s substantial. In the trailing twelve months, they clocked ₹50,976 crores in sales. More importantly, earnings per share hit ₹5.55 in the last twelve months, up from ₹4.23 the year before. That’s 31% EPS growth - real profit expansion, not just top-line fluff.

Here’s what changed:

Operating profit margins jumped from 11% three years ago to 19% now. That’s a massive improvement in how efficiently they convert sales into profit. In the latest quarter ending September 2025, they posted ₹820 crore net profit - the highest quarterly profit in company history. Operating cash flow per share sits around ₹8-9, meaning they’re generating real cash, not just accounting profits.

The balance sheet shows net debt of ₹49,193 crores, but don’t panic - most of that sits in their finance subsidiary which lends to truck buyers. The core manufacturing business actually generates strong free cash flow. They maintained a dividend payout ratio around 59%, returning cash to shareholders while investing in growth.

What management highlighted: Capacity utilization improving, new product launches gaining traction, export momentum accelerating. They’re executing their premiumization strategy - selling higher-margin products instead of competing only on price. The shift is working.

Valuation Metrics Point to Upside

Current P/E ratio sits at 31 times trailing earnings. That sounds expensive at first glance, but let’s dig deeper. The stock traded at an average P/E of 31-32 over the past three years, so you’re not paying a premium to historical norms. Given the 29% profit growth rate, you’re actually getting decent value - the PEG ratio works out to around 1.0.

Price-to-book stands at 8.6 times - admittedly high. But this isn’t your grandfather’s asset-heavy manufacturing business anymore. Return on equity hit 29% in the latest year. When a company generates 29% ROE, it deserves to trade above book value. The question is whether 8.6 times is justified - I’d argue it’s slightly rich but not egregious given the earnings power.

ROE of 29% and ROCE of 14% tell you this: The company uses shareholder money very efficiently. Every rupee of equity generates 29 paise of profit. The lower ROCE reflects the capital-intensive nature and debt in the financing arm, but the gap is narrowing as operational efficiency improves.

EPS growth accelerated from 54% CAGR over five years to 284% over three years - yes, that’s recovering from a low base, but the momentum is real. The latest twelve months showed 29% growth on a higher base, which is sustainable territory.

Dividend yield of 1.69% isn’t spectacular, but they just declared ₹1 per share interim dividend. With improving free cash flows, expect this to inch higher. The stock’s cheap not because of yield, but because the P/E ratio hasn’t expanded despite margin improvement.

The sector median P/E trades around 28-30. This stock’s trading right in line despite best-in-class market share and improving margins. That’s your margin of safety - you’re not paying for perfection, just fair value for a solid business getting better.

Long-Term Outlook: 12-18% Annual Returns Possible

Target price of ₹245 implies 33% upside from current levels. Over 5-10 years, expect 12-18% annual returns - that’s 2-3x your money in seven years if fundamentals hold.

Why this range? India’s commercial vehicle industry should grow 7-9% annually as infrastructure spending continues, e-commerce expands, and fleet replacement cycles kick in. This company is positioned to grow slightly faster - call it 10-12% annually - by gaining market share in LCVs, expanding exports, and selling higher-margin products. Add a 2% dividend yield, and you’re at 14% total returns conservatively.

The upside case:

If operating margins sustain at 18-20% (versus the historical 12-13%), and if the P/E re-rates to 35 times to match improved profitability, you could see 20%+ annual returns. That’s not my base case, but it’s possible.

Management’s capital allocation looks sensible. They’re spending ₹1,300-1,500 crores annually on maintenance capex, plus growth investments in electric vehicles and battery manufacturing. Promoter holding remains stable at 51.5% - skin in the game. Foreign institutional investors increased their stake to 24% from 21% a year ago. Smart money is accumulating.

The electric vehicle opportunity is real but uncertain. Their Switch Mobility subsidiary is bleeding cash in the UK but showing promise in India. The ₹5,000-10,000 crore battery plant signals serious EV ambitions. If they execute this right, it’s a meaningful growth driver by 2028-2030. If they stumble, it’s a drag on returns.

Risks you need to know:

Commercial vehicle demand is cyclical - tied to GDP growth, freight rates, and infrastructure spending. A slowdown hurts volumes.

Promoters have pledged 41% of their shareholding. That’s high and concerning if markets get volatile.

Competition is intensifying - Tata Motors dominates with 45% market share. This is the number two player trying to close the gap.

Raw material costs are volatile. Steel, aluminum, and commodity prices can squeeze margins if they can’t pass through price increases.

The finance subsidiary adds complexity and leverage. It’s profitable now, but any defaults in the truck financing portfolio could sting.

Electric vehicle transition is expensive and uncertain. They need to invest billions without guaranteed returns.

What’s going right:

India’s infrastructure push - ₹11 lakh crore capex in FY26 - directly benefits truck demand.

GST 2.0 reforms made truck prices more competitive, boosting replacement demand.

Export markets are opening up - Middle East and Africa showing strong growth.

Aftermarket revenue growing at 11% - this is higher-margin, recurring revenue.

Defense business up 25% - government’s Make in India push helps.

The industry tailwinds are solid. India’s logistics sector is modernizing. Fleet operators are replacing old BS-IV vehicles with cleaner BS-VI trucks. E-commerce is driving last-mile delivery vehicle demand. Government spending on roads, ports, and industrial corridors creates multi-year tailwinds.

This isn’t a screaming buy, but it’s a solid buy. You’re getting a well-run business with improving fundamentals at a reasonable valuation. The 12-18% return outlook isn’t sexy, but it’s achievable. The risks are manageable if you’re investing for 5+ years. Just watch the promoter pledge situation and don’t oversize the position.

Company Name: Ashok Leyland Limited